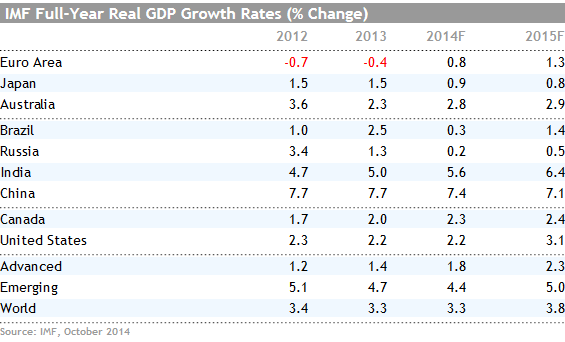

The International Monetary Fund, or IMF, releases a comprehensive forecast of global economic growth several times a year. Overall, the report the report now predicts just 3.3% growth in 2014 and 3.8% for 2015, down 0.1% and 0.2%, respectively, compared with the IMF's July forecast.

Robert Johnson, director of economic analysis with Morningstar, noted that markets seemed to take the new report as some kind of shocking revelation. Instead, he thinks the report still looks a little too optimistic, especially relative to China and Europe.

According to him, “The new forecast means that the world growth rate has been basically unchanged in each of the latest three years. Each year usually began with hopes of an improving situation, only to see those hopes dashed by the time the final numbers were reported. This same October report, produced a year ago, was forecasting 3.6% growth for 2014 (now 3.3%). Keeping with IMF tradition, things will be better next year and growth will accelerate to 3.8%.”

When referring to the above table, Johnson noted that “That new lower number still looks a little high to me, and the numbers for Europe and especially China look a bit high to me, too.”

The IMF believes that the U.S. Federal Reserve and the Bank of England will be the first two major central banks to start raising interest rates by the middle of 2015.

Reuters quoted Fed Vice Chairman Stanley Fischer as saying that the effort to normalise U.S. monetary policy after years of extraordinary stimulus may be hampered by the global outlook. The renewed concerns about Europe could represent a serious complication for the Fed, which had been expected to begin bumping up benchmark borrowing costs in the middle of next year.

Fischer said that the Fed would only move rates higher if the U.S. economy was ready for it and rising borrowing costs in the United States were unlikely to disrupt flows of capital and investment around the world. Countries like India and Brazil are concerned a rise in U.S. rates could suck investment away from their economies.