1) A bad year for investing, but the party was behind closed doors.

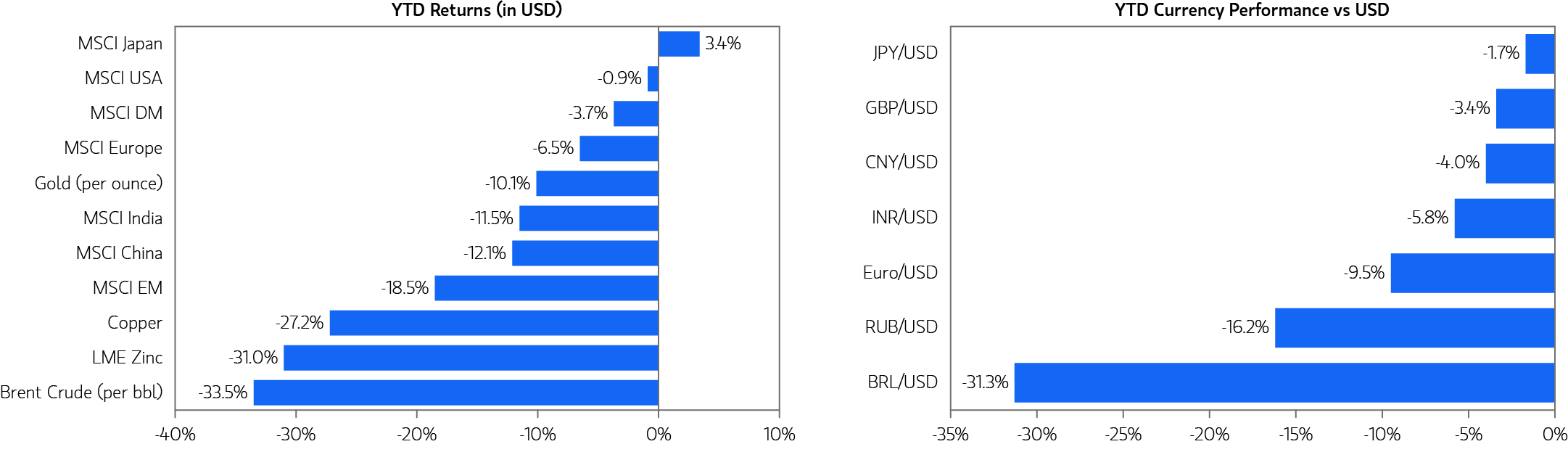

The year 2015 was unequivocally a bad year for almost all asset classes. To borrow a phrase from Bill Gross, investors have been crying in their beers in 2015. Barring a long U.S. dollar trade in the currency markets, most other assets from oil, gold and commodities to bonds and equities performed poorly, even more so when measured in U.S. dollars. The best performing large equity market for the year was Japan, with a paltry dollar return of 3.4%.

Once in a while, Mr. Market will hand a D grade to every pupil in the class.

Though there was no samba on the streets for the public market investor, behind closed doors of the private equity club, the party was roaring. As per a Goldman Sachs report, in the U.S. as of September 2015 more than 120 companies were valued at more than a billion dollars in the private market (popularly called ‘unicorns’), up from just 43 at the beginning of 2014.

These trends were mimicked in India as well. The best performing company in 2015 in India might well have been Flipkart with its valuation going up in every successive round of funding, from $1.6 billion early 2014 to currently about $15 billion.

Liquidity can find its way into unexpected places.

Source: Bloomberg, RIMES, MSCI, Morgan Stanley Research. Data as of Dec. 15, 2015