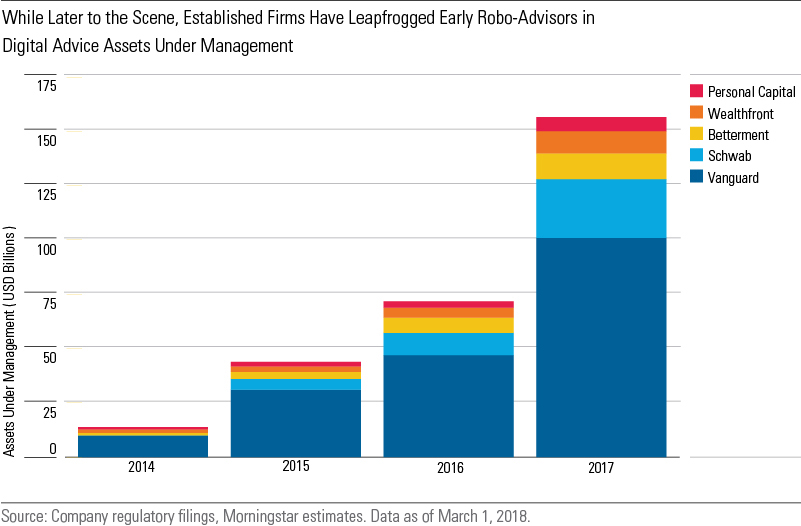

We took the opposite viewpoint in a 2015 report called “Hungry Robo-Advisers Are Eyeing Wealth Management Assets.” At the time, we asserted that established financial institutions with economic moats, such as Charles Schwab and Morgan Stanley, would stay competitive. And we found that the stand-alone robo-advisers would “have to invest heavily in advertising, or consolidate to gain scale, be acquired or partner with established brokerages, or go out of business."

Our dire assessment of the original robo-adviser business models has proved correct so far. Robo-advisers—which we defined as primarily digital firms that offer automated, semi-tailored investment portfolios direct to retail end customers—have failed to disrupt investment services incumbents and are still largely unprofitable. Many have sold themselves to established firms after realizing they can't count on investors giving them money. Robo-adviser costs also present a challenge to profitability.

Overcoming 3 faults of the original robo-adviser business model

The original robo-adviser model had three main challenges: high client-acquisition costs, ongoing costs of servicing clients, and low revenue yield on client assets. But new business models (and more aggressive digital-transformation efforts) are helping to address these faults.

Lead-generation tools and strategic partnerships are reducing robo-adviser costs, while building for scale and operating leverage eventually solves service costs. Revenue-enhancement strategies underpin much of our optimism for select robo-advisers becoming profitable. Upselling to human advice, ancillary service offerings, and incorporating proprietary products in portfolios are key revenue drivers.

We still don't see robo-advisers disrupting market-leading financial institutions. Instead, we expect established financial institutions to co-opt the technology of robo-advisers—along with the improvements to their user experience—and expand their own businesses.

Our new report, “Robo-Adviser Upgrade! Installing a Program for Profitability: Digital Advice Raises Profits for Investment Services Industry” takes a deep dive into this corner of the financial services landscape. Here’s a look at some of the highlights.

Key takeaways on robo-adviser wealth management

We believe robo-advisers have three life-or-death choices: grow slowly and hope investors keep funding them, partner with an established financial services firm, or grow quickly with high-cost advertising.

Betterment and Wealthfront have both raised capital in the last year, according to PitchBook data. We reasonably conclude that they've eaten through $100 million-$200 million of capital to reach $10 billion of client assets.

We still assess that advertising cost per account acquisition at robo-advisers is approximately $300 per gross new account and $1,000 per net new account. At their presumably low operating margin after they become profitable, the payback period on advertising costs can be more than a decade.

Strategies to lower robo-adviser management costs

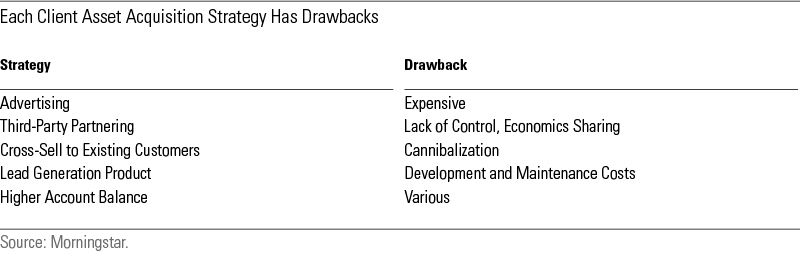

Four strategies can help reduce robo-adviser costs of client acquisition, but each approach has drawbacks.

Robo-advisers need to build a high-operating-leverage business model to be profitable. We believe digital advice firms will spur growth in salaried financial consultants, as opposed to the traditional financial adviser compensation model of a percentage of revenue generated, to produce operating leverage.

Expanded service offerings and higher revenue yields dramatically reduce the operating expense ratio and client asset hurdles to reach the goal of profitability. We estimate the break-even point for robo-advisers that sustain a 50-basis-point revenue yield could be $15 billion-$25 billion of client assets, 38%-63% lower than the break-even point for a robo-adviser that charges 25 basis points.

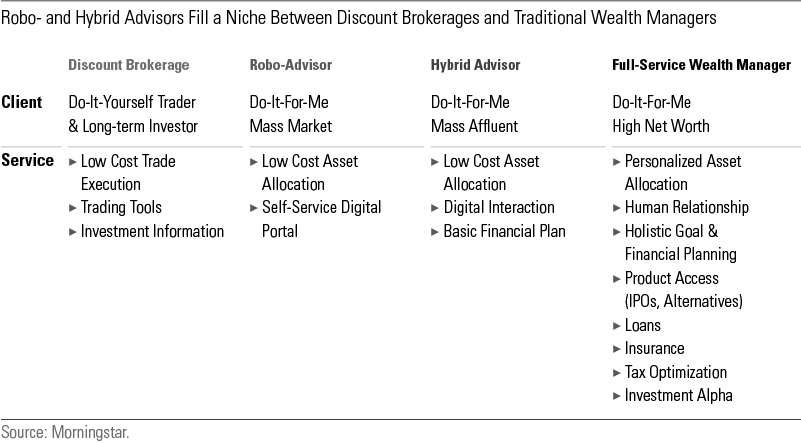

Looking at business models, we see robo-advisers, discount brokerage firms, and full-service wealth managers have value propositions that target different customer bases. Additionally, many of the discount brokerage firms are well scaled with material cost advantages, while the reputation, relationships, and product offerings of the full-service wealth management firms create customer switching costs. We believe the economic moats of incumbent investment services firms can withstand the robo-adviser encroachment.

This post by Michael Wong, Director, Financial Services Equity Research - North America at Morningstar, first appeared on Morningstar Blog.