Everyone loves a good profit – employees, investors and shareholders. But it does require a deeper look if you are analysing a company.

Dr Vijay Malik

explains how companies inflate their profits. They can show higher profits by either not revealing some expenses in the P&L, or resorting to some conventions to ensure that these expenses don’t reduce their profits despite being present in the P&L.

Tactic I: Companies do not show some expenses in the P&L

Investors will come across cases where companies spend but do not show it as an expense in the profit and loss (P&L) statement. One of the methods employed is capitalization. By capitalizing certain expenses that should be recognized as an expense in the P&L, the company can show lower expenses and higher profits in that specific year.

Globus Spirits Ltd

Note by the auditor on page 45 of the Annual Report.

Basis for Qualified Opinion:

As on March 31, 2014, Fixed Assets include Intangible Assets aggregating to ₹2,886.60 Lacs (March 31, 2013 – ₹3,608.25 Lacs) under the head “Knowhow and New Brand Development” representing intangibles internally generated by the Company through expenditure on advertisement and promotional expenses. Such recognition is not in accordance with Accounting Standard – 26 “Intangible Assets”. Had the Company complied with requirements of AS-26, Fixed Assets as at March 31, 2014 would have been lower by ₹2,886.60 Lacs (March 31, 2013 – ₹3,608.25 Lacs), Depreciation and amortisation expense for the year would be lower by ₹721.65 Lacs, Net profit after taxes for the year would be converted into net losses after tax of ₹1,477.82 Lacs and Reserves and Surplus would be lower by ₹1,905.45 Lacs

In FY14, the auditor of Globus Spirits Ltd pointed out that until FY13, the company capitalized advertisement and promotional expenses of about ₹36 cr as intangible assets in the fixed assets. Ideally, Globus Spirits Ltd should have deducted these expenses from the P&L statement as expenses in the years in which the company spent this money.

The qualified opinion by the auditor indicates that the pre-tax profits for the years before FY2014 were higher to the extent of ₹36 cr.

After this observation by the auditor, Globus Spirits Ltd deducted these expenses over the next five years (FY2014-18) as additional depreciation of about ₹7.2 cr. each year.

Emmbi Industries Ltd

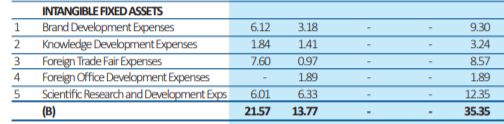

Page 72 of the Annual Report.

The FY16 annual report capitalized certain expenses - brand development, foreign trade fair and knowledge development – which, on the face of it look like expenses which should be charged to the P&L and not capitalized.

Investors should examine these expenses further and even try to get a clarification from the company about the nature of these expenses and what warrants them to be capitalized.

Tactic II: Companies show expenses in the P&L but nullify their impact on profits.

At first glance, it appears counterintuitive. How is it possible that an expense is present in the P&L, but does not reduce the profits?

Upon deeper analysis, the investor would notice that in such cases, the companies show a particular expense in the P&L but simultaneously show a transfer entry shifting an amount from the reserves to the P&L, which is usually exactly equal to the mentioned expense. The net result is that the transfer from the reserves overcomes the impact of reduction by the expense. As a result, the profit of the company remains unaffected as if, the expense simply did not happen.

