Adoption of electric vehicles has been slow around the world due to challenges like high costs of batteries, low demand, low supply, limited availability of charging infrastructure and so on. Governments around the globe are moving towards enabling regulations for faster adoption of EVs.

In India, the government proposed income tax deduction of Rs 1.5 lakh on interest paid on loans taken to buy EVs. Also, the goods and services tax (GST) on EVs has been brought down from 12% to 5%.

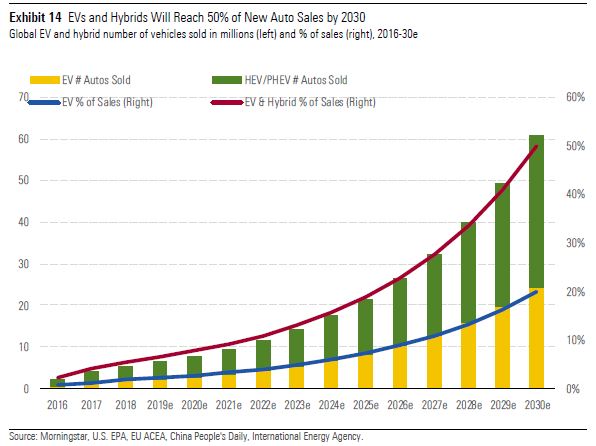

A recent report authored by Morningstar’s Equity Analyst Seth Goldstein, CFA Chair, Electric Vehicle Committee, shows how investors can benefit from increasing EV adoption globally. By 2030, the report forecasts that half of all new auto sales globally will be electrified in some form. Using our regional build up model, we forecast EVs and hybrids will reach 20% and 30% global penetration rates, respectively, by 2030. As shown in the iamge below, 2025 is set to be the inflection point when both EVs and hybrids begin to gain greater share each year as EVs will reach cost and functional parity with EVs in China, the EU, and parts of the U.S., which together represent over 60% of annual global auto sales.

According to Seth, many industries will be impacted by increased electric vehicle adoption between now and 2030. Product lines and demand will evolve throughout the auto supply chain and ancillary industries. Here’s a look at each industry's EV exposure to evaluate the degree to which industry stocks have the potential to benefit.

Auto Original Equipment Manufacturers (OEM)

The entire OEM sector faces high impact from the powertrain change as the sector is the end of the manufacturing value chain, but we think it will be very hard for any OEM to keep an edge over its competitors for a long period of time. Even if each firm has its own battery chemistry, over the long run we don't think there will be dramatic differences in performance and range of an EV, so any advantage moving a firm's stock price may be short lived. Also important is these firms' legacy powertrain businesses, which will still be operating even as each automaker is selling EVs. The launch of EVs will be nearly simultaneous across the industry, be just as capital intensive for all companies, and come without much differentiation other than brand. Ultimately, brand reputation will be the source of any potential economic rents extracted by only premium/luxury automakers.

Auto Suppliers

Suppliers to electrified powertrain vehicle programs have more potential benefit for investors than the mass-market automakers. Suppliers' technologies include engine components that increase fuel efficiency, the electronics that control propulsion systems (ICE, Hybrid, EV), battery power optimization, electric drive motors, and torque transfer devices that send power to the wheels. The mix of powertrain that automakers produce will be managed to meet government clean air standards and optimize asset utilization while providing consumers with competitive pricing. We expect industry adoption of hybrid-powertrain to drive battery and electric motor demand to higher volumes that enable better economies-of-scale while maintaining ICE volumes to maximize utilization.

Battery Manufacturers

Battery manufacturers have the potential to benefit investors as the industry will see increased revenue from the progress of EV adoption. However, we are concerned about the low margin of suppliers. Therefore, while major suppliers plan to expand production capacity up to 4-6 times in the next three years, the profit contribution from the battery business might be limited for most companies, because of the increasing investment cost and the pressure to cut prices as a result of intense competition.

Lithium

Lithium is one of the best ways to invest in electric vehicle and hybrid adoption as it is the required energy storage component in all transportation batteries. The need for lithium to power electric vehicles and hybrids exists regardless of battery chemistry or auto brand. Lithium demand will quadruple over the next decade as electric vehicle adoption increases. This will create the need for a similar increase in supply, incentivizing higher-cost supply to come online and increasing long-term prices. Ultimately, lithium producers' returns will be driven by their position on the cost curve. We like low-cost lithium producers who are already operating, as brownfield capacity expansions are cheaper and carry less execution risk.

Oil & Gas

Electric vehicles threaten to steal substantial share from conventional vehicles fueled by hydrocarbons. In the U.S. in particular, we expect long-term gasoline demand will decline faster than consensus expects, based primarily on our bullish outlook for EV penetration. As transportation demand eventually wanes, oil producers will need to turn to other industries, such as petrochemicals, for demand growth.

Utilities

By definition, electric distribution utilities will be the "fuel" providers for EVs. In addition, utilities are already among the initial investors in charging and other infrastructure to support EVs. We expect utilities will continue to be key investors in the supporting infrastructure for many years. The potential for electricity demand growth is minimal, but we expect it can help partially offset the substantial headwinds from energy efficiency. Additionally, U.S. utilities are seeking regulated returns for EV infrastructure investment, which provides earnings growth for investors.