September 2014

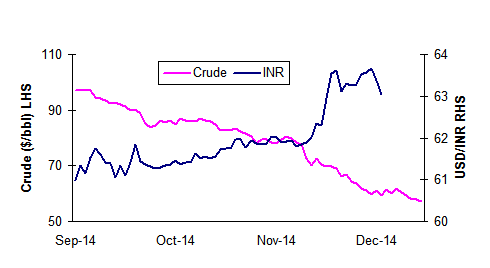

Oil was $100 and the rupee at 61. If a poll was conducted about the level of the INR should oil fall to $50, an overwhelming majority would have suggested the INR at 50-55.

January 12, 2015

Oil is $50 but the INR is at 62.

Is this a paradox or has something changed ?

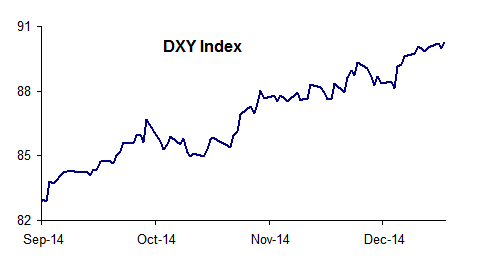

On discussing this with economists and other experts, one reason cited was the strength of the American dollar.

Source: Bloomberg; DXY- Dollar spot Index

The fallacy in the dollar strength argument

A $50 fall in oil prices equals a saving of 2.5% of GDP in CAD as against CAD of 1.9%, 1.1% and 1.3% (as percent of GDP) in the previous three quarters of CY14 respectively. These savings are so real and so massive, that they have the potential to alter the USD/INR demand supply equation on a sustainable basis. In view of this, the indirect impact of the strength of the USD, if any, should be moderate and temporary in our opinion.

It is therefore surprising that the rupee has actually depreciated by 4% v/s the dollar in this period.

A possible explanation

The fall in oil price is not only a recent one but a sharp one too. Consequently, the quarterly average prices are falling with a lag. Further,India’s oil imports enjoy nearly a 6-week credit period, which implies that the effective price for Indian cash basis will fall sharply in the January-March 2015 and April-June 2015 quarters.

* 107 and 49 - Amounts to a saving of 2.5% of GDP in CAD on run rate basis.

|

Jan-Mar12 |

Apr-Jun14 |

Jul-Sep14 |

Oct-Dec14 |

Jan-Mar15E |

Apr-Jun15E |

| Average crude price |

108 |

110 |

103 |

77 |

49* |

49* |

| India’s effective import price (E) |

109 |

109 |

107* |

90 |

63 |

49* |

| CAD (%) |

1.9 |

1.1 |

1.3 |

NA |

NA |

NA |

Source: Bloomberg, Kotak, *HDFC AMC estimates assuming current spot prices, NA: Not Applicable

- Does this imply that January-March 2015 and April-June 2015 quarters will experience a current account surplus ?

- If the above analysis is correct, then we are in for interesting times for the INR/interest rates.

|

|