Emami Ltd

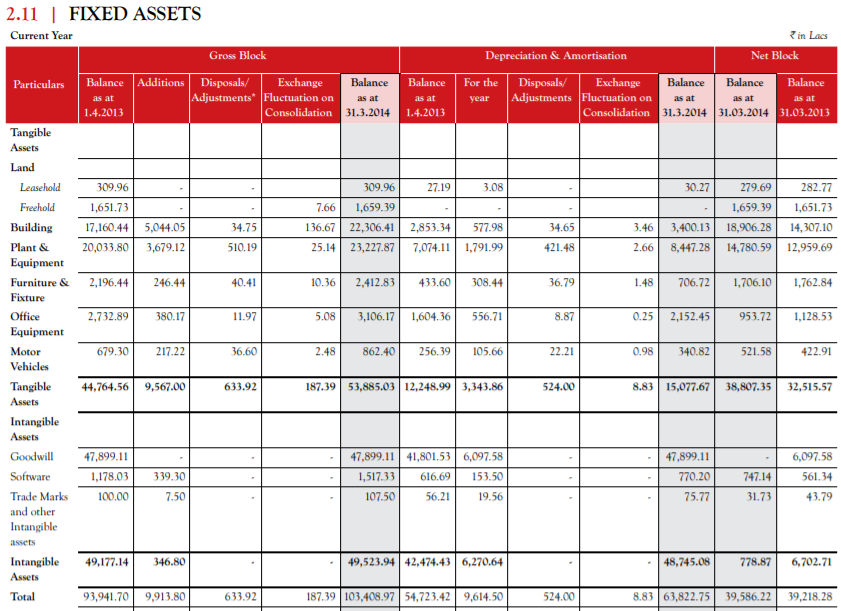

While analysing the annual reports from FY13 to FY14, the net intangible assets decreased from ₹67 cr to ₹7.78 cr. This is primarily due to the decline in goodwill by ₹60.97 cr.

The decline in goodwill is a regular amortization charge by which Emami Ltd has been decreasing its gross goodwill of ₹478.99 cr. over the years. In the previous years, it has been amortizing the goodwill at about ₹100-102 cr. per annum.

Page 149 of the Annual Report

The amortization of goodwill in the normal course of business and accounting is an expense in the P&L statement just like the depreciation expense for tangible assets. As a result, the profit of any company declines accordingly on the amortization of goodwill.

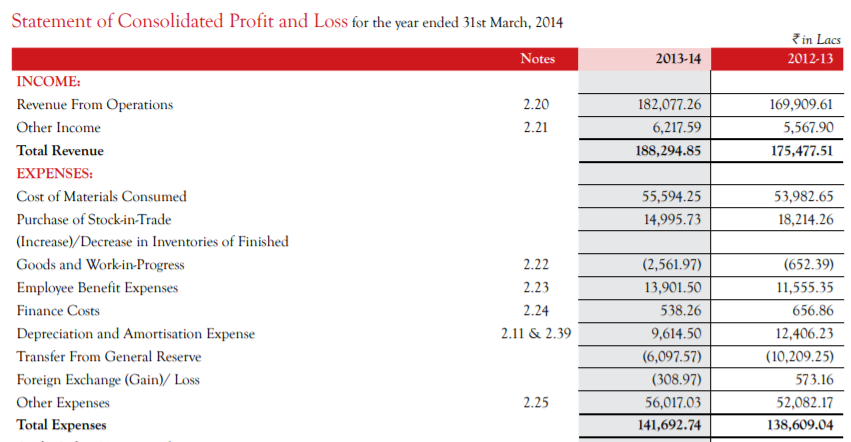

However, one important thing that an investor would notice while analyzing the amortization of goodwill by Emami Ltd is that it transferred an amount equal to the yearly goodwill amortization from its general reserve to the P&L statement every year.

Page 139 of the Annual Report

This entry nullifies the impact of goodwill amortization on its profits, not the overall cash position of the company.

If Emami Ltd were not following this practice of transferring amounts from general reserve to the P&L, then its profit before tax would have been lower by an equal amount every year. Emami Ltd has disclosed this practice in its significant accounting policies:

Intangible Assets:

a. Goodwill – Consequent to the scheme of arrangement being accounted for under Purchase Method by adopting book value method, the cost representing goodwill recognised is being amortised to Statement of Profit & Loss over, the estimated useful life of five years. As per the terms of the scheme equivalent amount of such amortisation is transferred from General Reserve.

In the normal course of business, it might amount to overstating of profits. However, as explained by Emami Ltd, it is doing the same as per the scheme of the arrangement, which I assume that would have been approved by any competent authority (in most cases a court of law) that would have allowed the company to adjust goodwill amortization directly against its reserves without impacting the P&L statement. The annual report does not provide details of which competent authority, if any, has approved/allowed such treatment of goodwill amortization against the general reserve.

As a result of the practice of the company to transfer the amount equal to amortization of goodwill, from reserves to the P&L, the impact of amortization expense on the profits is nullified.

You can access more information on

Dr Vijay Malik.com

and follow him on

Twitter

Disclosure: Dr Vijay Malik is registered with SEBI as a Research Analyst. He does not own any financial interest in any of the companies mentioned in this article.