We released the September 2013 quarter-end edition of Morningstar Offshore India Fund Spy. The full report is available to subscribers of Morningstar Direct. Here are some key takeaways from the report.

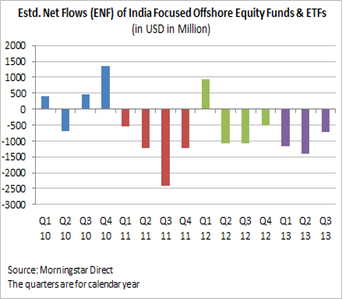

Asset Flows of India-Focused Offshore Funds & ETFs:

- India-focused offshore funds & ETFs registered a net outflow of $0.7 billion in the third quarter of 2013 (July-September), compared to a net outflow of around $1.4 billion in the second quarter of the calendar year. The YTD net outflow in 2013 (up to September) now stands at $3.3 billion.

- After seeing net outflows in July and August, the month of September actually recorded a small net inflow of $25 million into India-focused offshore funds & ETFs, which is the first monthly inflow registered since March 2012.

- In the third quarter of 2013, HSBC GIF Indian Equity registered the biggest outflow of $166 million among all India-focused offshore funds and ETFs. Over the past year, this fund has also registered the biggest net outflow of $707 million.

- A number of India-focused ETFs registered positive inflows during the third quarter, especially benefiting from the strong inflow seen into these ETFs in the month of September. A US domiciled ETF named Wisdom Tree India Earnings recorded the highest inflow of $195 million during the quarter.

- Aberdeen Global Indian Equity Fund, recorded the highest inflow of $477 million over the past year. Over this period, the fund has returned around -8.21%, compared to MSCI India’s -12.42% return. This Morningstar 5-star rated fund is among the top ten best performing offshore India funds over 3 and 5 years.

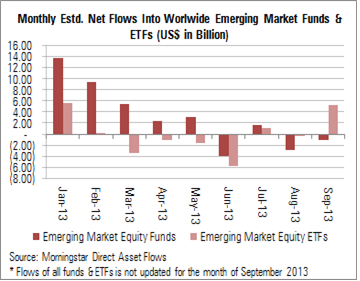

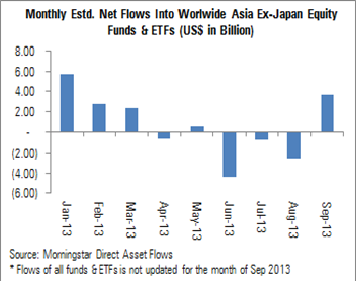

Emerging Market ETFs and Asia Ex-Japan Funds & ETFs See Some Investor Appetite Returning in September, Helping to Push up FII Inflows into India

- Flows into Emerging Market and Asia ex Japan funds & ETFs slowed down considerably, and actually turned negative in the second and third quarter of 2013. However, the Fed’s decision to not taper in its September meeting helped to bring back some risk appetite globally, and this in turn helped riskier asset classes like emerging markets, Asia-ex Japan, and also India in the month of September. It remains to be seen if this trend continues in the upcoming months as well.

- As per Morningstar Asset Flows data, Emerging Market Equity Funds registered a net inflow of more than $28 billion in the first quarter of 2013, which slowed down to a net inflow of only $1.3 billion in the second quarter of 2013 (primarily due to large outflows in the month of June), and a net outflow of $2.4 billion in the third quarter.

- Meanwhile, Emerging Market Equity ETFs registered a net inflow of $2.3 billion in the first quarter of 2013, followed by a net outflow of $8.8 billion in the second quarter of 2013, and then a net inflow of $6 billion in the third quarter. The month of September actually recorded a strong inflow of $5.3 billion into Emerging Market ETFs, as per Morningstar data.

- As per Morningstar Asset Flows data, Asia Ex-Japan equity funds and ETFs worldwide recorded a strong inflow of almost $11 billion in the first quarter of 2013. The second quarter registered a net outflow of $4.6 billion, of which the month of June itself saw a net outflow of $4.3 billion. The third quarter recorded a flattish net inflow of $300 million, but the month of September especially registered a strong pick-up in inflows to the tune of $3.6 billion

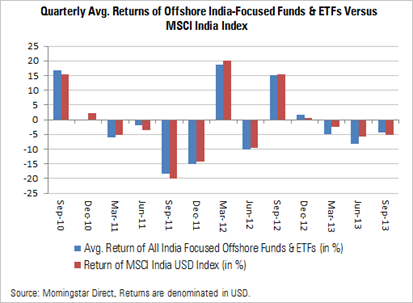

Performance of India-Focused Offshore Funds & ETFs:

- Indian equity markets managed to close the third quarter flat, with the benchmark S&P BSE Sensex index returning -0.08% (in INR terms). However the picture was very different for dollar denominated returns, due to the sharp depreciation in the rupee of around 5% during the quarter, which hurt foreign investors. The US dollar denominated MSCI India GR index fell 5.25%.

- India focused offshore equity funds and ETFs delivered an average return of -4.40% (in USD terms) during the quarter. These funds delivered a negative return of 12.31% (on average) in the month of August, but then managed to post a strong positive return of almost 12% (on average) in the month of September. This was the strongest monthly return posted by India-focused offshore equity funds & ETFs in a year.

- Five of the bottom ten performing India-focused offshore funds & ETFs during the quarter were small/mid-cap oriented funds, with the broader markets underperforming. With interest rates hardening during the quarter, funds having a higher exposure to interest rate-sensitive sectors like financials, realty, and capital goods also underperformed.

- Meanwhile, with the rupee depreciating during the quarter, funds/ETFs having higher allocation to export oriented sectors like technology and healthcare benefited.

- Among the ten largest India-focused offshore funds and ETFs, HSBC GIF Indian Equity A Acc was the bottom performer during the quarter—delivering a dismal return of -10.49%, compared to -5.25% returned by the MSCI India GR USD Index.