The other day, I received a video of the Alexander Falls.

Located in Canada, it normally flows for nearly 6 months in the winter. For much of the time, the flow of water is constrained to a small area which is kind of a pressure release and ensures that there isn’t much water build up behind the ice. But as summer approaches, an Ice Armada approaches the waterfall with a huge amount of ice. The pressure on the ice wall that is holding up much of the length of the waterfall holds back for a long time until it gives way in one single swoop.

Something of a similar nature took place in the market. For nearly 9 months now, investors have seen mid and small caps getting crushed while the market scaled new highs. In the space of just about a month, the wall has been broken causing a stampede of proportion not seen in recent times. Stocks have crumbled regardless of whether they had gone up in the earlier march or not.

Markets all about sentiments, and when sentiments take a turn for the worse, even the best of news isn’t good enough to stop the carriage from rolling over. When going up, stocks go up for a variety of reasons – some individualistic, others not. But when the tide turns, it really doesn’t matter whether the stock is a blue chip or a coconut chip; everyone falls like nine pins.

The difference though is both in terms of the depth of the fall and the reversal one sees at the end. The blue chips fall shallower than the coconut chips and are also faster when it comes to recovering those losses.

I see those who didn’t participate in the rally mock those who did and are now getting burnt as the pull back is in full swing. But there is an issue with not being invested either.

Let’s take asset allocation for example. The one I publish here is one which goes gradually from 0 to 100. It is the contrarian way of allocation since it asks one to reduce as the market keeps going up and adding more allocation as it keeps going down. It takes a lot of faith to be out of the market when its going up and keep adding more money when it seems the world is ending.

But there are ways of asset allocation where its more binary. You are either all in equities or all out.

If you were using Meb Faber’s timing model, which is based on where the market is with respect to its 10 month moving average, you would have been long on Nifty since January 2017 and would now be looking at exit given that its currently below the 10 month MA though the trigger will be when the close happens.

On the other hand, my own Asset Allocator started off in January 2017 at 75% but quickly went down and 30%-40% would be long-term average. Given how the market exploded, this looks like a missed opportunity.

But the problem with binary rules is the problem of whipsaws. For example, the same model has whipsawed quite a bit over time.

The arrows depict when the signal went into Buy and Sell mode

Click image to enlarge

While it has over time captured long trends, the final result is that the cost of whips means that we don’t capture all. Instead, we end up capturing 90% of the gains (2003 to 2018) while suffering half the draw-down Nifty suffered (during 2008). Not a bad deal, eh?

The logic behind both is similar – not to be exposed totally at the worst possible time and they achieve the same in different ways. But the key to success in both is sticking to it and that’s where the problem lies.

The market is falling currently and if you were to be following the model of adding more at every fall, this is the time to add to equities. If you were to be following the second model, this is the time to exit everything and shift to safer assets.

While selling after the market has fallen is tough, tougher is to actually go per plan and add more money at this juncture. Fear envelops the best of mind as we argue whether this is the time or is there still more pain-down the road.

In hindsight, panics have been the best times to invest. But, when one is a participant, it’s tough just to stay put with current investments, forget a fresh infusion.

Momentum and Value Investing

If you are a momentum investor, should you be invested in the market, let alone add to your holdings? Logic says that when markets are going down, momentum is the worst strategy to be invested in. But is that supported by data?

Momentum investing is very similar to value investing or investing in quality companies. It’s a strategy like any other, the only difference being in the way stocks are picked. In a strong bull market, value investors find it tough to find companies to invest into, but even in the strongest of bull markets, there are generally section of markets that appear fairly or cheaply valued.

During the last year or so, much of the market was in the grip of a strong bull market and yet, if you were a value investor, you could have found pockets of value in areas such as Information Technology and Pharma.

Markets are currently weak, but that doesn’t mean lack of stocks with positive momentum. The list of stocks with positive momentum has seen a decline in recent months, but even after applying filters to eliminate stocks that don’t have enough liquidity, I can still find 70+ stocks available to invest into.

Friends who run advisories based on quantitative momentum offer dynamic asset allocation based momentum strategies which goes into cash when the market is weak and boosts up the portfolio holdings when momentum is back.

Similar to the asset allocation difference, tactical asset allocation mixed with momentum strategy, both styles come up with their own advantages and dis-advantage. The choice is left to the discretion of the investor based on what one is comfortable with.

