The interest in sustainable investing has only gained in momentum over the years.

Way back in 2014, the Nielsen Global Survey of Corporate Social Responsibility noted that more than half of consumers surveyed globally said they would be willing to pay more for products and services from companies committed to positive social and environmental impact. Two thirds said they would prefer to work for a socially responsible company.

It can also be seen in increased assets under management in sustainable investment portfolios and in the number of asset managers globally that have signed the United Nations-backed Principles for Responsible Investment (PRI).

Recently, Morningstar announced the launch of the Morningstar ESG Asset Allocation Managed Portfolios in the U.S., a series of 5 funds of ETFs and mutual funds, for advisers whose clients are concerned about Environmental, Social and Governance issues, known as ESG.

From a values-based perspective, the thesis behind sustainable investing is that directing capital toward companies that are dealing effectively with sustainability issues will enhance the transition to a more sustainable global economy. By doing so, investors concerned with sustainability may also achieve good performance on their investments because many companies that are effectively addressing the ESG issues facing their businesses tend to be promising long-term holdings.

SIVANANTH RAMACHANDRAN, Director – Indexes, Morningstar shares an Indian perspective.

What constitutes ESG?

Ethical investing or sustainable investing is an approach that incorporates Environment, Social, and Governance factors and their impact throughout the investment process.

There are several ways to do this; at one end is a simple approach where investors exclude stocks with “sin” characteristics; at the other end is impact investing, where investors select stocks with specific characteristics to drive impact, such as gender diversity.

The most common ESG exclusions Morningstar employs are companies involved in controversial weapons (such as anti-personnel mines, cluster munitions, chemical, or biological weapons), tobacco, and civilian firearms; the underlying principle is things that kill you if used-as-directed. Other exclusions include alcohol and adult entertainment (social), or thermal coal (environmental).

ESG funds are typically underweight in mining, energy and utility sectors, and overweight technology, financial services and consumer sectors.

What are the advantages of investing in an ethical fund?

Ethical funds are appealing to socially investors who wish to express their ESG preferences. Unlike the stereotype of millennials and women being the most interested in ESG investing, new research from Morningstar shows that there is a broad appetite for ESG investing and by corollary, a vast untapped market for advisers to reach and retain.

ESG funds invest in stocks which are typically of high quality and lower volatility, and may outperform in certain market conditions.

Could you elaborate on the workings of Morningstar India's sustainability index?

Morningstar India Sustainability Index delivers exposure to a portfolio of about 80 Indian companies that exhibit high standards of sustainability while maintaining a risk/return profile similar to that of market. The top companies include Reliance Industries, infotech majors such as Infosys, Wipro, and financial services companies such as HDFC, Kotak Mahindra, and Axis Bank.

The construction follows a 5-step process:

1. Defining the eligible universe. The index draws from the large- and mid-cap subsets of the Morningstar India Index, which represent 90% by market capitalization.

2. Applying a product involvement screen. We exclude companies involved in controversial weapons as well as those that derive more than 50% of revenue from tobacco products.

3. Assigning Company Sustainability Scores. Eligible companies are compared to industry peers on ESG factors based on three metrics:

- A company-level ESG Score is assigned based on a company’s management systems, practices, policies, and other ESG indicators on a 0-100 scale.

- The Controversy Score gauges the seriousness of incidents related to a company—taking into account the intensity and impact of events impacting a business on a 1-5 scale, with 5 being severe.

- The Company Sustainability Score is the firm’s ESG Score with the firm’s Controversy Score subtracted.

4. Selecting best-in-class companies. Stocks are selected in priority order of their sustainability scores until they reach 50% coverage by float-adjusted market capitalization of Morningstar India index. Eligible companies that have experienced serious controversies are excluded from the index.

5. Controlling for deviation from underlying benchmarks. Weights in underlying sectors may deviate from the parent index by two percentage points. These constraints make the indexes appropriate for investors looking to achieve broad-based exposures or restricted from deviating significantly from their strategic asset allocation.

Given the paucity of fund schemes, how can an investor go about pursuing an ethical investing strategy?

