We released the June 2013 quarter-end edition of Morningstar Offshore India Fund Spy. The full report is available to subscribers of Morningstar Direct. Here are some key takeaways from the report.

A) Asset Flows and Assets of India-Focused Offshore Funds & ETFs:

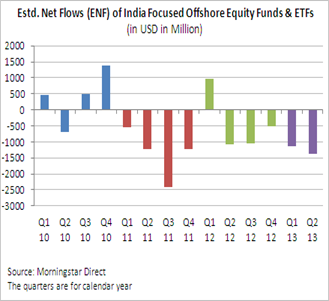

- Net outflows from India-focused offshore funds & ETFs rose to $1.4 billion in the second quarter of 2013 (April-June), from around $1.1 billion in the first quarter of the calendar year. The YTD net outflow in 2013 (upto June) now stands at a significant $2.5 billion.

- The outflow in the latest quarter has been largely caused by the weakness in the rupee, which dropped to all-time lows and breached the psychological mark of 60 (versus the USD). The recent comments from the Federal Reserve of the possibility of tapering down its quantitative programme later this year, also led to risk aversion among global investors and prompted outflows from emerging markets (including India).

- Assets of all India-focused offshore funds & ETFs fell by 12% to around $30 billion during the first quarter of 2013. The cumulative assets of these funds & ETFs are now down by a massive 45% from a peak of approximately $55 billion at the end of 2010.

- In the second quarter of 2013, HSBC GIF Indian Equity registered the biggest outflow of $216 million among all India-focused offshore funds and ETFs.

- India-focused offshore ETFs largely witnessed inflows during the quarter. iShares MSCI India ETF recorded the highest inflow of $231 million during the quarter.

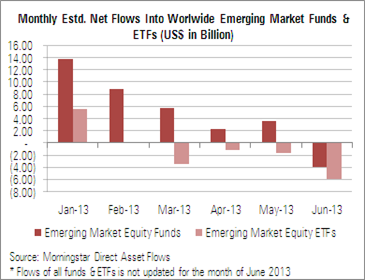

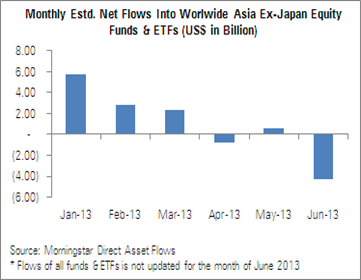

B) Emerging Market and Asia Ex-Japan Funds & ETFs Register Large Outflows in June, and Drag down Overall FII Inflows into India

- As per data from Indian market regulator SEBI, foreign institutional investors (FIIs) pulled out a net $1.8 billion from Indian stocks in the month of June 2013. However, FIIs pumped in a net $1 billion and $4 billion into Indian stocks in the months of April and May respectively.

- Flows into Emerging Market Funds and ETFs slowed down considerably in the second quarter of 2013, and actually turned negative in the month of June 2013. As per Morningstar Asset Flows data, Emerging Market Equity Funds registered a net inflow of more than $28 billion in the first quarter of 2013, which slowed down to a net inflow of only $2 billion in the second quarter of 2013. The month of June actually recorded a net outflow of almost $4 billion from emerging market funds.

- Meanwhile, Emerging Market Equity ETFs registered a net inflow of $2.3 billion in the first quarter of 2013, which later turned into a net outflow of $8.8 billion in the second quarter of 2013. In the month of June 2013, these emerging market ETFs recorded a massive net outflow of almost $6 billion.

- Besides emerging market funds, flows into Asia Ex-Japan equity funds & ETFs also slowed down considerably in the second quarter of 2013. As per Morningstar Asset Flows data, Asia Ex-Japan equity funds and ETFs worldwide recorded a strong inflow of almost $11 billion in the first quarter of 2013. The second quarter registered a net outflow of $4.5 billion, of which the month of June itself saw a net outflow of $4.3 billion.

-

If global risk aversion among investors continues, then that can further slow-down inflows into these funds, and therefore be detrimental to FII inflows into India. The Federal Reserve’s actions / announcements during the year can also have a major bearing on how flows into these funds shape up.

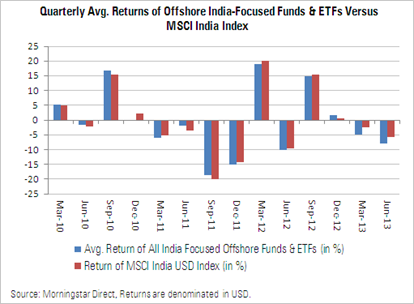

C) Performance of India-Focused Offshore Funds & ETFs:

- India-focused offshore equity funds and ETFs delivered an average return of -8% (in USD terms) during the quarter, significantly underperforming the benchmark MSCI India index, which returned -5.60% (in USD terms) over the same period. This is the worst quarterly return delivered by these funds in a year, or since the quarter ended June 2012. The sharp depreciation in the rupee especially played spoiler to returns of these funds.

- Funds having higher exposure to small / mid-cap stocks and to sectors like realty, infrastructure, metals and technology, underperformed during the quarter.

- Meanwhile, funds with a more defensive stance and having higher exposure to sectors like consumer defensive (FMCG) and healthcare managed to limit the downside, and outperformed the benchmark indices during the quarter.

- Among the ten largest India-focused offshore funds and ETFs, HSBC GIF Indian Open, which is domiciled in Japan was the bottom performer during the quarter—delivering a return of -16.33%, compared to -5.60% returned by the MSCI India NR USD Index.