This post by Parijat Garg, CFA was originally published on CFA Institute's Enterprising Investor.

To a quantitative investor, discretionary investing is ridiculously subjective — rife with confirmation bias, availability bias, base-rate ignorance, and more. To the discretionary investor, on the other hand, quantitative investing is hopelessly naive. A company is more than its price to book and return on capital employed.

The worlds of these two investors are like East and West. One would think that they would never come together.

But the promise of artificial intelligence (AI) in investing is precisely that: a meeting of the two worlds.

Recent developments in machine learning have created exciting possibilities to combine the two investment philosophies. Now quantitative investors can find much more intricate and non-linear relationships among the fundamental factors that drive investment returns. It is increasingly possible to process complicated financial statements to identify factors more elaborate than conventional varieties like value, momentum, and growth. For instance, an AI system might uncover a complex but predictable relationship among financial leverage, interest rates, operating margins, and the probability of bankruptcy.

On the other end, thanks to AI, discretionary investors can surface and quantify factors that had previously been matters of extremely subjective assessments. Through social media monitoring, they can gauge the public perception of a brand. They can measure the actual number of customers visiting a retail outlet using daily aerial photos of parking lots. They can also get a sense of employee morale from reviews on websites like Glassdoor. Weaving these factors into their investment process can add significant alpha to their returns.

And yet, there is an entirely overlooked dimension that may be even more exciting. It is now realistically possible to create an artificial replica of an actual investment manager, a machine that learns by example and develops its own investment style: chasing momentum, sticking to conventional notions of value, or buying growth at a reasonable price.

How would we build such a system?

Most systematic investment strategies rely on mean-variance estimation. Instead, we want a system that predicts what an investment manager would do given a specific set of data — information that is almost always insufficient to make a precise prediction about returns. This is a subtle but crucial difference. One important side effect is that such a system is allowed to say, “I don’t know what to do here.” Once we stop trying to predict returns and attempt to predict investment decisions instead, we can work with arbitrarily limited information.

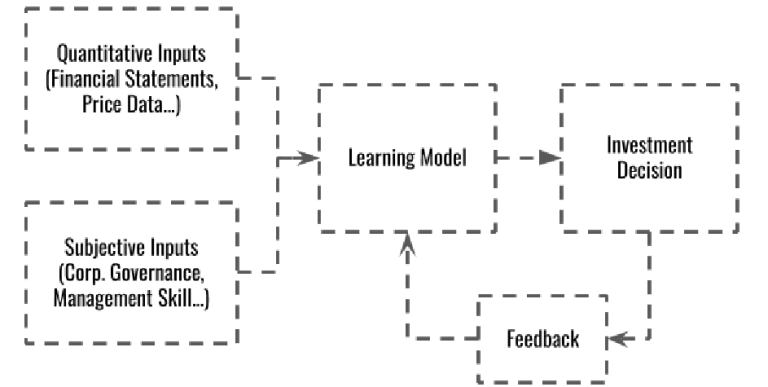

There are two broad sets of factors affecting an investment decision. The first is composed of quantitative factors derived from financial statements, market data, etc. The second includes subjective judgments about corporate governance, potential market size, disruptability in the case of stock selection, for instance, etc. Depending on style, an investment manager can include myriad factors within both categories and assign very different weights to each. The manager may not even be aware of the weights they subconsciously assign to them. Indeed, these weights may not even be linear at all, but a hierarchy of yes/no decision points.

Within the contours of modern AI systems, it is now possible to include all these factors in the decision process. We can begin to articulate the architecture of the system as follows.

There are two crucial observations. The first is that we are trying to model investment decisions, not risk or return. The second is that we treat subjective inputs as distinct from quantitative inputs. However, these subjective inputs are still quantitative in nature. For instance, we could include a rating of corporate governance on a scale of 1 to 5. Human judgment will continue to determine such criteria.

This architecture allows an organization to start building a system far more quickly than trying to model returns, one that also uses quantitative inputs only. More importantly, a system built like this will, over time, begin to reflect an investment manager’s style.

Within this architecture, there are infinite meta-parameters, or the factors included in the inputs used by the underlying model. The investment team’s ability to provide robust, subjective assessments would also matter a great deal.

No two investment managers are alike. There is no reason why two AI-driven systems should be either. By predicting investment decisions rather than returns, and by including a team’s subjective assessments into the decision process, we are guaranteed to obtain a large variety of unique investment machines — a prerequisite for the continued vitality and robustness of financial markets everywhere.

Have you begun to integrate AI into your investment process? How have you approached it?