Inflation over the past two years has punished savers. They are forced to scout for investment products that will give them a higher yield. This, in turn, puts a fair amount of pressure on debt fund managers to up the yield on their funds.

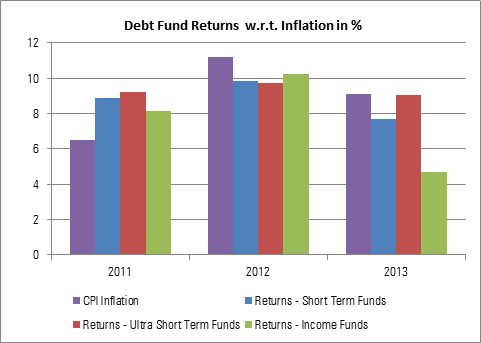

While all categories of debt funds – ultra short term, short term and income funds, were able to beat the inflation rate in 2011, returns from these products have lagged behind inflation in the following two calendar years (see table below).

Fund managers trying to increase the returns essentially have two options. One is to extend maturities. The other is to reduce credit quality.

With the Reserve Bank of India governor, Raghuram Rajan, training his guns on inflation, a scenario of declining interest looks distant. Hence the possibility of an aggressive duration call in debt is unlikely.

The other option available to increase the return of debt funds is to hike the exposure to lower rated paper. Generally, fund managers stick to AAA-rated paper. By going lower down the rating scale, a yield pickup of 1-3% - over and above the AAA yield, is possible. The exact increase depending on the quality of the paper.

Worth mentioning is that the initial success of a few asset management companies to deliver superior returns by taking higher credit risk has also led to competitive pressure in this industry. Consequently, other fund managers increase exposure to lower-rated papers in their existing funds if they do not have a separate fund generally referred to as an “Income Opportunity” fund.

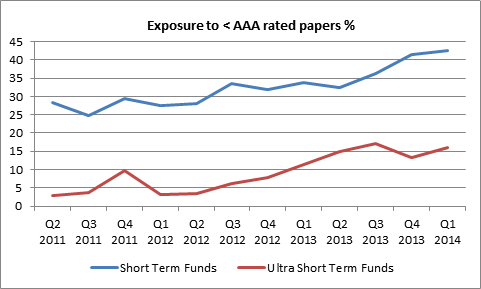

For short-term funds, the exposure to paper rated less than AAA (or equivalent) has moved up steadily from 28% to 42% of the portfolio over the past 3 years. For the ultra-short term category, exposure to papers which are rated lower than AAA (or equivalent) has moved up from 3% to 16% of the portfolio.

Exposure to these papers can come from Non-Banking Financial Companies, or NBFCs, as well as manufacturing companies. It could also be unrated paper of real estate companies or lending against securities types of transactions.

This increases the risk in the portfolios in two ways. One is the principal repayment risk. These papers carry higher risk of default than the safer AAA debt. Secondly, liquidity could be an issue specially in the case of redemption pressure, as was seen in 2008.

This is not to say that exposure to lower rated debt should be outrightly shunned. This can help to enhance the returns on the portfolio, especially in an improving economic environment, when some of these papers could be upgraded. But I think it is important that investors have a look at their fund portfolios or talk to their financial advisers and be cognizant of the risk which they are getting into prior to investing. This can save a lot of heart burn later.