At Morningstar, our endeavor has always been to create exciting products that provide investors objective and trustworthy data and analyses to help them achieve their financial goals.

For new visitors to our site, and even for regular users who might discover features they didn't know existed, we have created a walk-through for our website, discussing various areas of the site and how investors can make their way around it to use our research and data to their advantage.

We will keep coming back to this article and update it as and when we introduce newer features.

Mutual funds

Fund research has been our forte for decades, and it would be no exaggeration to state we created the fund-research industry globally.

First up, we have created a robust database for Indian mutual funds (both open and closed end) where you can find NAV, portfolio and performance information, risk and ratings (including the Morningstar Rating) for individual funds.

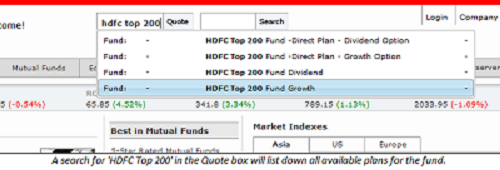

To look up any mutual fund, you need to input its name in the quote box, select the fund from the drop-down list and click on the fund’s name.

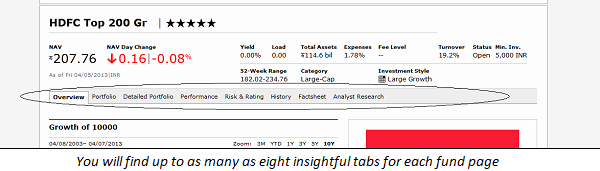

On any fund’s individual page, you will find various tabs providing information on that fund. On the overview tab, you find the “Growth of 10,000” chart, which maps the fund’s performance against the large-cap category and a suitable large-cap benchmark. You also find a snapshot related to the fund’s performance and risk and return measures, details of which you will find in the other tabs. On top, you will see the fund's Morningstar Rating.

The portfolio page contains several elements related to the fund’s investing style: current asset allocation, portfolio characteristics and style box. (Click here to read more about the Morningstar Style Box.)

The Detailed Portfolio page contains the fund’s complete portfolio holdings list, according to the latest disclosed portfolio.

Next up is the Performance page where you can look up the fund’s detailed performance, including year-on-year, trailing, monthly and quarterly returns, again compared to the fund’s category and a relevant benchmark.

In the Risk & Ratings section, you will see the fund’s Risk and Return rating over various time periods, based on which we compute the overall Morningstar Rating. On the same page, you can also see other MPT and volatility measures such as R-squared, Beta, Alpha, Treynor Ratio, Sharpe Ratio, Sortino Ratio and Upside and Downside Capture Ratios. (Click on each to find out more about these metrics.)

On the History Tab, you can view the fund’s historical asset allocation over the past five years, including style box and sectors.

On the fact sheet tab is a Morningstar-style PDF that will give you an instant snapshot about the fund including investment objectives, performances, ratings and portfolio details. Users can also download this PDF factsheet for themselves to keep.

Finally, wherever available, hop over to the final Analyst Research tab to find out more about the Analyst Ratings on and our analysis of the fund. The Analyst Rating is derived from our fund analysts’ evaluation of what we believe are the five key pillars that indicate a fund’s potential (People, Parent, Process, Performance and Price) and is our qualitative, forward-looking view on whether we think the fund will be able to outperform its peers over the long term. (To read more about the Analyst Ratings, click here.)

Once you have read the brief Fund Analyst Report, we would encourage registered users (registration is free) to download the Analyst Report PDF--button located on the top right on the Analyst Research tab--which contains our views on each of the five Ps in a more detailed manners.

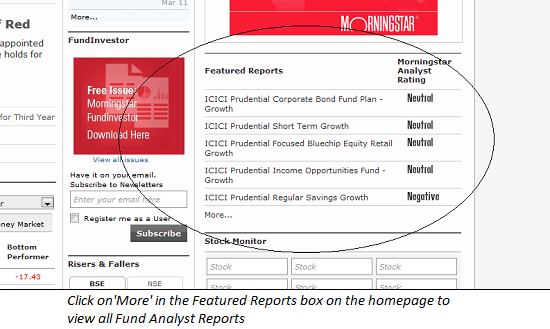

Users can also access the complete list of funds under Analyst Ratings coverage by going over to the Featured Reports box in the right-hand column on the Morningstar homepage. Clicking on the ‘More’ button will open up that houses all funds under analyst coverage. (For a detailed on the differences between the Morningstar Rating and Analyst Ratings for funds, please click here.)

