I invested Rs 1 lakh lumpsum in DSP Natural Resources and New Energy Fund two years ago. I have still not made profits on this investment. Should I hold on to this fund or exit?

-Arun

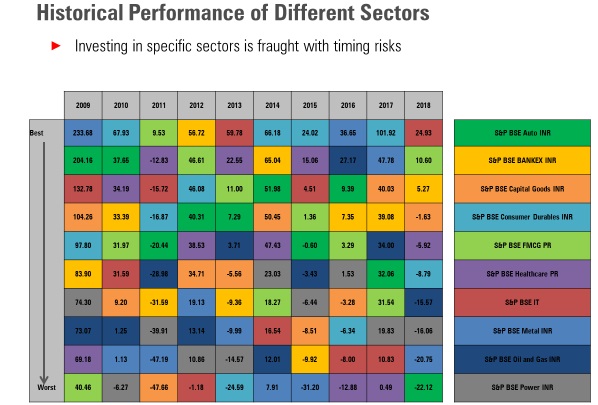

It will be useful to know your full portfolio holdings to get a sense of what percentage of your portfolio is invested in this fund. Typically, we think investors are better off investing into diversified equity funds. Investing in sectoral/thematic funds can be tricky since the timing of entry and exit in these funds is very crucial. As the chart below demonstrates, no one sector will continue to be the best performer year over year. If you were to think of taking exposure to sector/thematic funds, limit it to 5-10% of your portfolio.

I am investing via SIP in ABSL Frontline Equity Fund since Jan 2016 and performance of this fund within category and as compared to index is poor. What do you suggest? Continue, stop or look for a better fund?

- Rahul

The fund has gone through a period of underperformance in the short run but has otherwise been a consistent performer over the long term. We recommend holding on to your investment. Mahesh Patil runs this strategy with a benchmark aware approach by loosely aligning the funds weight with the benchmark sector weights. But he takes active stock calls within this space. While Mahesh looks for predominantly growth stocks, he is cognizant of valuations and picks his stocks accordingly. Over the short run, some his stock calls haven’t delivered on a relative basis to the benchmark but that is not unusual. Since 2018, the market has been very polarized and rewarded a few stocks which had relatively higher valuations. As per the funds’ philosophy, the portfolio was underweight some of these stocks. Every manager goes through a cycle of underperformance depending on their individual style of investing and the current short-term market cycle. This fund can add significant value over an entire market cycle. Thus, we recommend holding on to your investment in the fund.

Should I hold on to HDFC Hybrid Equity Growth and HDFC Midcap Opportunities Growth?

-Bushan

Both are good funds and you can continue your investments in them.

HDFC Hybrid Equity is a balanced fund which invests 65-70% of assets in equities and the balance in fixed income instruments. These are simple asset allocation funds which provide investors the benefit of both equity and fixed income exposure by investing in one single fund. This fund is one of the best in the category.

HDFC Mid-cap Opportunities is also one of the best mid cap funds in the industry. Currently the performance may appear to be unimpressive, which is largely because the mid cap segment of the Indian equity market has witnessed a downturn. However, over the long-term, this fund offers a good investment proposition.

Interestingly, both funds are managed by the same manager (Chirag Setalvad) who is a very competent and seasoned manager in the Indian mutual fund industry.

My current holdings:

- Mirae Large Cap: 3,000

- Reliance Large Cap: 2,000

- Mirae Bluechip: 2,000

- SBI Focused Equity: 2,000

- SBI Small Cap: 2,000

- Reliance Small Cap 1,000

- SBI ultra short Duration Debt Fund: Rs 3.4 lakh

- Bank Deposits: Rs 45 lakhs

I like to continue my SIP investments for the next 10 to 15 years with these schemes. My age is 40+. Retirement age: after 55.

-Satyaranjan

You have a good set of funds in your portfolio run by proficient managers. Most funds are fairly well managed strategies generating above average returns. But we expect a larger allocation towards equities. When you build a portfolio, you would look to make an allocation across asset classes depending upon your risk and return objectives and investment time horizon. You have investments in SBI Ultra Short Duration – given it’s a fixed income funds with portfolio macaulay duration between 3 to 6 months, it will yield lower than equity funds. We also noticed that a large portion of your assets is in fixed deposits and hence the weighted average return of your portfolio will be lower.

You have two small cap funds in your portfolio which invest at least 65% of their net assets in small-cap stocks. Small-cap stocks are excellent wealth creators over the long term, but also can be volatile in the short term. For instance, 2018 is a classic case in point when small cap stocks corrected significantly and so did small cap funds. But since you have a long-term horizon, small cap funds can serve you well. However, we would recommend consulting with an Investment Adviser who will guide you through understanding your risk return objective and help draw up a suitable asset allocation for your portfolio.

You can read our views on some of the funds that you mentioned here.

