Looking at the period from January 10, 2020 to February 9, 2020, here is a graphical representation of the impact the outbreak has had.

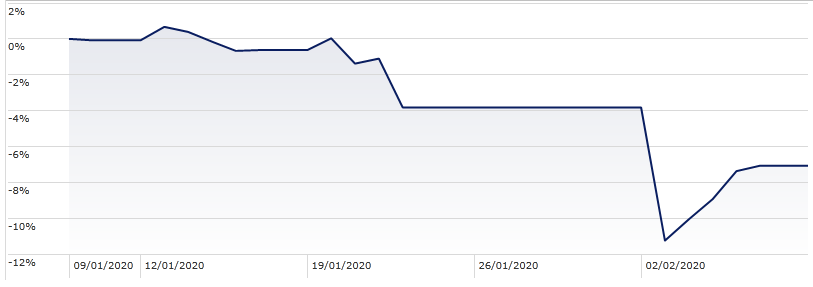

The Chinese stock market was the first to feel the brunt of investors' concerns over the impact of the coronavirus. Fearful of the impact on the company earnings and economic growth, investors have shied away from the region since the outbreak.

Rules in place in China mean its stock market, and any single stock listed on it, can only rise or fall by a maximum of 10% per day. While that may have helped smooth out some of the volatility, it has not been able to fully protect the market from investor panic.

The Shanghai Composite Index (SSE) started to trend downward on January 20, when China reported a third death and more than 200 infections, many outside Hubei province (where the virus was first identified) including Beijing, Shanghai and Shenzhen.

But the first major stock market fall occurred on January 23, after a number of cities were placed under quarantine, while others cancelled events for the Lunar New Year.

The main plunge, however, came on Feburary 3 after the Lunar New Year holiday and following the WHO's classification of the coronavirus as a global emergency. This was China’s biggest market fall in four years, with shares down 8%, and travel and tourism sectors were the hardest to be hit.

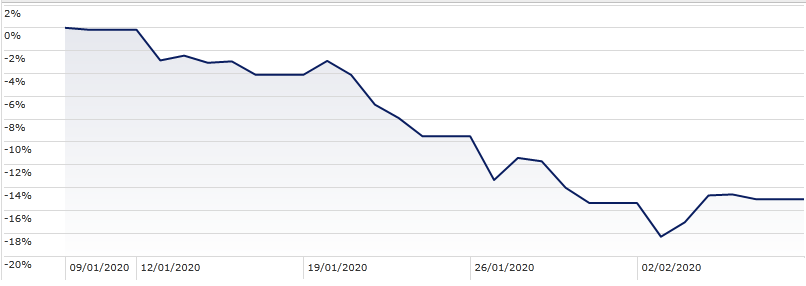

Oil and Gas

As China is the biggest buyer of most of the world's commodities, the outbreak of the coronavirus has also hit the global oil and gas sector. If the Chinese economy is adversely affected, imports of commodities will drop. The oil spot price is down almost 12% over the past year and the Morningstar Gas-Oil Commodity Index also suffered the same swing in sentiment, enduring a further fall after the January 20 coronavirus announcement.

As with the SSE index, the gas-oil index took its biggest tumble on February 3 and has started to edge up again in recent days.

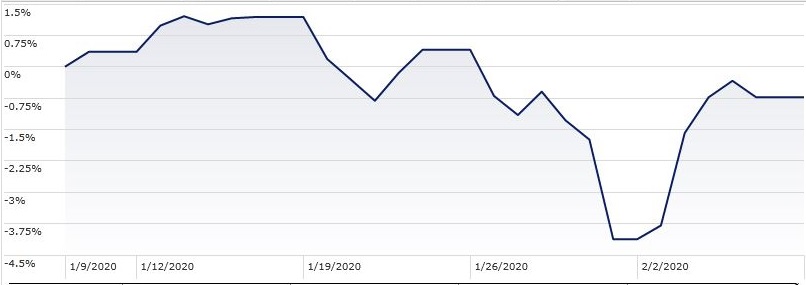

U.S. Stock Market

After an initial reaction to new of the outbreak, the Dow Jones bottomed out on January 31 and has also started to recover since. This was helped as President Trump reached an initial truce with China in their trade stand-off - China has now cut tariffs on $75 billion of US goods.

