If you are active on social media, you would have encountered the #10YearChallenge, which entails posting a photograph of yourself a decade earlier along with one of you now. (Though frankly, I cannot see why this is a 'challenge').

Some individuals posted 2008 and 2018 photographs; while others opted for 2009 and 2019. But whichever tenure was selected, they ensured that they put their best foot forward.

Environmentalists latched on and used the hashtag to make a point about climate change and the environment. Some stark, and frightfully vivid, revelations there.

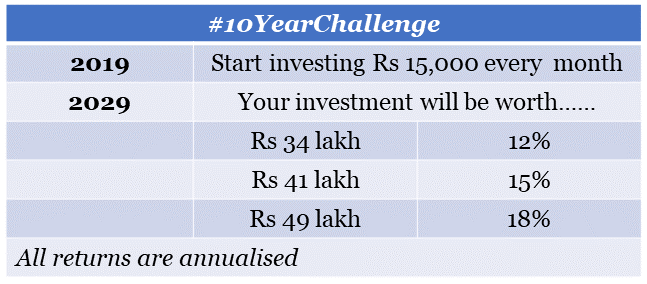

An Indian investor who goes by the Twitter handle Fundamental Investor, presented his followers with an investing equivalent: If they set aside Rs 15,000 every single month starting this year, a decade later (2029), their investment would be worth a very tidy sum.

He presented the following figures with the respective estimated rate of return:

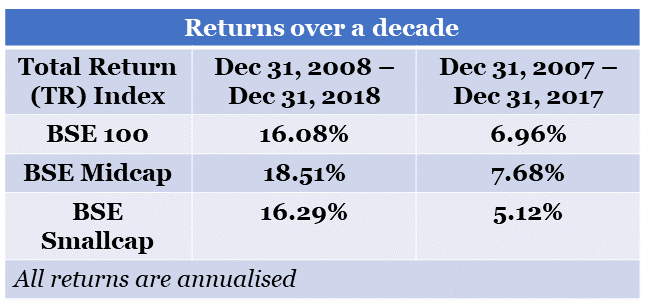

I tweeted the returns for the decade ended December 31, 2018, just to gain some sort of perspective. They were extremely impressive.

But typical of the Twitter theatre, there was scepticism. In this case, it was extremely valid and I certainly appreciate the inputs of Prashanth Krish and India Equity Research, which I have reproduced below.

- Does the starting point P/E matter? After all, Nifty PE was 12.97 in 2008 but 26.17 in 2018. In other words, re-rating of valuation itself would give 7.27% CAGR.

- What about the inflation outlook? Inflation levels were extremely high in 2008, hovering between 8% and 10%. The inflation monster has been tamed, and since equity returns are linked to inflation, that should be accounted for.

- The returns assumed are way too high. Rather than employ 2008 to 2018 returns, use 2007 to 2017 returns. Anything extra is a bonus.

All relevant points. It was also obvious that expectations needed to be much more subdued. Looking at the returns over 2 decades turned out to be a jolt of sorts.

Herein I realised my error.

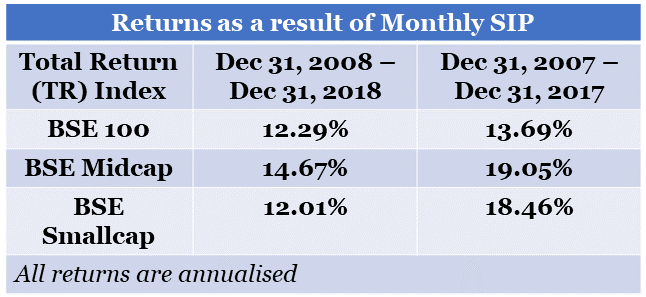

The #10YearChallenge of Fundamental Investor specifically looked at a monthly investment, what we would call a Systematic Investment Plan, or SIP. It entailed setting aside a fixed amount every single month.

So once again, we ran the figures through the Morningstar Direct database and came up with this.

Here are the takeaways:

1. Save. Invest. Keep aside a fixed portion of your earnings to invest regularly.

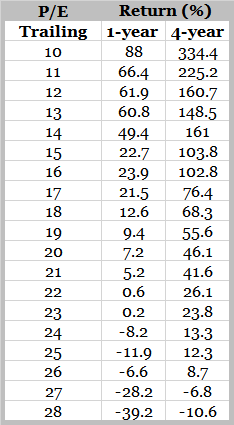

2. Investing in equity helps you combat inflation and create wealth. India Equity Research agreed on encouraging individuals to invest in equity over the long term but cautioned about keeping the asset allocation in perspective. And went one step ahead and provided the data below to prove that getting more people into the equity market at elevated PE levels would backfire.

3. Hence, invest via SIPs. Systematically investing through downturns makes the world of a difference. Don’t stop your investments in panic when the market turns volatile or slumps. Phoenix2106 stated that he intersperses his SIPs with periodic bulk investments when the market crashes.

4. Give yourself a long tenure when it comes to equity. The #10YearChallenge is not written in stone. If there is a ferocious bull run 8 years down the road, book profits. If at the 10th year the market is in the doldrums, you will just have to wait.