Sector funds are not sparse in supply; we have them in the FMCG, Technology, Precious Metals, Energy, Financial Services, Infrastructure spaces.

But with asset management companies recently launching pharma funds, Larissa Fernand and Himanshu Srivastava relook the role of sector funds in a portfolio.

John Bogle, the founder of Vanguard, once commented that an investor could go through his entire life without ever owning a sector fund and probably never miss it. We agree with his view, which is that a well-diversified portfolio doesn’t need sector funds. Simultaneously, we are sticking our necks out by saying that sector funds deserve more respect, if you play it right (with an emphasis on the latter).

As far as your equity portfolio goes, a way to further juice your returns is to tactically time your entry and exit into a sector fund. Simply because sector bubbles and collapses represent opportunities for earning outsized returns and avoiding losses.

Take a look at the sector performances below. The green mark indicates the best performer that year and the yellow one, the worst. It can well be the case that the best performer in one year is the worst the very next. (click on image to enlarge)

We are not sugar coating it; we are outrightly stating that absolute calls in a sector fund should be based on market timing. And by this we don’t mean the ad hoc predictions of market tops and bottoms which one gets by watching TV anchors scream themselves hoarse. We are talking of informed calls that are made after studying market cycles, dynamics of the relevant industry, macro-economic analysis, and maybe even technical analysis.

The point we are making is simple.

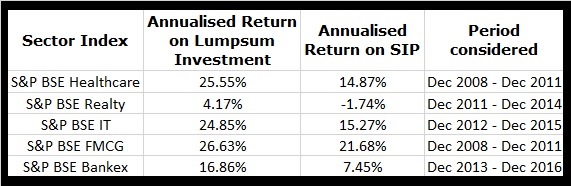

If investing in a regular diversified equity fund, opt for the systematic route, known as SIP. But if opting for a sector fund, it is better to do a lumpsum at the opportune time. Move into such funds tactically, not with a buy-and-hold mindset. A look at the table below reveals that more money is made when you do so.

If you made a one-time investment at the start of the considered period, the return would be higher than had you opted for a monthly systematic plan over the concerned period.

If you believe that sector funds are the proverbial pot at the end of the rainbow in the mutual fund arena, then keep this in mind.

- Take a call to invest in the most 'favorable' sector, by this we mean the most favorable risk/reward characteristics. Get in when the sector has been beaten down and exit when it gets its place in the sun.

- Don’t enter a sector after it has chalked up great numbers. And if that is what you have done, then hold on and exercise patience. It is difficult to stick with sector funds because a rocky ride is guaranteed.

- Have a well-conceived investment strategy. You must know why you are investing in that sector and what is your view on it. So even though there may be a disconcerting drop along the way, it will not shake you and you will be able to view it with perspective.

- Don’t ever view such funds as core holdings. Core holdings should be diversified equity funds with a stable track record.

- Even if you believe you have timed your entry into the sector fund to perfection, don’t gamble too heavily on it. The exact amount will depend on the individual in question. But, by and large, and we are generalizing here, don’t let your sector funds exceed 10% of your equity portfolio.

- If you don't have the money to invest at one go, it is fine to opt for an SIP. But do so when the sector is languishing at lows. Because that is what will provide the kicker to make money. Avoid investing in a sector, one-time or SIP, when the bulls are riding it and valuations are stretched.