My own choice has been to keep asset allocation outside of the system similar to how money management in trading systems is kept outside of the trading algorithm. This for me ensures that I can use strategies such as value averaging to add more money to my portfolio whenever such opportunities arise while at the same time ensuing that I always know where I am in relation to the overall asset allocation.

Market falls like now can be an opportunity if you were to believe that we are closer to the bottom or a threat if one perceives that the bottom is still far away.

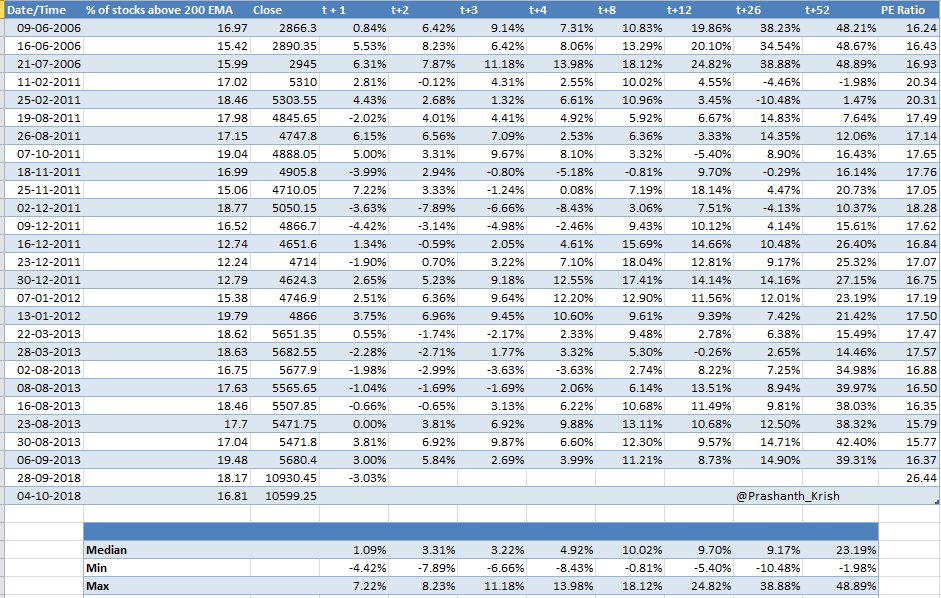

One way to look at is to see the breadth of the market and compare it to historical numbers. For example, the percentage of stocks that are trading above 200 EMA is now below the 20% mark. Historically, this has been seen when markets were closer to the bottom than closer to the high though the exception to the rule would be 2008 when the percentage went below 20% in March. If you invested at that point in time, by the time a year was up, the market itself was down another 50%.

But ignore the 2008-09 drama and the reality differs. Only once in all the instances (25 of them) did markets close in negative even a year after the event (Feb 2011 Entry). The median return for buying when the percentage of stocks trading above 200 EMA went below 20 was a decent 23%.

Click image to enlarge

The market has deteriorated significantly in a very short span of time. Rather than a gradual time-based correction, this has turned to be a strong price-based correction.

Based on one’s risk appetite and liquidity position, I believe this is an opportunity to add. It’s not yet time to go overboard – for me that will be if Nifty tests the 9,000 levels (9,200 is the 200 Weekly EMA and if you look at history, other than in recessions and 2008, this has been the point of bounce.) Rather, ensure that fresh money is deployed to return the allocation which would have suffered due to the current fall back to equilibrium.

Secondly, 9,000 also means a 20%+ correction from peak. Given the destruction we have already seen in the market, further fall is tough to see at the current juncture.

It doesn’t matter if you are a value or momentum or quality investor, given the breadth of the fall, you should be able to find good opportunities. They may become even better opportunities, but in the face of the fact that we don’t really know the future, not betting anything isn’t the best solution, especially if you are comfortable with both the liquidity and the asset allocation.

It’s not enough to just read about the great investors and traders, when the time comes, it’s the ability to stay the course and take the risk that differentiates (subject to surviving though) the professional from the amateur.

Alpha doesn’t come free because you wish to invest when everyone is doing the same, alpha comes for being different and this is one such time.

Prashanth Krishna is the head of compliance at Wizemarket Analytics Private Limited.

You can follow him on Twitter.

This post initially appeared in Portfolioyoga.com