Equity markets were on the receiving end in the month of July. The benchmark S&P BSE Sensex index closed the month with minor losses of only 0.3%, but the broader markets and some sectors like banking, realty, capital goods and metals fell heavily during the month.

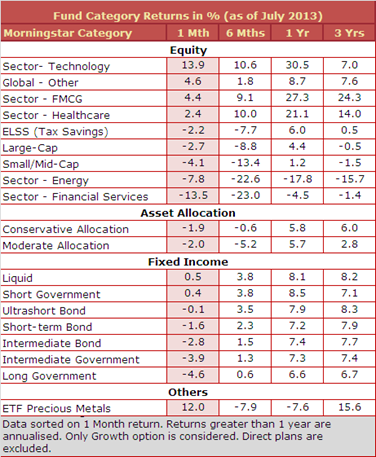

The biggest losers from the equity space in July were financial sector funds, which delivered an average return of -13.5% during the month, compared to -13.7% returned by the S&P BSE Bankex index. Infrastructure funds also suffered during the month as rate-sensitives underperformed significantly. Infrastructure funds delivered a return of -8% (on average) in July, bringing their YTD losses to a significant -22%. Some PSU funds also underperformed significantly during the month with the S&P BSE PSU index plunging 11.6% in July. Energy sector funds also disappointed with power stocks falling sharply.

Large-cap equity funds outperformed their mid-cap cousins by a significant margin in July, delivering an average return of -2.7%. Small/mid-cap equity funds delivered an average return of -4% in July, on the back of a similar loss in the month of June. The benchmark CNX Midcap index fell more than 6% in each of these two months as well.

The saving grace from the equity space in July were technology sector funds, which delivered a return of almost 14%, compared to around 19% returned by the S&P BSE IT index. Defensives like FMCG and healthcare sector funds also fared well in an otherwise volatile market. Besides that, global funds also outperformed, with global markets faring better than the Indian markets, and also benefiting from the rupee depreciation.

It was a terrible month for fixed income, with the RBI taking various steps to suck out liquidity from the system to curb volatility in the rupee. This put significant pressure on bond yields with the yield of the benchmark 7.16% 2023 government bond rising by more than 70 bps in July, to close at 8.17%. The 10 year yield is now up more than a full percentage point, from its lows hit in late May. Bond funds delivered their worst monthly return since January 2009, when yields had also shot up significantly. Long term gilt funds were the bottom performers, since they bear more interest rate risk, and delivered an average return of -4.6% in July. Intermediate bond funds also delivered an average return of -2.8% during the month. Shorter tenure funds outperformed as they bear less interest rate risk, although ultrashort bond funds closed July with minor losses, and liquid funds surprisingly delivered negative returns on certain volatile days.

Gold ETFs saw a strong recovery in July, benefiting from the rupee depreciation and the recovery in international gold prices. They delivered an average return of 12% in July, making it the best monthly return since the month of August 2011, when these gold ETFs returned around 15%.