3) Good macro does not equal good market.

The year 2015 stands in sharp contrast to 2012.

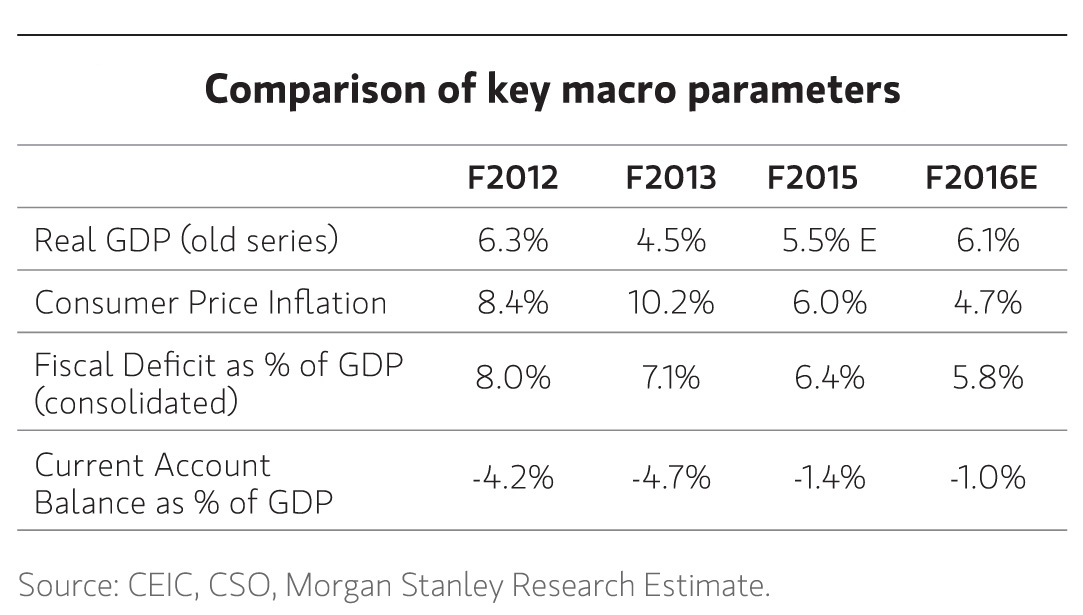

The former was a good year for macro, as measured by the four key parameters of GDP growth, inflation, current account balance and fiscal deficit. But this did not translate into spectacular returns for the stock market.

In comparison, almost nothing went right on the macro front in 2012, but it marked a great year with the market (BSE 100) returning 30%.

The Reserve Bank of India cut rates by 125 basis points during the year, yet the yield on benchmark 10 year G-sec which was at 7.86% as at end 2014 was hardly changed at 7.79% as we write this.

In the short term, macroeconomic fundamentals may not have a positive correlation with market returns.