Finally, don’t forget to subscribe to our free monthly FundInvestor newsletter that provides insightful month-end market commentary and fund news, articles and Morningstar ratings to stay updated about the market. You may find the FundInvestor icon in the middle column of the homepage.

Stocks

Even as we are known more for our mutual fund data and ratings, our equity data and research practice is as comprehensive as you could think.

Like with mutual funds, you can use the Quote Search box on the homepage to input and open any stock’s individual page.

On the individual stock page, the first Overview tab provides an instant snapshot of each stock, including a chart mapping the stock performance going back to 10 years, the company profile, dividend information, financials and so on.

Roll over to the Performance tab to find out the stock’s year-on-year performance, trailing returns, yearly dividend etc.

On the Financials and Key Ratios, you will find the company’s yearly financials going back, in many cases, to 10 years. Also find data on several key ratios that would help you make better investment decisions.

Finally, wherever we have coverage, do remember to read our Stock Analyst Report for each stock on the Equity Research tab. (Click here to know more about how our Equity Research works.)

Our stock analysts assign a valuation to each company under coverage (using our propreitary discounted-cash flow model) after evaluating the firm’s business model, economic moat (sustainable competitive advantage over peers) and management stewardship, among other things, and forecasting its growth and profitability in the years ahead. (Read: How Morningstar Calculates Stocks' Fair Values.)

Registered users can view our complete view on each stock under our coverage by download the PDF on Equity Research page, including our complete thesis of the company, valuation, growth and profitability scenarios, consider-buy-and-sell prices, economic moat rating, risks, and our bull and bear cases.

To enrich user experience, we also have an easy-to-understand five-scale Morningstar Rating for each stock under coverage. The rating signifies whether the stock is trading below, near or over our fair value (with a one-star rating indicating extremely overvalued, three being fairly valued and five-star rating being extremely overvalued). Our equity research philosophy is long term in nature and we encourage users to not treat our Morningstar Ratings for stocks as short-term recommendations but rather use them to create a worthy long-term portfolio.

Do note that the Morningstar Rating for stocks is completely different from the funds rating: with the former indicating whether the stock’s market price is trading close to or away from our fair value (and implying a forward-looking outlook on whether we think the stock will rise or fall over the long term) while the rating for funds is a backward-looking indicator of a fund’s risk-adjusted performance versus peers.

For a list of all stocks under analyst coverage, hop over to the home page and click on the More button in the Equity Research box of the middle column.

Insurance Funds

We recently added an “Insurance Funds” tab to our homepage. Here, you can view not just NAV and comprehensive portfolio, risk-and-return rating and performance data for ULIP funds--something you would not find anywhere else in the Indian market--we also introduced our popular Morningstar Ratings for such funds (similar to our funds ratings) to help investors evaluate these funds. (Click here to read about the launch of the Insurance Funds page and the Morningstar Rating for insurance funds.)

Tools and Calculators

On the tools page, we have an array of sophisticated tools to help you research your investments, across funds, stocks and ETFs. These tools are in the form of performance screeners, ranking tools, compare tools and powerful calculators. (Read more about our Tools page here.)

Articles

At Morningstar, we also regularly put up insightful articles written by our journalists and analysts, providing pieces on a host of topics such as market news, economic analyses, portfolio-planning insights and investment commentary.

You can find the latest articles on our homepage but to view our complete archives, click on the Archives tab on the home page or the More button beneath the articles. Here you can sort articles on the basis of dates, categories and author.

Do check out everything that we have to offer currently, provide us with your feedback in the comments section, and keep coming back for more--we are always in the process of making our site more feature-rich and easier-to-use than before.