In my research and investing career of over a decade, one of the long-held beliefs I have bought into was that the cement industry is a cyclical industry, says Ankit Kanodia of Smart Sync Services.

Only after doing some considerable research, was I able to discard this misconception.

Let me explain how.

What are cyclical businesses?

Any business whose fate is attached to the fate of the economy is a cyclical business. If the economy is in a downturn, you have a tough time selling your products. On the contrary, when the economy is on the uptick your products get sold pretty fast. So far so good.

This is a very simple way to explain cyclicality in a business.

According to Investopedia, "A cyclical industry is a type of industry that is sensitive to the business cycle, such that revenues generally are higher in periods of economic prosperity and expansion and are lower in periods of economic downturn and contraction"

Now, if we consider the cement industry and the generally held belief that it’s a cyclical sector, we would tend to think that the following is true for most cement companies:

- Their revenues, profits, and cash flows will follow the mean reversion rule.

- Their fortunes will mirror the performance of the economy.

- Margins will go through wild swings

- Over a long period, investors will not generate wealth holding on to these businesses

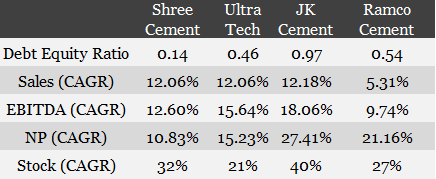

Let’s evaluate four cement companies over a specific time period. The Stock CAGR is uniform for all at 10 years. As far as the other parameters go, it is 7 years (Ramco Cement), 8 years (Shree Cement) and 10 years each for Ultratech and JK Cement.

As you can see above, the mean reversion doesn’t seem to work here. Rather there is a stable and regular growth in numbers. Their performance does not reflect the challenging times of the Indian economy over the same period.

The above is just a representative sample. There are other cement companies that share a near similar track record. Even margins of some of these players have continued to be resilient in a tight range for long period (including periods of boom and bust).

And mind you, until FY21, we did not experience any meaningful uptick in the economic indicator for a very long time.

Following this argument, one can even point out that the steel sector is not cyclical, because JSW Steel in the steel sector has been able to grow its revenues, profits, and cash flows for a long period, even during economic downturns. My counterpoint to that would be this: How many other steel players have that kind of performance over a long period? None. Zero.

JSW, through its managerial efforts and efficiencies has been able to achieve something that other players have not been able to match.

While, in the case of cement, we have several examples. The industry structure is such that many players have been able to not only survive but also thrive.

Is Cement a secular industry?

No. I am not making a case of cement being a secular industry.

My limited point is that being a regional commodity and almost having a negligible impact from the foreign market, the sector is not a cyclical one like steel, iron ore, aluminum, sugar, etc.

It is probably far more stable than we think it is.

Cement is a Commodity.

Cement has Seasonality.

But Cement is Not Cyclical.