The writer of this article blogs at Fundamental Investor and tweets at @FI_InvestIndia.

Dividends are the shareholder’s apportion of the company’s profits or reserves paid periodically (annually or quarterly). In the investor’s hands, this can be used to meet ongoing expenses, or can be reinvested.

While no one single number can reveal the financial strength of a company, earnings (or growth towards positive earnings) tell you how healthy a company is.

As the business grows, so do earnings. When that happens, the share price slowly and steadily moves up. The dividends follow that similar trajectory. I myself am personally invested in companies where 50% of the Earnings Per Share, or EPS, is returned to shareholders in the form of dividends.

Let me explain Dividend Yield before I proceed.

Company A

- Face value per share: Rs 2 per share

- Current price per share: Rs 1,200 per share

- Annual dividend per share: Rs 40

- Dividend Percentage: (Dividend/FV) x 100 = (40/2) x 100 = 2000%

- Dividend Yield: (Dividend/Share Price) x 100 = (40/1200) x 100 = 3.3%

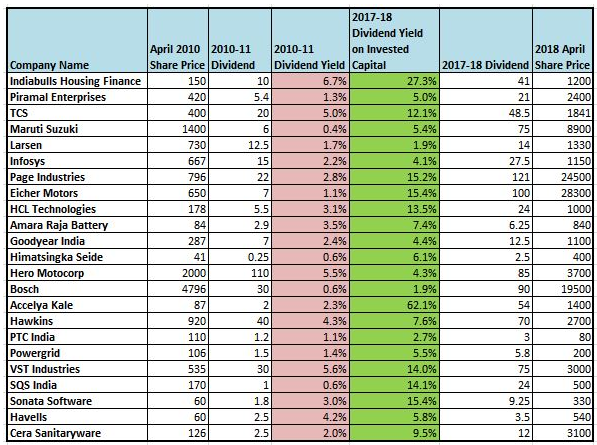

Let's narrow down on Maruti Suzuki; a fantastic business over the decades. And assume that you invested in that company in 2010.

2010

- Stock price: Rs 1,400

- Number of shares bought: 100

- Invested capital: Rs 1,40,000 (1400 x 100)

- Dividend per share: Rs 6

- Dividends earned that year: Rs 600

- Dividend Yield: 0.4%

2018

- Stock price: Rs 8,900

- Number of shares held: 100

- Invested capital now worth: Rs 8,90,000

- Dividend per share: Rs 75

- Total dividends earned that year: Rs 7,500

- Dividend Yield on invested capital of Rs 1.4 lakh: 5.4%

Have you noticed the magnificent rise in the dividend amount? From a mere Rs 6 to Rs 75? And the corresponding rise in the dividend yield?

Lesson I: The yield might appear low at the time of investment, to the point of being ridiculously meagre. But, if the business compounds over time, the yield will be astounding.

While the past is no determinant of future returns, for the sake of argument let’s say Maruti Suzuki continues to gain market share and earnings progressively rise. The dividends will follow suit. Imagine the benefit to the investor. Do think about it.

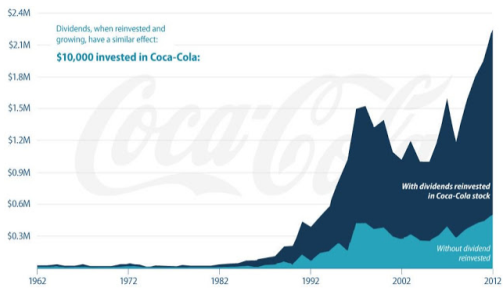

Now just imagine if this dividend was compounded. While we are all familiar with the standalone term compounding, dividend compounding is probably a novel term in your investing lingo.

The graph below will drive home my point.

As elucidated in the visual, the difference in returns is enormous between Dividend Reinvested and Dividend Withdrawn.

Should you continue to buy more shares with the dividends received, the dividends will compound along with the business share price (assuming that company continues to grow steadily over decades). The results are eye popping.

Investors generally focus on the price points of a stock - the buying and selling. The stock price of a company will keep fluctuating, and along with it, your notional profit or loss. But it is time to open your eyes and realise that there is another way a stock provides an individual with returns; and that is dividends.

Lesson II: Dividends offer tremendous flexibility to the investor. She can either use it to meet her expenses. Or, can use it to further invest in the company and grow her wealth.

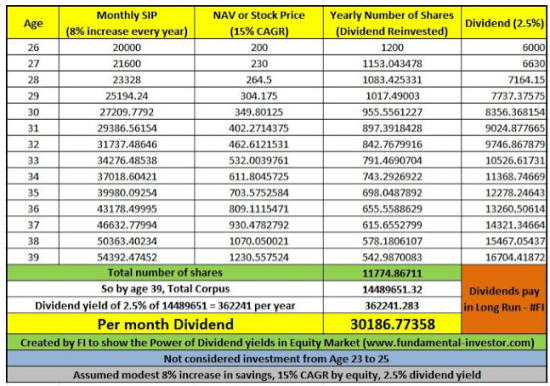

Take the case of an investor who starts at the age of 26. She increases her systematic investment at the rate of 8% per annum. And I am assuming a 15% CAGR with a 2.5% dividend yield. Now grasp the power of dividend compounding.

This is precisely the reason I have a strong affiliation for companies that have a consistent dividend paying policy and adhere to it. Because the main benefit to the investor comes when she holds the dividend-paying stock for decades.

Lesson III: Real wealth is created by building a portfolio over time of dividend yielding stocks. The price of the stock can shoot up astronomically (and you may not want to sell, hence profits are notional). Or, it may tumble down in a bear market. But dividends are real.

So here is what to keep in mind when scouting for dividend paying companies.

- Business has to keep growing. When I say business I specifically mean earnings growth must be steadily progressive. Else, dividends won't grow.

- Check dividend payout history. Is it regular? Consistent? Growing? Flat? You can find this information in Corporate Actions page on the stock exchange website.

- Check dividend paying policy of the company, which is available in the Annual Report. Then see if they have adhered to it religiously.

- Avoid cyclical companies while looking for consistent dividends. In such companies, the dividends too will be cyclical.

The companies mentioned in the article are purely for illustrative purposes and NOT stock recommendations.