I remember Tim Cook's words in 2019, when he explained why Warren Buffett views Apple as a consumer company. He commented that Apple has always tried to be at "the intersection of technology, the liberal arts and humanities. We make products for people. The consumer is at the centre of what we do."

Another debate simultaneously rages, as we all attempt to position the Apple stock. Is Apple a growth stock, a value stock, or both?

With a market capitalization of roughly $2 trillion, Apple is too big to ignore. The company is a major driver of equity returns, whether the market is seen as cheap or expensive. Even in a broad equity market index, there will be a generous allocation to Apple. It consumes nearly 5% of the Morningstar U.S. Market Index--which counts 1,439 stocks.

DAN LEFKOVITZ, strategist for Morningstar's Indexes group, answers the query.

Most people likely think of Apple as a growth stock, counting it along with many other technology names.

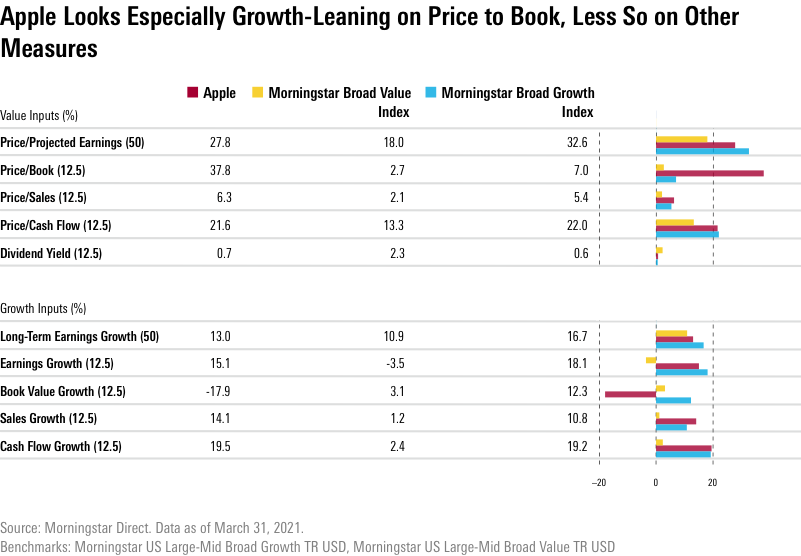

Price/book (PB) value is one measure that makes Apple look like an extreme growth stock. PB has come under criticism for its neglect of intangible assets, such as intellectual property. Apple derives most of its value from intangibles, including its formidable brand and the iOS operating system that seamlessly integrates hardware and software. Since Apple’s book value is low, its PB value ratio is high.

At Morningstar, we use a 10-factor style model that reduces reliance on any one metric. (You can see the 10 inputs that determine the Morningstar style-box classification below.)

During the dot-com frenzy of the late 1990s, Apple Computer (as it was then known), was considered a technology industry has-been. In 2000, Apple’s growth rate and valuation multiples landed it closer to the value side of the style box.

Then came an astounding run of innovation (iPod, iTunes, OS X, MacBook, iPhone, iPad, Apple Watch). Apple spent 2004 to 2016 as a high-flying growth stock.

Since 2016, Apple has generally drifted to the middle of the Morningstar style spectrum. Apple falls into the “large core” segment, meaning that it displays a mix of value and growth characteristics.

(Click on the image to enlarge)

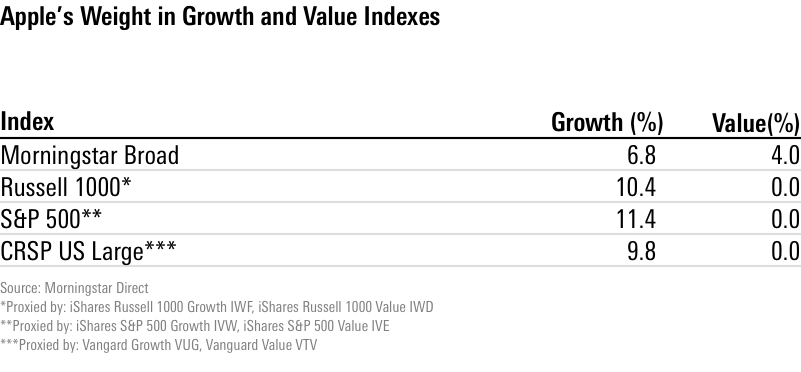

Exchange-traded funds tracking growth indexes hold more than $300 billion in investor assets, and even more investor capital is in other passive growth investments such as traditional index funds.

Investors in some growth index funds might be surprised to learn that more than 11% of portfolio assets end up dedicated to Apple.

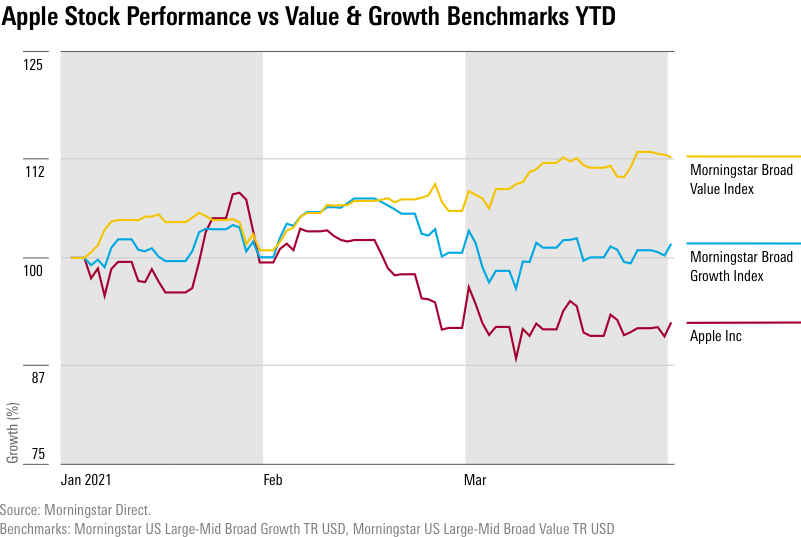

Apple’s prominence makes it a key driver of relative returns. For index-tracking funds and ETFs, the more Apple exposure the better in recent years. But in early 2021, Apple’s share price declined, reducing overall returns for many index-tracking funds.

Meanwhile, managers of the more than $2 trillion in active growth funds have a tough decision to make. If they like Apple, they need to dedicate a very chunky portfolio allocation in order to maintain an “overweight” position. If Apple does well, an “underweight” position will disadvantage them. On the value side, funds that owned Apple got a big boost relative to benchmarks with no Apple exposure in recent years. In 2021’s value rally, though, Apple exposure would have held a value fund back.

For investors, the lesson is value--or growth--is in the eye of the beholder. So, when looking at a fund’s portfolio holdings, Apple is a clear example of why methodologies matter.