Term life insurance is affordable and straightforward. It guarantees payment of a predetermined amount should the policy holder pass away during the specified time period.

So should you opt for a 100-year policy or a shorter tenure?

Abhishek Kumar of SahajMoney answers that query.

Amol, a young working professional decided to buy a term plan to ensure the financial safety of his dependents.

He discussed it with his carpool mate Sahaj, a fee-only financial planner.

Sahaj went on the assumption that since Amol plans to retire by the age of 65, he actually requires cover only till that age. Post retirement, Amol will depend on passive income from his retirement corpus built during his active income-generating years.

However, Sahaj compared both options in the term plan, the one offered until 100 years of age versus the other offered only till 65 years. The individual to be insured was a 25-year-old, non-smoker, male.

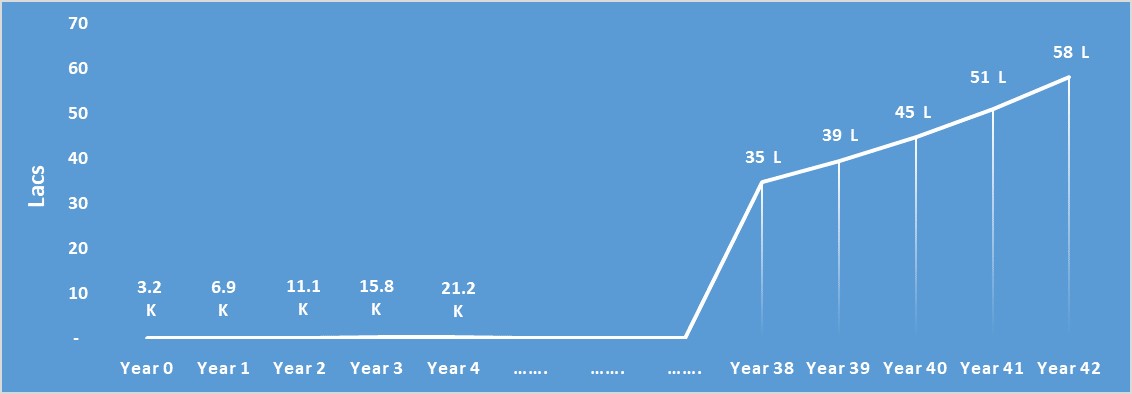

The annual premium (including GST) for 100 years coverage was Rs 7,250, and Rs 4,007 for 65 years. The difference being Rs 3,243.

Sahaj went with the assumption that if Amol was to buy a term plan only till 65 years of age and rather invest the differential amount (Rs 3,243) into an investment option, such as an equity mutual fund, with a 14% CAGR (Compounded Annual Growth Rate), the outcome would be different.

If Amol invests Rs 3,243 rupees into an equity mutual fund, with an annualized return of 14% over 40 years, the probable pre-tax amount would come out to be nearly Rs 50 lakhs. If one does not withdraw this amount and lets it compound in a debt instrument, at 6% CAGR, the pre-tax amount would turn out to be Rs 3.8 crore in another 35 years. This is much more than the sum assured of Rs 50 lakhs offered by the life insurance company till 100 years of age.

That’s the power of compounding!

Point to be noted: For the sake of simplicity, the above example has overlooked the tax benefit aspect of premium payment under Section 80C of India Direct Tax Law.