Equity markets continued with their march ahead in May, although gains were more subdued this month, compared to April.

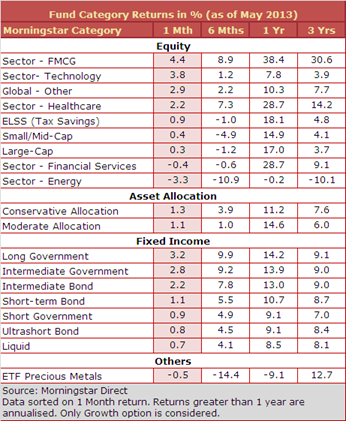

FMCG sector funds were the toppers from the equity space in May—delivering an average return of 4.4% during the month, compared to a 3.4% return by the S&P BSE FMCG index. Technology sector funds also bounced back in May, and delivered an average return of 3.8%, compared to 6.2% returned by the S&P BSE IT index. In the month of April, technology sector funds had received a thrashing and returned -11.3% (on average), after disappointing results by IT major Infosys.

Returns of diversified equity funds were subdued in May. Large-cap equity funds delivered an average return of 0.3% during the month, compared to 0.8% returned by the S&P BSE 100 index. Small/mid-cap funds returned 0.4% on average in May, compared to 0.1% and 0.7% returned by the CNX Midcap and BSE Midcap indices respectively.

Energy and financial sector funds were the bottom performers from the equity space in May. Energy sector funds returned -3.3% during the month, significantly trailing the S&P BSE Oil & Gas index, which returned -0.7%.

It was great month for bond and gilt funds, as yields fell sharply in May, on expectations of further rate-cuts. The sharp fall in headline inflation also put downward pressure on bond yields. Long-government and intermediate-government bond funds delivered their better monthly returns in over 4 years in May (or since the month of April 2009). Intermediate bond funds also fared well during the month and matched the same feat. Shorter tenure funds like liquid and ultrashort bond funds lagged during month.

Gold ETFs continued with their decline and posted an average return of -0.5% in May, bringing their YTD return to a disappointing -11%. They had fallen sharply in April—delivering an average return of -8.5% during the month.