Pension Fund Regulatory and Development Authority (PFRDA) was recently uplifted to a statutory status, by the passing of the pension bill in parliament. While the government continues to promote its flagship defined contribution retirement system, and looks to instill investor confidence in the National Pension System (NPS), the news on the returns front is not very encouraging, especially in recent times.

National Pension System offers different classes of schemes, all of which are market linked. Due to the market linked nature of these schemes, performance can vary significantly on a year on year basis. In the buoyant market of 2012 this proved to be favourable as most schemes delivered remarkable returns. Central government (CG) and State government (SG) schemes delivered double digit returns. Equities (E), Corporate Bond (C) and Government Bond (G) schemes also delivered double digit returns with equity portfolios delivering an average return of nearly 30%. However, so far this year, the market linked nature of these schemes has proven to be more of a detriment. (All trailing returns in this article are ended September 27, 2013 unless mentioned).

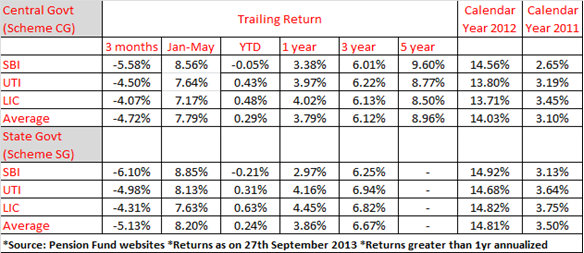

State and Central Government Schemes

In 2013, markets took a turn for the worse, and so did the returns on NPS. In a year where equity markets remained flattish to positive, debt markets played the spoiler. With over 85% allocation to corporate bonds and government securities and an average maturity of over 10 years, the central and state government schemes, which manage most of the NPS corpus, took a heavy beating. The numbers largely remained flattish on a year to date basis; a significant drop from the double digit performance recorded in the previous year. At one point, at the end of May 2013, Scheme CG and Scheme SG were sitting on average YTD returns of 7.8% and 8.20% respectively.

Presently, the average year to date return for Scheme CG and Scheme SG stood at 0.29% and 0.24%, respectively, at the end of September 27, 2013.

Returns over the last three months testify to the volatility witnessed in the fixed income space. RBI’s various liquidity tightening measures to curb rupee depreciation, has put bond yields under pressure, therefore driving down returns. Furthermore, the unexpected hike in repo rate in the recent monetary policy review has once again added to the pressure, and further dampened sentiments in the fixed income markets. The central and state government schemes have lost 4.72% and 5.13% respectively, on an average, over the last 3 months.

SBI pension fund, which was sitting on an average maturity of around 14 years for Scheme SG & CG at the end of June 2013, was the worst hit by this volatility. The last 3 month’s return stood at -5.58% and -6.1%, for its central and state schemes, while the year to date return was also below the peer average.

Equity and Corporate bond schemes have fared better this year

The “E” class schemes invest primarily in index funds that replicate the portfolio of either the S&P BSE Sensex or CNX Nifty. These schemes by nature are passively managed, hence are totally dependent on the performance of the underlying index. They have now been given the option of active management, since early 2013. Performance of E class scheme has been middling, albeit better than government employee schemes, so far this year. Average year to date return of Scheme E has been around 1%, and returns over the past 3 years are flattish, or in the red.

The “C” class option, which invests primarily in corporate bonds has been the best performer of the lot. Although the recent turmoil in fixed income markets has eaten into returns, it has still managed to deliver an average return of 3.1% so far this year, and an average return of 9% (annualized) over the past 3 years.

Government bond scheme the worst hit

The G class scheme, which invests in government securities, has been the worst hit so far this year. Far from shielding the portfolio from market uncertainties, government securities have instead induced more duration and interest rate risk into the portfolios, in the current environment.

The G class scheme was the top performer till the end of May, delivering an average return of 10.16%. This run came to a halt when RBI introduced a host of reforms in mid-July to curb rupee depreciation, putting significant pressure on the yields. The 10 year benchmark government bond (7.16% GOI 2023) yield rose from around 7.5% levels at the end of June 2013, and breached the 9% mark in mid-August, on the back of a sharp fall in the rupee. The 10 year yield later recovered significantly, with the rupee rising, but the recent unexpected repo rate hike has once again put pressure on bond yields, and the 10 year yield closed the month of September at around the 8.7% mark. This impacted G class returns greatly as most of the portfolios were sitting on an average maturity of 13 to 18 years. As a result, the G class scheme lost 8.66% on an average in the last 3 months (ended September 27, 2013), bringing the year to date return to a disappointing -2%.

The higher duration profile of funds in Scheme G, has especially hurt returns over the past three months, and caused them to underperform other long term gilt mutual funds available in the industry by a significant margin. But then again, pension products have a much longer investment horizon compared to mutual funds. Although their longer duration stance may hurt in the short term, it may help to realize better yields over the longer term, and also cut down on re-investment risk.

Conclusion

NPS returns have been disappointing so far this year especially due to the volatility witnessed in the fixed income space. But for an investment vehicle with a horizon spanning till retirement, long term returns become even more relevant. The 5 year trailing return for the central government scheme stands at an average of 9% (annualized), higher than the average return of 8.7% on EPF or 8.4% on PPF over 5 fiscal years. Meanwhile, the 3 year trailing returns for central government scheme has been moderate, and stands at an average 6% (annualized), primarily due to the poor or lackluster performance of equities and government bonds in year 2011 and so far in 2013 as well.

NPS is still the most cost effective investment avenue and provides tax benefits over and above the deductions under section 80C. It offers investors the flexibility of varying allocation to debt and equity markets and switching fund managers. All things considered, the National Pension System is a worthy investment alternative, delivering competitive returns over the long term, with possibility of minor blips in the short term, due to its market-linked nature.

* Dhruva Chatterji, Senior Investment Consultant at Morningstar, also contributed for this article.