Having begun this calendar year on a strong note, the surge in assets in the mutual fund industry continued for yet another month, though at a slower pace. The key drivers were the rising equity market and positive inflows in the Income category.

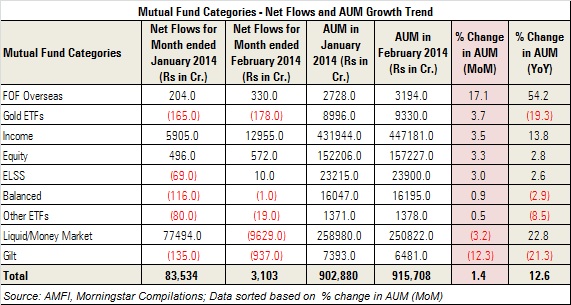

Total assets under management, or AUM, grew by 1.4% on a month-on-month basis to Rs 915,708 crores as compared to Rs 902,880 crores in the month of January 2014. Ironically, despite a growth in AUM, total industry inflows dropped significantly. Total flows for the month of February 2014 stood at Rs 3,103 crores as compared to Rs 83,534 crores in January 2014.

Worth noting is that February is usually the month when the inflows tend to be the lowest. In February last year, the inflows were Rs 3,584 crores. This could be attributed to the nearing of the financial year end when banks and financial institutions prioritize meeting their tax obligations.

Equity funds, on the other hand, continued to see inflows for the fourth consecutive month marking investor confidence in the equity market.

Debt funds: Mixed numbers

Debt funds have predominantly been driving the overall industry asset trend and this month too was no exception. Income funds, the largest by market share and AUM, size saw the highest inflows during the month. The category also registered a strong growth of 3.5% in February 2014. Inflows amounted to Rs 12,955 crores as compared to Rs 5,905 crores the month before. Majority of these flows can be attributed to the number of fixed maturity plans, or FMPs, launched during the tax season.

On the other hand, the Liquid and Money Market categories saw the funds flowing out and assets dipping as compared to the previous month. Banks and financial institutions are normally seen exiting their investments during this period to meet the financial year-end tax obligations. These two categories saw net outflows to the tune of of Rs 9,629 crores in the month of February as against huge inflows in the month of January. At the same time AUM of the two categories dropped by 3.2%.

Gilt funds registered the sharpest AUM fall during the month-- over 12%. On the flows front, the category witnessed outflows for three consecutive months with this month’s outflows amounting to Rs 937 crores.

Equity: Inflows continue

The equity market surge resulted in assets soaring during the month. The equity category registered a growth of 3.3% during the month. The category also saw inflows of Rs 572 crores as against Rs 496 crores in January. The ELSS category witnessed a pick-up with the tax season on. It is usually in the month of February and March that the category records net inflows and this time was no exception. The ELSS category saw net inflows of Rs 10 crores with an asset growth of 3%.

Balanced fund categories witnessed minimal outflows of Rs 1 crores while the asset base grew by a marginal 0.9%.

Gold ETF: Assets rise, outflows continue

Despite the price of gold rising over the past two months, this category seems to have lost its appeal, as reflected in fund flows. The Gold ETF category continued to witness net outflows, to the tune of Rs 178 crores in February, for the ninth consecutive month. However, the category asset base grew by 3.7% as compared to a 2.4% growth in the month before. This clearly indicates lack of investor confidence in this category despite the revival of global prices.