Humans have a very complex relationship with risk, constantly assessing and reacting to our perception of it. While it is apparent in all spheres of our lives, it gets extremely tangible in the arena of investing.

But nobody takes a risk in the expectation that they will fail. So what gives? What makes us think that Lady Luck will stack the odds in our favour?

Peter Bernstein throws light on the role of skill and luck.

Roulette, dice and slot machines are games of chance. The odds—the probability of winning—are all you need to know for betting in a game of chance. The outcome is determined by fate. But the principles at work explain only part of what is involved in poker or betting on the horses. Here, choice and skills also come into play. There are cardplayers and racetrack bettors who are genuine professionals, but no one makes a successful profession out of shooting craps.

We cannot eliminate the role of luck in investing, no matter how skilful we are. Neither can we depend only on luck. But, with a bit of skill, can we tempt luck? Instead of a blind shot in the dark, can we take calculated risks to change the odds? This is where cultivating the art of serendipity comes into play.

Serendipity is often conflated with luck, or very loosely, good fortune. That is not particularly accurate. Serendipity is an aptitude for making desirable discoveries by accident. It is the occurrence and development of events by chance in a happy or beneficial way.

So how does one create serendipity in investing? How does one set the stage to “get lucky”?

Mahesh Mirpuri has some interesting insights on this topic. He applies the learnings of a venture capitalist to the personal finance sphere. Read it in his own words.

I recently had the pleasure of listening to a very engaging interaction between two brilliant and successful men – V Shankar, who founded CAMS, and G V Ravishankar, the managing director at Sequoia Capital.

Very briefly, this is what transpired between them.

Shankar asked GVR to speak about “creating your serendipity” in the context of venture capital investing. Here are GVR’s insights.

Depending solely on chance to encounter success is no different from hoping to win a lottery. But by your choices, one can create the conditions for Lady Luck to visit. Here are the three operating principles by which one can “manage serendipity”.

- Be there, always. Be there to take decisions. Be committed. Be passionate.

- Make yourself heard. Make yourself seen. Make yourself available. Let potential entrepreneurs know that you are there to evaluate a venture of theirs.

- You cannot be impatient. Give time for the seed to become a tree.

How must investors apply this to create conditions favourable for investing success?

- Nothing can be accomplished without commitment.

Commit to a savings plan, stick to your process, and stay the course. Once you are grounded in your commitment, the turbulent waters won’t rock your boat that easily.

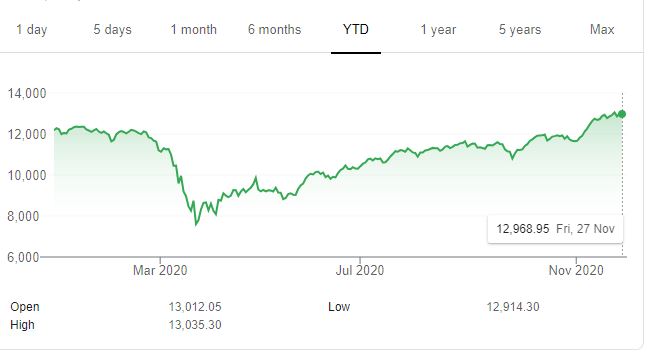

When the market experiences a precipitous fall, it is extremely difficult to stand apart from your emotions. I personally witnessed investors acting in panic in March and bailing out of the market when it was at its lowest. They threw their process to the wind and completely disregarded their asset allocation. If only they had refused to act impulsively, they would have been able to ride the equally dramatic recovery.

Be committed to your savings plan. Stick to your process. Stay the course. Those who stuck to their systematic investing strategy, those who decided to stay the course and not flee, those who were committed to adhere to their assigned asset allocation created their serendipity.

You owe yourself a good result. Acting impulsively will result in sub-optimal consequences.

- Have an open mind.

You may not be able to navigate the financial ecosystem by yourself. This has nothing to do with your reasoning or intelligence. There are many financial products out there, and you may not understand all. Some may be aptly suited for your situation, but you may have a closed mind as others have dismissed it unfairly.

Even if you do grasp a basic understanding of each, you may not know how to combine them together in a portfolio.

Not only do you lose, but a worse scenario would be one where you opt for a product that is not suited to your needs at all.

Seek advice from professionals who make it their job to study how various investments work. Not only do they have head knowledge, but their experience of the market terrain and its upheavals can keep you grounded when you see your net worth eroded. Obstinate refusal to take help will hinder your progress and your learning curve. Don’t let your ego stop you from creating wealth.

- Extreme patience can produce abnormal profits.

Results don’t fructify overnight. Investments need time to generate returns. Restraint is required to sit out volatility. Patience would mean that you are invested in that one good year which will make a big difference to your investment outcome. Impatience is dangerous to your wealth.

All the three points mentioned will go a long way in creating your investing serendipity. Let me conclude by leaving you with a graph. It needs no explanation. Look at it in the context of what I have written.