There are no harmless mistakes when it comes to investing. Some of your moves, or lack of them, could end up being extremely costly.

Mistake 1: NOT having a “why”.

I must save. I should save. This has a strong negative implication, and a sacrificial angle. Replace that with a driver; a motivation. Because saving is not an end in itself. It is meant to serve a purpose.

What is it that you want your money to do for you? What is it that you really desire? It could be anything. It may be accumulating gadgets, building a fabulous home, or retiring in a decade. Try this: “I am saving because I want to go on a hot air balloon ride in South Africa.” Can you see the clarity, positivity and sense of purpose that comes along with this?

Remember, there is no right and wrong. There is no good and bad. There is no normal and absurd. Just be true and honest to yourself. Someone else’s pleasures may not bring you happiness. What fulfils them may not be your cup of tea.

The ONE reason you fail at saving

Mistake 2: NOT starting.

Have you ever realized how paralyzing negativity is? Fear that we will never reach our monetary target. Uncertainty as to how much it is we need to save. Confused about where to begin.

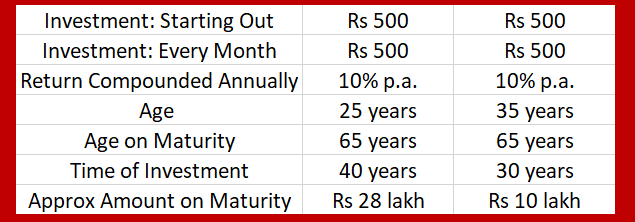

Don’t fall for the spiel that you should start investing when you have some “decent money”. All money is decent, however miniscule. Every single day that you delay investing, you're losing money. As you can see below, just Rs 500/month with a 10-year difference resulted in a gap of Rs 18 lakh. Start small; just start.

Mistake 3: NOT investing.

You will not get wealthy by parking your funds in a bank fixed deposit. For wealth creation, you must must invest in equity.

Don’t let direct stock picks be your initial investments. Individual equities can misfire and leave a bad taste in the mouth, and a hole in the pocket. If you push forward with equity funds, you will have a basic grounding in seeing your investment value fluctuate as the market moves in either direction. It will give you a sense of how comfortable you are with volatility. You stand a real chance of benefiting from these experiences.

You may feel stocks are fine as you can afford to lose small amounts of money when you are young as you have ample time to recover. But those small amounts, if invested wisely, can add up to serious money over a young investor's time horizon; wasting even a few of those early years with misguided experimentation can have a decent-sized opportunity cost.

Equity mutual funds are the best way to invest for long-term. They allow you to spread your investment among many companies. You can start small and can opt for a systematic investment plan (SIP), that allows you to invest fixed amounts every single month or quarter.

Mistake 4: NOT being consistent.

Leverage the power of consistency. You don’t get fit by exercising only when you feel like it. You don’t build a skill by studying and practicing it only when you are in the mood. You don’t get rich by being lax with regular contributions. See the difference a monthly contribution makes, as against an annual contribution.

Let us look at a return of 10% per annum, compounded annually over 25 years.

- Initial investment (₹500) + zero additions: ₹5,417

- Initial investment (₹500) + ₹500 (start of every year): ₹59,508

- Initial investment (₹500) + ₹500 (start of every quarter): ₹2,14,404

- Initial investment (₹500) + ₹500 (start of every month): ₹6,27,462

This is the reason why SIP works wonders and is a great psychological hack.

WHERE TO INVEST TO GET STARTED

If you have a goal that is much closer at hand, such as buying a car or a bike or taking a holiday, this money shouldn't be in stocks at all. If you are investing in equity funds, the money must stay invested for many years to ride the market upheavals.

SUGGESTION: A large-cap fund will lay the foundation for a solid portfolio.

WHAT DOES IT MEAN? The word ‘cap’ refers to market capitalisation. Market capitalisation is calculated by multiplying the number of shares issued by the company with the market price per share. For example, a company with 20 million shares selling at Rs 50/share would have a market cap of Rs 1 billion. Market cap allows investors to understand the relative size of one company versus another. Large-cap companies are presumed to be financially solid and are relatively safer when compared to smaller companies. Such stocks are not as volatile as mid and small cap stocks. They do not collapse as dramatically during a bear market.

SUGGESTION: If you would like to take a little more risk to get a better return, you can consider a large-and-mid-cap fund.

WHAT DOES IT MEAN? A large-cap mutual fund is an equity fund; one that invests a minimum 80% of its corpus in large-cap stocks. Such funds scout the universe of stocks that form the top 100 companies (by way of market cap) listed on the stock exchange. A large-and-mid-cap fund invests at least 35% in large caps and a minimum of 35% in mid caps.

SUGGESTION: To play it safe and to gingerly test the waters, a balanced advantage fund should do the trick.

WHAT DOES IT MEAN? Balanced Advantage Funds, also known as Dynamic Asset Allocation Funds, invest in asset classes like equity and debt, and keep modifying their asset allocation based on the market valuations.

Dhaval Kapadia, Director - Portfolio Specialist, Morningstar Investment Advisers India, suggests the following:

Narrow down a fund/funds, and begin to invest systematically. In Why SIP is the best thing for an equity investor, I explain how it works for your benefit.

Larissa Fernand is Senior Editor at Morningstar India. You can follow her on Twitter.