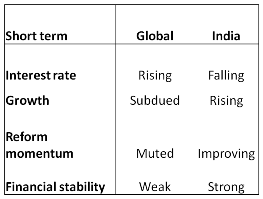

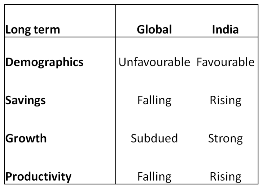

Why we believe India is in a sweet spot compared to the rest of the world.

In the history of financial markets, there will be very few like India which offer such an edge over the rest of the world, both on a short- and long-term basis.

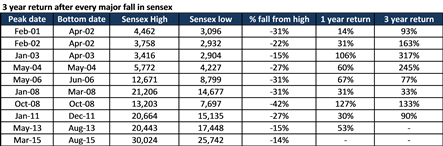

Sharp corrections should not always be viewed with negativity and gloom. In fact, sharp corrections with a structural uptrend offer compelling opportunities.

Sharp corrections (10-20%) are seen often within the structural uptrends witnessed in global as well as Indian equity markets.

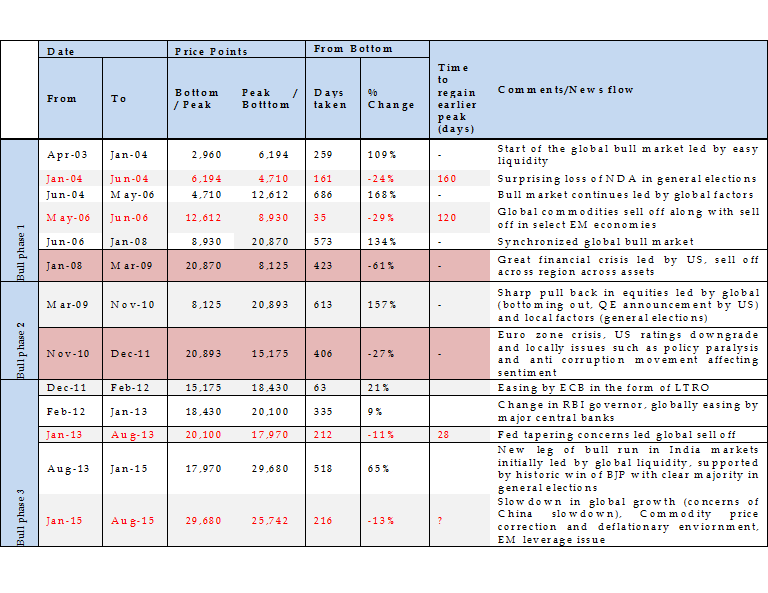

We collated data and analysed similar corrections seen over the last 15 years.

A look at the table below confirms our stance and only goes to prove that they have been the best time to increase equity exposure.

Bull market phases in Indian equities and corrections (Sensex)

Source: Bloomberg

The above table highlights that there have been three bull phases (including the ongoing one) in Indian equities over the last 15 years. While markets rallied 7 times in the bull phase of 2003-08, there were few instances when the market corrected sharply (more than 15%).

However, in these cases, the market regained its previous peak in a short period of time (3-4 months). Data suggests that this is a typical characteristic of any bull market.

Market movement is not linear and corrections are inevitable in any bull run. Correction in a bull market is an opportunity to build positions.

Source: Bloomberg

Volatility is a part and parcel to investing. It is perceived to be negative but need not be. In general, it provides the right opportunity to build positions in otherwise great companies. To reiterate, it provides an excellent opportunity to increase allocation to equities.

Conclusion

Indian macros have never been better; oil at $43 and falling further , current and fiscal deficit trending lower, subsidy burden falling, inflation at multi-year lows and a falling interest rate environment.

On the reform and growth front, things can only improve from here.

Yes, it is taking time to get the economy kick-started, but the direction is clear and trending up.

Keep the faith and be positive!