'Past performance is no indicator of future returns' — an investor must have seen this caveat several times in advertisements for mutual funds.

Morningstar assigns its famous star ratings to a number of mutual funds. A star rating is a measure of the fund's past performance compared to peers within its category, after taking into account the risk it took, and associated costs.

The next time you see a fund advertising it has been rated five stars, you know it is a measure of its past performance. Now, if past performance is no indicator of future returns, why do funds continue to tout historical past returns to woo potential investors, and should you prefer a five-star fund — which means it has outperformed its peers — over a one-star fund?

Should investors be star-struck?

Morningstar introduced the famous star-rating system for mutual funds in 1984 in the United States — since then, we made a few minor tweaks to the way we look at past performance and rate a fund.

The quantitative, backward-looking measure calculates a fund's risk- and cost-adjusted performance compared to peers over various timeframes and arrives at an aggregate rating.

For decades, the Morningstar Rating for funds has had a major impact globally on investors' purchase decisions, with some investors appearing to think of higher star ratings as a buy signal.

Morningstar's philosophy on the star ratings is simple: investors should use them as a starting point to short-list good funds but should not simply base their decisions on the number of stars a fund has, and must also consider other important aspects elaborated upon later.

The arguments against blindly buying performance-based, higher-rated funds, are straight-forward: good performance could cool down in the future while funds with weaker performance may make changes to their approach to shore up performance; a fund that may have invested in a hot area of the market may underperform later; or an experienced manager who was largely responsible for superior returns may have left the helm.

Separately, Morningstar also issues qualitative, forward-looking Analyst Ratings for funds (based on a scale of gold, silver, bronze, neutral and negative), which reflect the analyst's opinion about a fund's potential to outperform, going forward, based on a subjective analysis.

Morningstar's Analyst Ratings are issued after evaluating five key areas that we believe are crucial to predicting a fund's future success (we call it the five Ps): people, process, parent, performance and price.

Do 5-star funds outperform?

Studies carried out by us suggest if you bought funds with strong historical risk-adjusted performance, or funds rated four or five stars by Morningstar, and held them for a period of five years, you would have fared better than if you had invested in a one- or two-star fund over the same timeframe.

In a retrospective analysis, we picked up funds across various categories and sorted them into various buckets: from one to five stars. Each star bucket contained the same proportion of funds from each category (small, mid or large cap; value or growth, short or long-term bond etc).

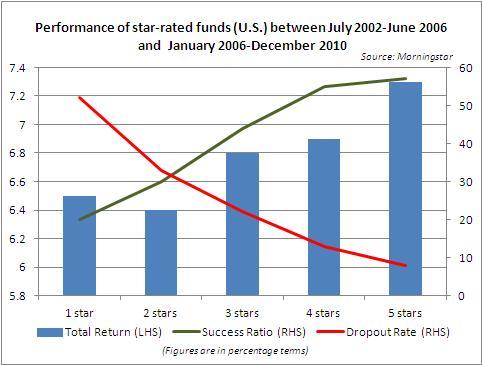

The U.S. study pulled data from across two five-year periods: July 2002 to June 2007 (a period symbolized by a bull run for stocks) and January 2006 and December 2010 (which was marked with bouts of high volatility, including the vicious 2008 bear market) as the ratings sample was available.

The results showed performance for higher-rated funds tended to be better.

Another interesting highlight that turned up was the success ratio (which measures which funds survived a time period and beat the category average for that period) rose as you went from one to five stars while the dropout rate (the percentage of funds that died during the time period) dipped.

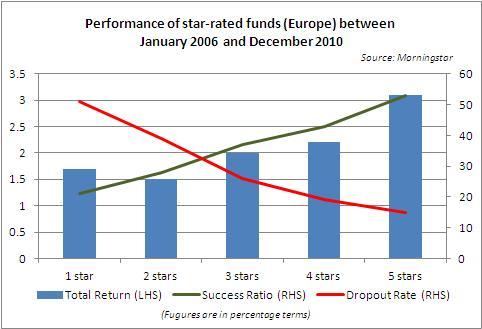

Running the data for European funds between the period of January 2006 and December 2010 came up with similar results — returns for higher five- and four-star funds beat those of two- or one-star funds.

The results for Indian funds

We also conducted a similar study for Indian funds but the time period was shortened to four years — September 2007 to August 2011 — going back to when we started star-ratings coverage for Indian funds.

Also, to further segregate the data, we divided the funds across various categories this time. However, success ratio and dropout rates were not included in the study as a number of high-performing bonus-option funds winded up in 2007 and so dropout rates for five-star funds turned up unusually high.

It is clear that the four- and five-star funds outperformed the one- and two-star funds with a wide margin across all categories.

Based on the studies conducted across U.S., Europe and India, one can conclude that the risk-adjusted performance by category appears to be mildly predictive of future performance while, when fund deaths are considered and taken into account, long-term risk-adjusted performance is even strongly predictive.