During the heady days of the bull market before the financial crisis of 2008 set in, some investors must have put money in funds that were top-rated back then (the high-flying performers) only to later discover that their performances dipped later on, leading to a subsequent fall in their star ratings.

Star ratings, as awarded by Morningstar, are based on a fund's historical risk-adjusted performance compared to other funds in the same category.

The ratings are strictly quantitative, meaning they are calculated on the basis of the fund's returns after taking into account the risk taken and other costs. This is not a forward looking view on these funds (read more about what's behind the star rating here).

That said, studies we have conducted in the past indicate that higher-rated funds have generally shown to outperform low-rated funds over different market cycles.

Our own opinion on the star ratings is that a higher star rating does not constitute a ‘buy' signal but investors should use higher-rated funds to screen the better ones.

So while several funds that had high ratings went on deliver superior performance for investors and held on to their ratings, here we looked at those that didn't.

Thus, we screened funds that had four- or five-star ratings before the 2008 global financial crisis, but have lost their lofty star ratings since then due to uninspiring performances. In most cases, the patchy performances and the fall in star ratings were followed by an exodus of investors and a drop in the fund's asset size.

The study thus highlights funds that took excessive risk onto their portfolios, or didn't have a strategy in place to counter the risk in a falling market.

Morningstar started issuing star ratings for Indian funds in August 2007, and thus an earlier period could not be considered for this analysis. Finally, for purposes of brevity, we restricted the study to equity funds belonging to the Morningstar's India Large-Cap and Small/Mid-Cap categories.

Large-Cap Equity Funds

Reliance Equity Fund

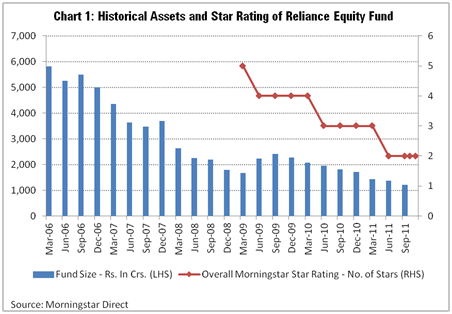

This once heavy-weight equity fund was the most successful new fund offer (NFO), but has disappointed investors with its performance, and lost a large part of its assets along the way.

The fund's high-profile launch in early 2006 made it the most successful new fund offer ever in Indian history. It collected almost Rs 5,800 crore in early 2006, beating the earlier record of about Rs. 4,500 crore by UTI Mastergain 92 (now renamed as UTI Equity Fund) in the year 1992.

The fund outperformed in 2008, falling 44.85%, compared to a loss of 51.46% for the average large-cap peer.

However, between 2009 and 2011 (year to date), the fund landed in the bottom quartile (bottom 25%) for the category.

Over a 5-year period (through to November 2011), the fund has delivered negative returns compared to about 5% (annualized) for the category.

As performance fell, the fund lost about 80% of its assets from a fund size of almost Rs 6,000 crore (at peak) to Rs 1,216 crore for the September 2011 end quarter (average assets for the quarter).

The fund's star rating dropped from 5 stars in March 2009 (first star rating issued for the fund by Morningstar) to 2 stars in November 2011.

The fund is a classic example of all that was wrong with the fund industry during the boom year--rampant promotion of new fund offers (due to higher commissions for distributors), client portfolio churning (switching from one fund to another), or similar funds being launched (old wine in new bottle).

Infrastructure Funds

This once-hot theme has severely disappointed investors in recent years.

First off, Morningstar considers infrastructure funds as diversified equity funds (and not sector funds)--due to their exposure to a variety of sectors from construction and real-estate to even financial-services, auto, telecom, industrials, utilities and logistics sectors--and categorizes them on market-cap basis into large-cap or small/mid-cap equity funds.

Thus, as these funds' investment universe more or less overlaps with that of diversified equity funds, we consider them as part of the same group/universe and rate them alongside other diversified equity funds.

During the boom years, these funds delivered high-flying returns and many fund houses launched several so-called infrastructure funds, but their performances have disappointed after 2008.

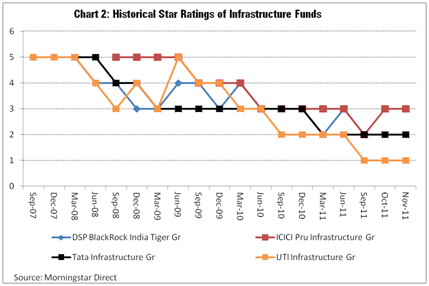

‘Infrastructure' funds in the Morningstar Large-cap category include DSP BlackRock India Tiger, ICICI Prudential Infrastructure, Tata Infrastructure and UTI Infrastructure.

All the above-mentioned infrastructure funds were 5 stars in late 2007 and early 2008.

Since then, most have been downgraded to 1 or 2 stars, due to their poor performance (refer to Chart 2 below).

The assets of these funds fell between 50-60%, from their peak (at the end of 2007) to the end of September 2011. The exception is UTI Infrastructure Fund, whose assets grew, due to the merger of another infrastructure fund (viz. UTI Infrastructure Advantage Fund – Series I) into this fund effective from January 2011.

Birla Sun Life Equity/Tata Equity Opportunity

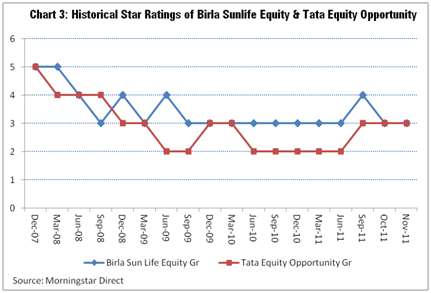

Both these funds have lost some edge over time, with their Morningstar ratings dropping from 5 stars in 2007 to 3 stars presently

Each of the funds delivered top-quartile/second-quartile returns each year between 2003 and 2007, outperforming other peer funds by a considerable margin.

However, the financial crisis took both funds by storm and their performance dropped to the third quartile (within the peer category) in 2008.

Performance picked up to the top quartile in the year 2009, but again languished thereafter. The assets of both these funds have fallen by about 50% since the end of 2007.

Small/Mid-Cap Equity Funds

ICICI Prudential Midcap (formerly ICICI Pru Emerging Star)

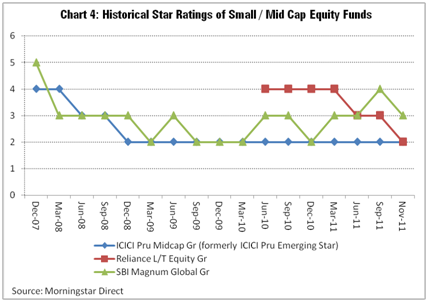

This once-popular mid-cap fund's performance has been a drag in recent years; it has also lost a large part of its assets over time.

The fund changed its name to its current form in September 2011. It was a top-quartile performer in the years 2005 and 2006 (within the mid-cap category), and performance in the year 2007 was also good.

The fund had a tough 2008, being one of the bottom-performing mid-cap funds. Performance picked up in 2009's market rally, but languished thereafter, and dropped to the bottom quartile YTD in 2011.

Its overall Morningstar Star Rating dropped from 4 stars at the end of 2007 to 2 stars in late 2008, and has remained there since. The drop in its performance also mirrored in its assets shrinking more than 70%, between the end of 2007 and the September 2011 end quarter.

Reliance Long Term Equity

This fund's inability to fully capitalize on the 2009 market rally is still weighing on its performance. A disappointing 2011 so far does not help.

Launched toward the end of 2006, this fund does not have a very illustrious overall track record. Performance was good in 2007 and the fund did not fall as much as some of its peers in 2008.

However, it failed to capitalize on the market rally in 2009, delivering a return of 79%, and lagging substantially behind a typical mid-cap fund, which returned almost 95% during the year.

The fund turned around in 2010 but put up a lackluster showing again in 2011 (YTD), with performance placing in the bottom quartile.

Its first star rating was issued by Morningstar in mid 2010 at 4 stars, which gradually declined to 2 stars presently.

The fund's assets fell by about 63% between the end of 2007 and the September 2011 end quarter.

SBI Magnum Global

The once-blue-eyed-boy of the mid-cap category has lost some of its sheen lately, due to some patchy performance.

This mid-cap fund was the star performer from 2004 to 2006, though it lagged the category in 2007's rally in mid-cap stocks.

2008 was another disappointing year for the fund, with performance falling to the bottom quartile, although it recovered smartly in 2009's rally and emerged as one of the top performing mid-cap funds during the year.

Its patchy performance again played out in 2010, although so far in 2011 it has managed to do a pretty good job of limiting its downside. The volatile returns of this fund has dragged down its overall trailing returns, with the fund underperforming both the peer category and the CNX Mid-cap index over a 5-year period (ended November 2011).

Similarly, the fund's star rating has also been volatile, falling from 5 stars in 2007 to 2 stars in early 2009, before recovering to 3 stars presently. Its assets have also come off by more than 50% between the end of 2007 and the September 2011 end quarter.

Later in this series, funds that have held on to their star ratings over time and those that climbed the ratings ladder.