The Dow responded to the deal with a sharp rebound, helped along by a stellar run in Tesla shares at the start of the month (which have since fallen back slightly).

The U.S. market is perceived to be an attractive investment in an environment of very low bond yields. The Federal Reserve could also help with further stimulus. As a result, investors may have turned to the US stock market as a port in the storm.

Gold

The price of the yellow metal tends to soar as market uncertainty increases, and gold has enjoyed a strong run since the end of 2019.

Gold rallied around 20% in the last few months of 2019 to reach $1,550, in part because the Federal Reserve had been cutting interest rates. The gold price started to swing up at the end of January as fears around the coronavirus grew. The price eased off at the start of February as optimism around the trade deal improved the outlook for the U.S. economy and the potential for the Fed to raise interest rates again. But the price remains above recent averages, at around $1,571. This upward trajectory could continue.

Japanese Yen

The Japanese yen is another safe haven asset investors tend to gravitate to when the going gets tough. As a result, the currency has also enjoyed an uptick in recent weeks.

The chart below shows the performance of the dollar against the yen over the past month, highlighting how the Japanese currency strengthened towards the end of January. By January 31, $1 bought just 108.38 yen, down from an exchange rate of $1 to 110.2 yen two weeks earlier.

The dollar has recovered some of its strength since the initial panic has abated, but remains below the 110 yen peak.

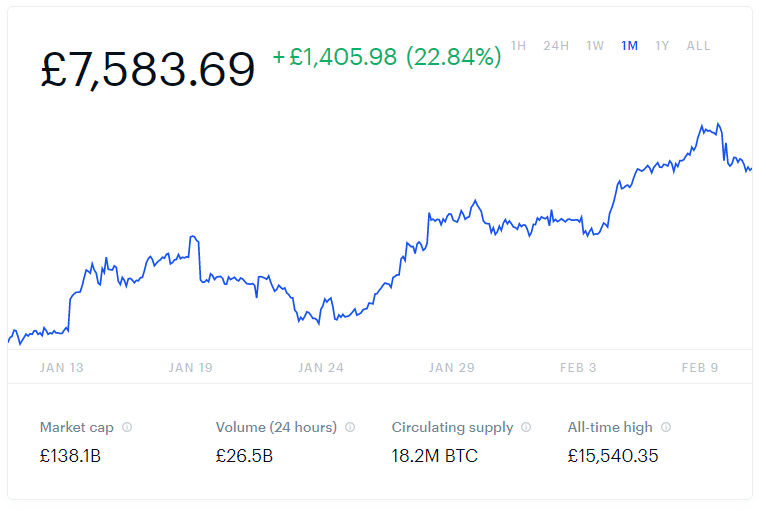

Bitcoin

And while some investors have rushed towards safe haven assets, others have preferred to speculate on market sentiment and invest in Bitcoin. Alternative assets such as this are often appealing at times of panic because they are generally uncorrelated, that is, their price is not determined by the same factors driving, say, gold, equities or the USD.

For some investors, Bitcoin is "digital gold", sharing characteristics of the traditional yellow metal in that it is a "store of value" - ie. it can relied on to hold its value over time. Crypto-currencies are also thought to be a hedge against turmoil in traditional markets. Unlike gold, though, Bitcoin is a relative newcomer on the financial scene so its true function within the financial markets has yet to become clear.

Indeed, Bitcoin currently represents almost two-third of the total crypto-currency market, but its value has been incredibly volatile over the years. Since the end of January, the price of a Bitcoin has started to trend upwards, reaching £7,922 on February 10. It was £14,000 at the end of 2017 in the first wave of Bitcoin mania.

Sensex

All the above data is sourced from Morningstar Direct. The commentary has been written by Annalisa Esposito and initially appeared on Morningstar.co.uk