Sequence-of-returns risk, or sequence risk, is something that is grossly overlooked.

This is the risk that comes from the order in which your investment returns occur. It is the risk of the market declining in the last few years of your working life and early years of retirement, coupled with withdrawals, that detrimentally attacks the longevity of a portfolio.

This issue is particularly relevant during the first few years before and after retirement. When you start making portfolio withdrawals, the value of your portfolio reflects both market performance and cash outflows, which can be a double whammy during extended market downturns.

AMY ARNOTT, portfolio strategist for Morningstar, explains it in a very simple fashion.

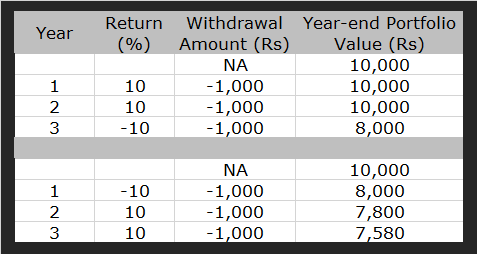

The amount you have: Rs 10,000. The amount you plan to withdraw: Rs 1,000 per year.

If you earn 10% (first year), 10% (second year), and -10% (third year), you'd end up with Rs 8,000 by the end of the third year.

But if the returns happen in the reverse order: -10% (first year), 10% second year, and 10% (third year), you’d end up with Rs 7,580 by the end of the third year.

Why? Because the negative return at the beginning of the period (when more assets are in the account) carries more weight in the overall results. The portfolio doesn’t benefit as much in rupee terms from the two years of positive returns because there are fewer rupees remaining.

Different Sequence, Different Results

Let’s complicate it a bit, by making it more real.

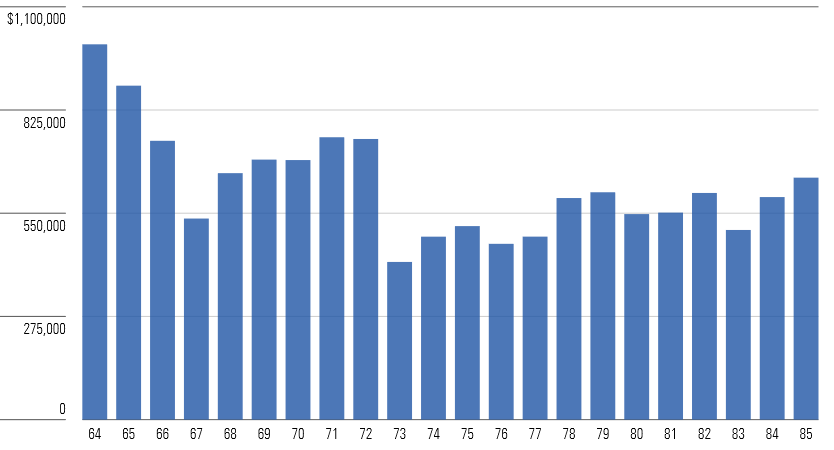

- Retiring age: 65

- Retired in the year: 2000, just as the market was heading into a 3-year downturn

- Starting value of all equity portfolio: $1,000,000

- Annual withdrawals: $40,000

- Increase in withdrawals to account for inflation: by 3% each year

- Actual returns: Morningstar US Market Index starting in 2000

The portfolio’s value would have been nearly cut in half by the end of the third year. As a result, the portfolio didn’t benefit as much in dollar terms from the market’s rebound starting in 2003. Adding insult to injury, the portfolio would have suffered another major blow when the market dropped about 37% in 2008.

Because this sequence of returns was so negative, the portfolio never fully recovered. By age 85, the individual’s portfolio value would be down to about $644,000. That's probably enough to sustain an average spending level, but it doesn't leave a huge cushion for extra costs late in life such as long-term care.

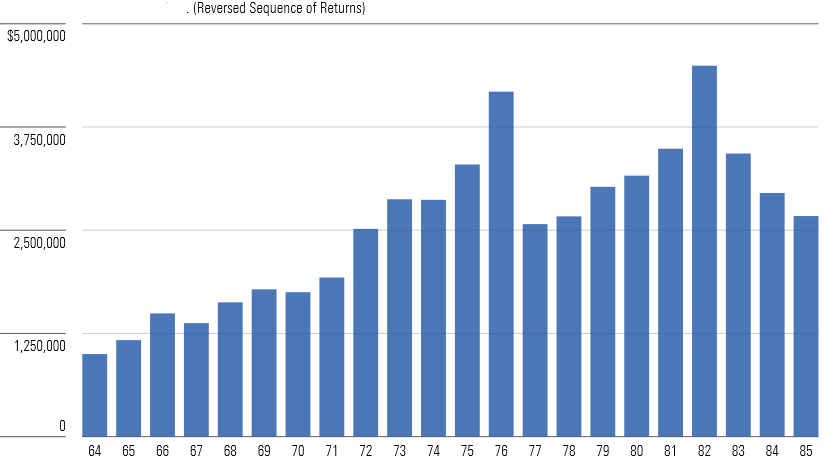

If the sequence of returns had been reversed (the Morningstar US Market Index earned the same returns as it did from 2000 through 2020, but in reverse order), the picture would be far brighter. By age 85, the portfolio’s value would be down from its peak, but still close to $2.7 million.

In a later article we shall look at how you can combat it.