The Economic Times reported that Gold exchange-traded funds, or Gold ETFs, witnessed a net inflow of Rs 145 crore in August, making it the first such infusion in nine months. Assets under management of gold funds touched Rs 5,799 crore by August 31, 2019, from Rs 5,080 crore at the end of July.

Gold ETFs witnessed buying on the back of the rise in gold prices, a weaker rupee, and uncertainty on the economic outlook in India. However, Kaustubh Belapurkar, Director - Manager Research, Morningstar India, believes that “until a trend of sustainable inflows is not witnessed, it will be difficult to establish if the sentiment towards gold has truly changed.”

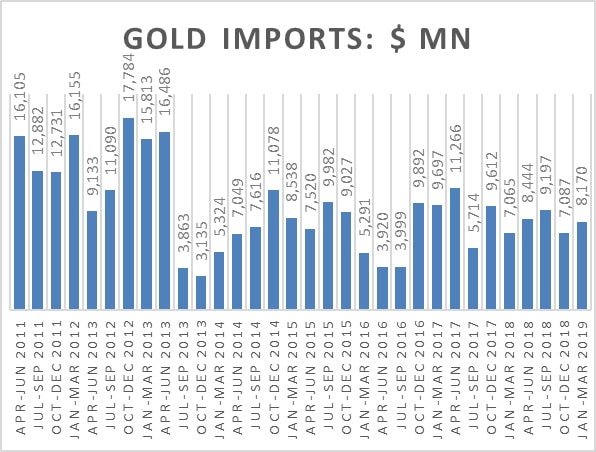

Indians love gold. Just last quarter, our country imported around $8 billion worth of the yellow metal. Cutting down on imports will help our economy a great deal.

source

DEEPAK SHENOY, CEO of Capitalmind, a SEBI registered portfolio manager, suggested a few ways to bring down the imports of gold.

Below is an edited version of some of them.

1. Deter smuggling by reducing the import duty

Reduce the import duty on gold to 2.5% over the next 20 months; it is 12.5% today. If you add GST, it goes up to 15%. Alternatively, the government could do away with import duty altogether and keep the GST of 3%.

Also, if gold prices are lowered and controlled, it will reduce the price of gold so the net real interest paid for Sovereign Gold Bonds will be lower.

The government will obviously lose revenue – at $8 bn/quarter, the government stands to make around Rs 20,000 crores a year on duty. But this must be viewed in conjunction of the savings we would have if imports are reduced to half.

A high import duty makes it extremely lucrative to smuggle in gold. For example, a smuggler could earn as much as Rs 3 lakh, on 1kg of gold, given the price difference abroad and the duty here, with just 1 kg of gold.

In the June quarter, over 1.1 tons of gold was caught when being smuggled. Do note, this was only the amount caught. There is plenty that slips through the net, and we are not even referring to the corruption in customs, where a palm is greased to turn a blind eye.

2. Encourage bullion exports

We can import, but cannot export gold bars or coins. We can export jewellery, but it needs to have at least 6% value add to be able to export the gold itself.

Exports of bullion must be permitted; Sovereign backed “India Gold” with a purity and a buyback guarantee from MMTC (who anyhow mints gold coins).

Such exports should not get export benefits (otherwise this will just get round tripped) though we should eliminate import duty/input GST from exported gold. There may be some issues with funding through bank loans, but in any case, funding for the sector is highly regulated.

3. Bring the gold home

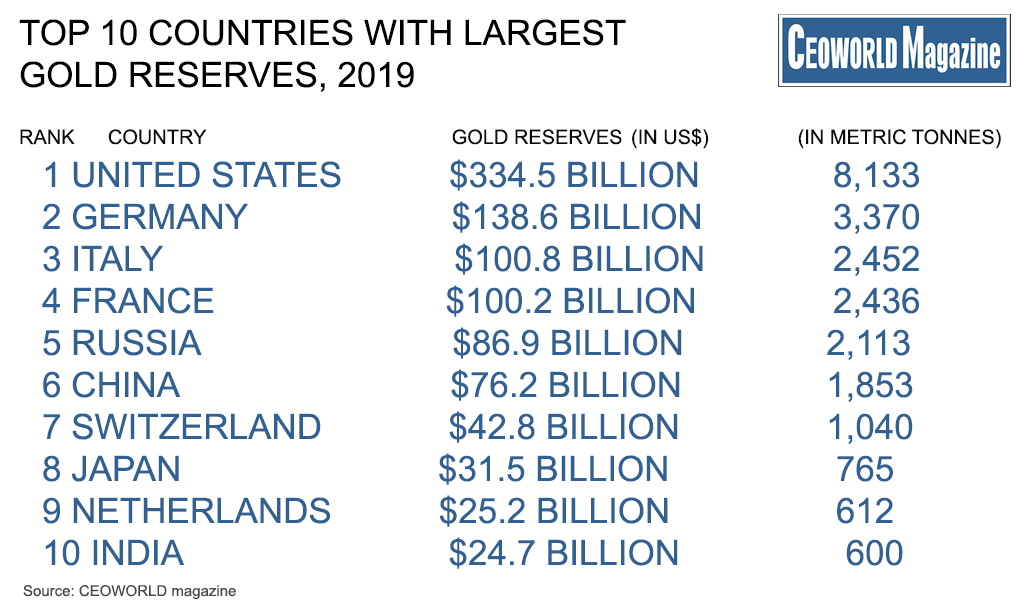

It is a normal practice for central banks world over to keep their gold reserves overseas with central banks of other countries like the Bank of England. As of end June, The Economic Times put RBI’s gold holdings at 19.87 million troy ounces (about 618 tonnes of gold) valued at $24.3 billion.

This cannot be done at one go. But a 10-year plan can be drawn up where about 60 tonnes can be brought back every year, which will replace a significant portion of the gold imports.

This gold can be sold to jewellers or banks locally and replace that value (on the RBI Balance Sheet) by buying government bonds. India has only 1/3rd as much of government bonds compared to U.S. dollar reserves – we need a healthy balance of the two.

Or, a cross deal with importers – whatever you import, we will pay for with actual gold through RBI reserves. This is a “gold swap” of sorts – the importer pays the RBI instead of the person they import from (who gets Gold from the RBI instead, which is anyhow stored abroad). This way, no dollars go out to pay for the gold.

source

4. Encourage gold loans

- Make gold loans as “priority sector” and reduce their cost, even if originated by an NBFC and sold to a bank.

- The condition being: The gold or jewellery must be melted and placed in the government gold deposit scheme (like this SBI one). This can be done by an NBFC or a bank. On repayment of the loan, the lender gets back gold from the deposit scheme and gives it to the customer (as gold, not as jewellery).

- The loans can have much lower interest rates.

This way, gold comes into circulation and is effectively a productive asset as people take loans to spend or invest.