We released the March 2013 quarter-end edition of Morningstar Offshore India Fund Spy. The full report is available on subscription. Here are some key takeaways from the report.

A) Asset Flows and Assets of India-Focused Offshore Funds & ETFs:

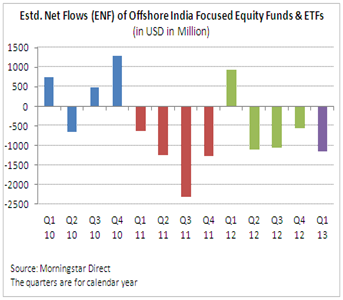

- India focused offshore funds & ETFs continued to register outflows to the tune of $1.1 billion in the first quarter of 2013 (January-March). This was the highest quarterly outflow for these funds since the last quarter of 2011, when India focused offshore funds & ETFs recorded a net outflow of $1.2 billion.

- Assets of all India focused offshore India funds & ETFs fell by about 7% to $34 billion during the first quarter of 2013. The outflows from these funds and the fall in Indian stock markets during the quarter contributed to the fall in assets.

- In the first quarter of 2013, FF – India Focus (from Fidelity) registered the biggest outflow of $206 million among all India focused offshore funds and ETFs. Next in line was HSBC GIF Indian Equity, which recorded a net outflow of $176 million during the quarter—making it the fourth consecutive quarterly outflow for this fund.

- The largest offshore India fund Aberdeen Global Indian Equity Fund, recorded the highest inflow of $267 million during the first quarter of 2013, making it the sixth consecutive quarterly inflow for this fund.

B) Emerging Market and Asia Ex-Japan Funds & ETFs Continue to be the Big Contributors of Foreign Inflows into India:

- As per data from Indian market regulator SEBI, foreign institutional investors (FIIs) pumped in more than $10 billion into Indian stocks YTD in 2013 (up to March). However, data from Morningstar shows that India focused offshore funds and ETFs registered outflows so far in 2013.

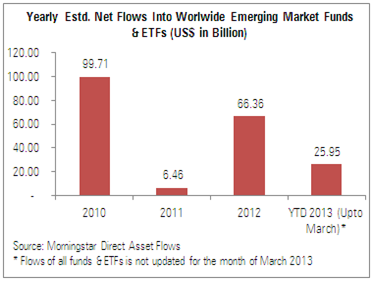

- One big contributor of flows into India in 2012 and YTD in 2013, has been emerging market stock funds and ETFs. These funds have a meaningful allocation to India in their portfolios, and have registered huge inflows from investors during 2012 and in Q1 2013. As per Morningstar Asset Flows data, Emerging Markets Funds and ETFs worldwide registered a net inflow of close to $26 billion YTD in 2013 (up to March). However flows into these funds did slow down quite considerably in the month of March. A bulk of the inflow (almost $18 billion) came in during the month of January, followed by $8.2 billion in February, and a slight net outflow of approximately $150 million in March, for those funds that have declared data.

- Besides emerging market funds, Asia Ex-Japan equity funds & ETFs also registered decent inflows in 2013. As per Morningstar Asset Flows data, Asia Ex-Japan equity funds and ETFs worldwide have recorded a strong inflow of $9.7 billion YTD in 2013 (up to March).

C) Performance of India-Focused Offshore Funds & ETFs:

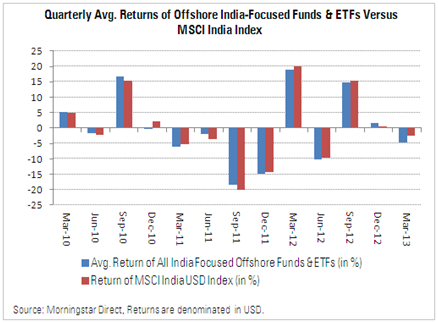

- India focused offshore equity funds and ETFs delivered an average return of -4.77% (in USD terms) during the quarter, versus MSCI India NR USD index’s 2.55% fall. Funds having higher exposure to small / mid-cap stocks underperformed during the quarter, as these stocks were beaten down badly. Six of the bottom ten performing India-focused offshore funds & ETFs during the quarter were small/mid-cap oriented funds or ETFs.

- Infrastructure themed offshore funds also were among the bottom performers during the quarter as cyclical and interest-rate sensitive sectors fell quite significantly during this period. Meanwhile, funds with a more defensive stance and having higher exposure to sectors like technology, consumer defensive (FMCG) and healthcare managed to limit the downside, and outperformed the benchmark indices during the quarter.

- Among the ten largest India focused offshore funds and ETFs, HSBC GIF Indian Equity A Acc was the bottom performer during the quarter—delivering a return of -8.88%, compared to -2.55% returned by the MSCI India NR USD Index.