Picture this.

A little girl walks through the toys section of a retailer, pure delight written on her face. But in Maya’s case, the excitement was evident for completely different reasons.

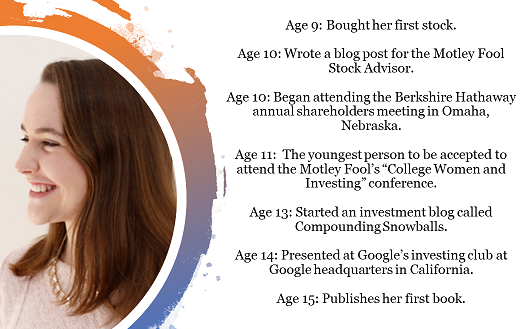

At the age of nine, Maya sold her American Girl dolls to buy shares in Mattel and Hasbro. Her father printed out the stock certificate which she kept in a folder that contained her notes on the company. When she walked the aisles of Target, she beamed with joy basking in the awareness that she was a shareholder of those companies.

I know what you are thinking, and you are wrong. Peter Lynch is not her father. But Maya Peterson could well be the poster girl for his style of investing.

If you think that was just a passing phase or a one-time burst of passion, I recommend that you read her latest article – The bank that stands the test of time and tides. And do so keeping in mind that she is all of 17 years old.

On reading up about Maya and my email interactions with her, what impressed me was her ability to draw analogies that made for an excellent investing narrative. Let me explain in the context of what, I believe, are the keys to her success. (Her quotes are in itals).

# Make investing tangible.

Peter Lynch, one of the world’s most savviest investors, was a diehard proponent of “buy what you know”. He advocated using your experience and insights and do-it-yourself research to build a profitable investment portfolio.

Deliberately or not, Maya latched on to this philosophy. Remember, she began dabbling in shares when she was just a child. So, it was natural that it would have to be with products she clearly had an affinity with.

She bought shares in Mattel and Hasbro due to familiarity with toys.

When it came to Pepsi, the numbers revealed that the company makes more money with their chips than their drinks, her favourites being Sun Chips and Cheddar Sun Chips.

Being a dancer, she would use Johnson & Johnson’s toe tape on a daily basis. Since she went through a roll a week, each at a cost of $3.99, she calculated that they made $207.48 from one customer and one product by the end of the year.

Nestle was due to her familiarity with a lot of their brands.

Gilead Sciences due to her passion for science.

It is interesting to see that the companies she owns reflect different aspects of her personality – her passion for science, her love for dance, her liking for chocolate. But equally fascinating is her evolution as an investor.

From buy what you know, she graduated to know where you buy.

More recently, she invested in insurance companies. This, after doing considerable reading, attending shareholder meetings, engaging with other investors.

One of her favourite stocks is Berkshire Hathaway. She likes the safety it provides and the diversification into a whole bunch of companies that you can relate to. Maya has been attending the Berkshire Hathaway shareholder's meeting since she was 10 years old. She loves the vibe of the community that assembles from all across the globe, all yearning for knowledge and establishing connections with other investors.

And rather than just checking boxes, she looks to see the big picture. When she bought her first stock, she focused on P/E, RoE and Debt/Equity ratios. She candidly admits that she failed to grasp the challenges the industry was facing and an indepth understanding of the company’s products.

Interestingly, she now also pays attention to non-financial metrics like employee retention rates, diversity of the board, employee benefits, and incidents of injury. Simply because these matter to society and to investing over the long haul.

# Be clear, and unapologetic, about your investment strategy.

Maya still broadly follows Peter Lynch’s style of investing. She invests in companies that she understands and believes will succeed over the long term.

I am an individual investor. I am not a risky investor. I am fairly young. I have not spent a lot of time researching all the investment strategies out there. I feel comfortable and confident with my own. Every investor is different, and I stick with works for me. Overall, I try to keep it simple.

I like the way she draws an analogy with ice cream. Some use a cone, others prefer a cup. While some pile on toppings like hot fudge (which, by the way, is her favourite), peanuts or cherries, others may shun it. Some may prefer a plain vanilla, others a flavour. There’s no judgement here, each to their own.

Impressive about Maya is the fact that she does not fall for quick tips. She tries to understand who leads the company, reads up about the company, in few cases attend shareholder’s meetings, looks at metrics, asks herself if she trusts them with her money and how it will be used, and how quickly she can expect it to compound.

# Have the grit to see it through.

Back to the ice cream analogy, she mentions how she was often chided for eating it incredibly slowly. But, she viewed it as having the patience to savour a good ice cream to the point where it annoyed others, but gave her gratification.

Patience is a characteristic I developed long before I started investing or even interacting with simple math.

I honestly don’t think she is being flippant. In a very matter of fact tone, Maya admits how beautiful and slender girls are in their ballet costumes and pointe shoes, softly landing and gracefully spinning. But no one sees the years and years and years of practice to enable that apparently effortless spin, fouette, hop, and jump, all the while enduring unbelievable amounts of pain and staying on beat.

She should know. She is a dancer. And as any dancer, musician or athlete would testify, there is no evident progress on a daily basis, but the results are starkly evident in the long run. I am reminded of Messi’s quote: “It took me 17 years and 114 days to become an overnight success.”

She still holds onto the Mattle stock, which she describes as her first investment, her best and her worst.

The first, well, that’s obvious.

The worst because it has done pathetically, stock performance wise.

The best, because you learn more after you lose money. The need to pay attention to a company holistically, have a clear understanding of the overall balance sheet, be cautious about the various metrics one should pay more attention to, and never underestimate debt.

She has honed amazing skills that hold her in good stead as an investor; the discipline to dig deeper, the patience to hang on, and the humility to learn from one’s mistakes.

# Develop the capacity for a long view.

Maya has played the long-term edge to the hilt.

She is in a sweet spot. A teenager. Zero debt. Not a spendthrift. No liabilities. Does not pay rent, or any household bills for that matter. And a portfolio of stocks.

How many teenagers view their monetary decisions as one that will impact their future? She probably does because she has built a narrative around it.

Compounding is the idea that if you have a small ball of snow at the top of the hill as it rolls down, it will continue to get bigger. In reality, time is the hill and snow is your investments. Why not start off when you have a really, really long hill and some good investments, however small the initial amount may be?

That brilliantly explains the name of her blog Compounding Snowballs.

She often articulates that to invest, you have to first make a choice to save. Again, her insights from her daily life are the key. Avoid the $3 bottle of Coke. Do it for just 10 days, and you have $30 to invest. After the gym, a daily Snapple from the vending machine will quench your thirst but set you back by $365 over a year.

On the other hand, when $365 starts earning interest and then that interest compounds, amazing things happen!

Her ability to make a smart choice now to yield positive returns in the future, is admirable.