From time to time, Morningstar publishes articles from third-party contributors under the "Perspectives" banner.

Here, Chirag Mehta, Fund Manager - Commodities, Quantum Mutual Fund, writes about the gold run of the past decade and whether the recent pause signals the end of or a correction in the uptrend.

If you are interested in Morningstar featuring your content, please find further details here.

We often create stories to make sense of what is going on around us and look at history to find reasoning that provides the substance to base our thesis on.

In doing so, we often find historical events, which seem a close approximation and follow them as a guide, unless proved wrong by the recent unfolding. And in financial markets, this process could be really painful.

Gold 'bubble' to burst?

In gold markets, too, we often compare the current bull run to that of the 1970s, expecting the same result. But there is a cautionary remark--as gold hits set a new peak at $1920/ounce--is gold poised for a similar tumble the way it did in the '80s--falling after peaking at $850/ounce?

This has become a thesis and market experts would battle against any view as it threatens their sense of meaning.

They tend to ignore the subtle difference that underlies the current movements. They believe that history repeats itself and the recent patterns will mimic its historical past in terms of duration as well as price magnitude.

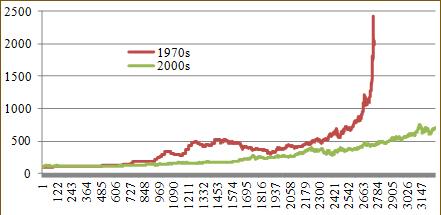

By the logic, let's see where we are in the current bull run compared to that of '70s. Here is an inflation-adjusted chart of gold price comparison (in $/troy ounce) between the 1970s and today. (Rebased to 100; Source: Bloomberg)

The '70s bull run began in 1971 when U.S President Richard Nixon shut the gold window, ending the direct convertibility of the U.S dollar to gold at $35 an ounce.

In effect, he took the whole world off the vestiges of the gold standard, starting a gold run that lasted nine years till gold peaked in 1980.

The current run, starting in 1999--when prices bottomed out--totals a duration of 12 years, surpassing the earlier bull run.

So does the comparison become irrelevant? No. Looking at price history, while it seems the rally started in 1971, the bull market probably began before than that--perhaps even before 1961--when buying pressure was such that the London Gold pool was introduced to stabilise gold prices.

However, there was no visible gain as the official gold price remained at $35 an ounce, even with the ongoing dollar printing. So from a duration perspective, there is no logical comparison between the duration of the gold run.

Let's get the price magnitude in the picture. Gold began at $35 an ounce in 1970s .By the time it reached $850, going up almost 25 times. Gold began the current bull market at $250 an ounce. A 25-fold increase will give us a target of $6250, suggesting a threefold increase from the high set in 2011.Then how do people suggest that gold has peaked based on historical comparisons?

This time is different?

No one can predict prices based on such parameters because the markets, economies and policymaking at the broad level are very different during both the periods to even attempt such baseless comparisons. Studying what has happened in the past does not tell us what will happen in the future, but it helps set our expectations as to what is possible and reasonable.

It also prevents us from being surprised when markets do not do the obvious. It is better to learn from the past--and one should not overlook--while appreciating the similarities, and the subtle differences among the different time periods.

There are numerous similarities for the wider economy, between now and the 70s: a bull market in commodities, inflation, high unemployment, economic and social problems, floundering government and policymakers, volatility across asset markets and so on.

In the 70s, for instance, there was big spending on account of the Vietnam War and President Lyndon Johnson's Great Society social programmes.

Deficits were large and inflation, oil and gold were soaring whereas the dollar was in a downtrend.

Today, there is even bigger spending as the war on terror continues. Deficits are huge, oil and gold have been soaring, inflation is picking up, and the dollar is declining.

But there are many differences too: the most significant is that the post-Bretton Woods monetary system was in its infancy. Whereas, the fiat monetary system is well established today.

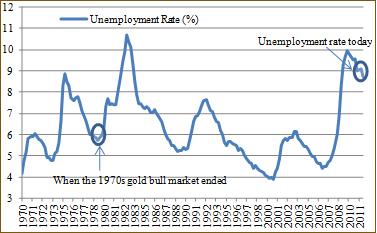

In the 70s, the U.S. economy was in a better shape than today. At the end of the 70s (nearing the end of the bull market in gold), the employment picture was quite healthy.

But now, there is a massive problem with unemployment along with wildly out-of-control debt on both the private and public levels. Thus, Paul Volcker's simplistic solution to inflation, which also served as the trigger for the end of the 1970s gold bull market of increasing interest rates, is off the table. Here's a chart of the U.S. unemployment rate. (Source: Bloomberg)

Also, there is unprecedented inflation in the form of an increase in the monetary base. What's missing, so far, is the inevitable consequence of the inflation--steady rising prices.

Inflation will appear and when it does, the government will find it difficult to put the inflation genie back in the bottle, as increasing interest rates would not be desirable with such high levels of debt.

The action to dramatically raise interest rates during the 1970 era indicated that the Fed was willing to take an economically-destructive move to support the dollar's value.

However, at present, actions have been more accommodative and liquidity infusions are sustained with a policy to mask the problems faced. The debt burden today is so huge that rising interest rates would make servicing the debt incredibly difficult.

More buyers as the race to bottom continues

The interesting difference with the gold bull market of today and that of the 1970s is that today the rest of the world is getting involved due to the global economic crisis and fear of fiat paper.

As evident from World Gold Council's gold demand trend reports, China and India are buying gold in hundreds of tons over the last few years.

It is estimated that only about 10% of the world could own gold during the 70s bull run. This was due to either legal restrictions or a lack of liquid capital, 90% of the world populace was unable to join the gold buying league.

Today, few countries prohibit gold ownership, and a far higher percentage of the world's population has transitioned out of poverty. Still, the fact that today, less than 1% of assets internationally are allocated to gold investments is another bullish contrarian indicator.

That is in stark comparison to the end of the last bull market in 1980 when 26% of global investments were allocated to gold.

Another difference this time around is that no country wants a strong currency, in order to compete in the global marketplace. The end result is that gold is now rising around the world, hitting records and attracting attention, reinforcing that investors worldwide are putting more faith in gold.

These differences suggest the current gold rise could be even bigger than the bull market of the 1970s, and they provide even more fuel for today's gold bull market. The recent recoil in its prices should be viewed as a buying opportunity rather than the beginning of its downtrend.