While there is a paucity of funds which intentionally pursue sustainable investment strategies, investors and advisers could still incorporate ESG into their investment process by other means.

One approach is to use the Morningstar Sustainability ratings (Globe ratings), a measure of how well the fund portfolio’s holdings are managing ESG risks and opportunities relative to the Morningstar category.

Fund sustainability scores in a Morningstar category are sorted to assign a percentile rank. At least 10 portfolios in a category must receive portfolio sustainability scores to assign ratings. Fund are placed into 5 normally distributed groups using a distribution that mirrors fund Morningstar Ratings (“Star Ratings”).

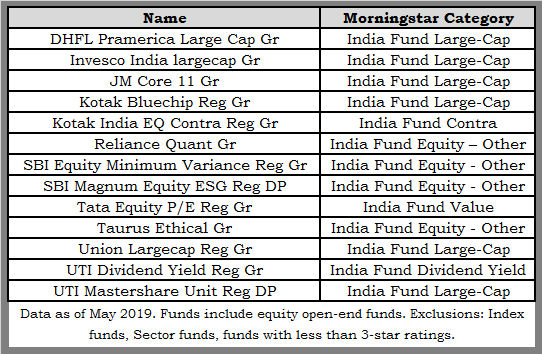

The table below shows select 4- and 5-globe rated Indian open-end funds.

Is it possible to marry ethical investing and sound returns or should an investor be prepared to compromise on returns once she decides to pursue this strategy?

While its typically assumed that ESG investing comes with a performance cost, the research suggests it need not be the case. A meta-study of over 2000 empirical studies on the link between sustainability and corporate financial performance was conducted in 2015 (ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Friede, Busch 2015). It showed a non-negative ESG–CFP relation 90% of the time. More importantly, the large majority of studies reported positive findings.

Could you share the returns of ethical mutual funds?

Sustainable funds have performed well in the last few years. According to 2018 Morningstar US ESG landscape report, sustainable funds, on average, outperformed on a relative basis in 2018. A full 63% of sustainable funds finished in the top half of their respective categories, including 35% in the top quartile. Only 37% finished in the bottom half, including just 18% in the bottom quartile. For equity funds alone, the percentages were about the same, and there were no significant differences between ESG consideration, ESG integration, and impact funds. On the strength of last year's returns, 57% of sustainable funds now rank in the top half of their categories over the trailing three years. For the trailing five years, 58% rank in their category's top half.

In Europe, at the end of 2018, returns of 32% of sustainable funds landed in the top quartile of their respective Morningstar Categories, and 62% finished in the top half. By contrast, the returns of only 17% placed in the bottom quartile.

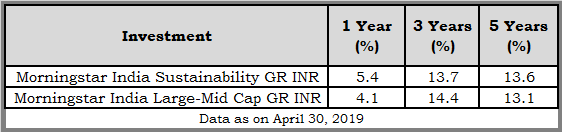

In the Indian context, Morningstar India Sustainability index, a broad and diversified portfolio of Indian companies which target top half of Indian market by market cap out-performed on a 1-year and 5-year basis.

What should an investor pay heed to?

As ESG investing becomes more popular, there are risks that the companies with attractive ESG characteristics become overvalued. Secondly, there are no standard definitions when it comes to ESG, although firms like Sustainalytics, SASB, and others are trying to come up with common framework for investors to assess ESG issues of companies. Without common standards, investors are susceptible to greenwashing, with firms claiming adherence to ESG principles without following through on them.

In Europe where ESG investing is the most mature, European commission came up with regulations for asset managers to disclose how they integrate environment, social, and governance issues in their investment process, to avoid greenwashing. Investors need to do their due diligence and not go by labels when they evaluate Sustainable funds.

How do you view this strategy’s prospects over the next 5 years?

At the start of 2018, global sustainable, responsible and impact (SRI) investment assets reached $30.7 trillion, a 34% increase from 2016, according to Global Sustainable Investment Alliance.

Responsible investment commands a sizeable share of professionally managed assets, ranging from 18% in Japan to 63% in Australia and New Zealand. As it becomes more popular in terms of flows and assets, sustainable investment strategies may command a premium over the short term. Ultimately, expected returns are a function of stock valuations.