I am 49. I need to work with great urgency on my retirement. I have no dependents.

I work as a consultant and have around Rs 1 lakh per month to invest. But I plan to set up an office, and would like to keep cash around Rs 50,000 towards it. So I am okay with investing Rs 50,000 every month.

I have a PPF account. I have two insurance policies for which I pay premiums of 50,000/ annum and Rs 10,000/annum. I have two fixed deposits of Rs 15 lakhs.

What I do not have: Mutual Funds, stocks, medical insurance.

Can you guide me on how to set up my portfolio?

- Purva

ADITYA SHAH, Portfolio Manager at Hercules Advisors, drew up a basic financial plan for Purva, which has been reproduced below.

Based on the limited information provided, this is a provisional plan. I strongly recommend that you get this regularly updated as per the market conditions and any change in risk profile.

Medical Insurance

Before I move onto any suggestions for the retirement kitty, I advise instantly for a medical coverage.

I don’t mean to frighten you, but I would like to jolt you into action. The healthcare inflation in India has been rising steadily at double the rate of overall retail inflation. And I don’t mean just the rise in hospitalization costs, but even pathology tests, a visit to the doctor, a visit to the dentist or the ophthalmologist.

Instead of a straight cover, I suggest a basic cover and a top up. It would work out cheaper.

Insurance

You mention that you have two policies. I am assuming that you opted for them under the notion that it also fulfils an investment need. But I would like to rectify your thinking.

Insurance is a product used to hedge life risk and is NOT an investment product. I suggest you sit with a financial planner and carefully analyse the existing insurance policies. After all, you are paying hefty premiums.

Investments

You have said that retirement is the only goal you have.

As a financial planner, I suggest that you list down all your assets – investments and real estate and inheritances. Also list your liabilities and responsibilities and loans that have to be serviced. This will give you a clear idea as to your risk capability. A good investment plan can only be arrived upon an assessment of the risk profile.

I will suggest a few broad guidelines based on what you have mentioned.

You have indicated that all your investment is in the Public Provident Fund (PPF) and fixed deposits. It is a pity you have no equity investments, because equity is a strong element in wealth building.

Assuming you will spend Rs 6 lakhs in a year for 40 years after retirement, you will need a corpus upwards of Rs 3-4 crore. Of course, this number will rise due to inflation. As of now, the risk of outliving your money remains pretty high.

I suggest that you have a portfolio with a 50% exposure to equity to start with. The equity exposure must be revisited at regular intervals. If the risk of falling short of the retirement corpus increases, then the equity exposure must increase. Generally as one ages, the equity exposure must come down. However, in your case, the compulsions dictate that equity exposure be maintained.

Start now

Initially, a Rs 5 lakhs investment and aggressive systematic investments (SIPs) of Rs 50,000 should be undertaken. The endeavour should be to increase the SIPs each year at least by 10%.

Break up your SIPs into equity funds as:

- Nifty 50 Index Fund: 40%

- Nifty Next 50 Index Fund: 40%

- Multicap fund like Parag Parekh Long Term Equity Fund: 20%

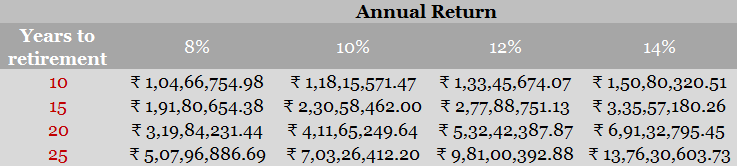

I have suggested the above based on the assumption of 10-year SIPs earning 10-14% per annum.

Assuming an initial corpus of Rs 5 lakh, and SIPs of Rs 50,000 per month, which will help you save and invest Rs 6 lakh per annum, below are the various scenarios.

Start thinking

Since the risk of outliving your savings is high, here are some strategies to consider.

- Cut down on your standard of living and increase your savings. You can consider doing this right now.

- Think about increasing your earnings through various other sources and streams.

- Every year, as you get an increment, increase your savings.

- Postpone your planned retirement date. Consider working for more years.

- Get medical insurance so that your savings are not touched should you fall ill.

- Start investing in equity to help build wealth.

Here are some articles and case studies you can read: