The below is an extract from the India Domestic Fund Flows Q4 FY23 report. This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market.

Quarter: January-March 2023

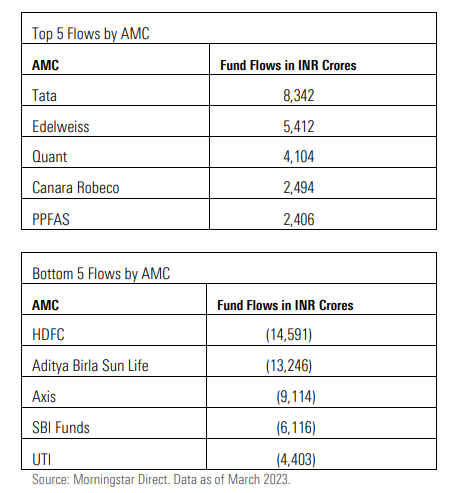

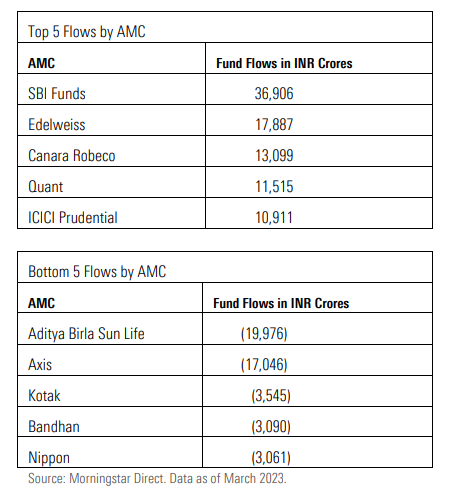

Edelweiss Mutual Fund and Canara Robeco Mutual Fund are seeing consistent inflows. They also featured in the

Top 5 Flows last quarter. UTI Mutual Fund has featured in the

Bottom 5 Flows over the last two quarters.

HDFC Mutual Fund and SBI Funds had a great run last quarter only to move from

Top 5 to

Bottom 5.

FY23: April 1, 2022 - March 31, 2023

Note:

- Figures are in Indian rupees (INR crores).

- Data is of domestic open-end funds and Exchange Traded Funds (ETFs)

- Data is as of March 31, 2023

- A domestic fund is one that is domiciled in India and invests primarily in Indian markets. In this report,

we have included the asset flows of funds and ETFs with an allocation to Indian stocks and bonds as of

March 2023.

- This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market. The flows are estimated from assets and total returns for the quarter ended March 2023. Morningstar calculates estimated net cash flows for global open-end funds and exchange-traded funds, an estimate of the money put in or withdrawn by fund investors, accounting for reinvestment of distributions.

- The disclosure of daily net assets is at the discretion of the fund provider.

AMC Inflows and Outflows as on December 31, 2022