I am 48 and my wife is 40. We are government employees. These are my investments for my child’s education. I will need this money in 5-7 years.

- Axis Bluechip Fund: Rs 3,000

- Mirae Asset Large Cap: Rs 2,000

- ICICI Prudential Bluechip: Rs 2,000

- Mirae Asset Emerging Fund: Rs 3,000

- Canara Robeco Emerging Equities: Rs 3,000

- Axis Focused 25: Rs 3,000

-Parasuraman

First and foremost, while you have mentioned your investment objective and its horizon, its equally important to estimate as to how much corpus you want to accumulate for your child’s education.

Going by the details provided by you, with SIP amount of Rs 13,000 per month for investment horizon of seven years, you would be able to accumulate a corpus of around Rs 16 lakhs, expecting an annualized 11% return. This is an estimation and can change depending on the market environment and performance of the funds in which investments are made.

Most funds selected by you are good and you can continue investing in them. However, you don’t have a dedicated mid cap fund in your portfolio. If your investment horizon is seven years and you have the stomach for the risks associated with mid cap funds, then you can consider adding one to your portfolio. You can also replace a fund from the given list and add a mid-cap fund. Despite intermittent volatility, mid-cap funds are good for generating long term wealth.

From the list of funds, the one that you can consider replacing with a mid-cap fund is Canara Robeco Emerging Equities. This fund is from the Large & Mid-cap category. You also have Mirae Asset Emerging Fund which is from the same category and is a better option compared to Canara Robeco Emerging Equities.

You can click on this link to select a mid-cap fund for your portfolio if it is in line with your risk appetite.

You should also consider adding some fixed income/debt exposure to your portfolio, if you have not done so already. This would provide a cushion to your portfolio when equity markets are not doing well. This should at least comprise of 20% of your overall portfolio.

The closer you are to your investment objective; you should start de-risking your portfolio by moving into less risky investment avenues. Also, you should consider opting for the services of an investment adviser who can help you streamline your investments in line with your investment objective and help you in conducting regular review and rebalancing.

I am investing Rs 14,500 in equity mutual funds as SIPs since last November 2018.

- Motilal Oswal Multi Cap 35: Rs 2,000

- Kotak standard Multi Cap: Rs 2,500

- SBI Magnum Multi Cap Rs 2,500

- ABSL Equity Multi Cap Rs 2,000

- Parag Parikh Long Term Equity: Rs 2,000

- Mirae Asset Emerging Blue Chip: Rs 2,500

- SBI Small Cap: Rs 1,000

I will increase my SIPs by 15-20% every year. I want to accumulate Rs 3-4 crores after 23 years till my retirement in March 2043. Kindly advise.

- Shankha

The funds in your portfolio are fine. One thing we do note that since you have a long-term investment horiozon, you could increase your allocation towards small and mid-cap funds by another 15% of your portfolio, as long as you have the risk appetite. While these funds may be more volatile over the short term, over a long investment horizon of at least 7-10 years, they can yield significant returns.

You can choose from our top-rated funds here.

With regards to your retirement goals, given you current SIP amount and intended yearly SIP increase, you should be in a good position to meet your retirement goals 23 years down the road. It is important for you to review your asset allocation as you approach retirement and accordingly reallocate.

I am a moderately aggressive investor with 20 years investment duration. These are my current holdings:

- Kotak Multicap: Rs 5,000

- Invesco Contra: Rs 5,000

- Mirae Emerging Bluechip: Rs 5,000

- L&T Midcap: Rs 2,000

Should I invest in Mirae Large Cap (Rs 5,000 SIP) by reducing amount from Invesco Contra and L&T Midcap to reduce volatility in the portfolio?

-Prodyut Ghosh

Glad to know that you are a long-term investor. We have observed that you do not have large cap fund in your portfolio. Large cap funds should ideally form the core holding of any investor’s portfolio. While they may not be huge wealth creators in comparison with small/mid cap funds, from an asset allocation perspective, large cap funds add an element of stability to portfolios. You can find a list of highly rated large cap funds here.

Mirae Asset Large Cap is an outstanding fund managed by Neleesh Surana. We have a lot of comfort around the manager and his research-intensive investment approach. The fund has a well-considered process, which has resulted in an above average performance, a trend we expect to endure. The fund witnessed changes in the category, but we do not see much concern given the fund’s historical large-cap tilt.

Invesco India Contra is a value-oriented contrarian fund and does not have market capitalization restrictions. The fund focuses on stocks that are fundamentally strong, but currently undervalued or out of flavor, but are expected to do better in future. Investment in Contra Fund can be riskier compared to other categories if the markets do not behave the way the fund manager anticipated. This can lead to losses and hence one must seek expert advice. L&T Midcap offers a high risk-high return investment proposition. These funds can get exposed to above average volatility during market downturn or when small-cap stocks lose their sheen.

The aptness of both the funds in your portfolio and allocation to it would depend on your risk appetite.