This article has been written by Christine St Anne, Morningstar Australia's online editor.

In 5 things to note about asset allocation, we focused on the role of strategic asset allocation in portfolio management. Indeed, portfolio management, asset allocation and diversification are foremost in investors' minds when it comes to wealth creation.

But there is also one other crucial link that is a driver of wealth, according to Morningstar Investment Management managing director Chris Galloway.

Quoting research from U.S. investment doyen Charles Ellis, Galloway said human capital is the vital link in the overall financial path towards growing one's wealth. "Financial capital includes tradeable asset such as stocks and bonds, which have been used when constructing an asset allocation, but this process is incomplete without considering human capital," he said at the recent Morningstar SMSF Strategy Day held in Sydney.

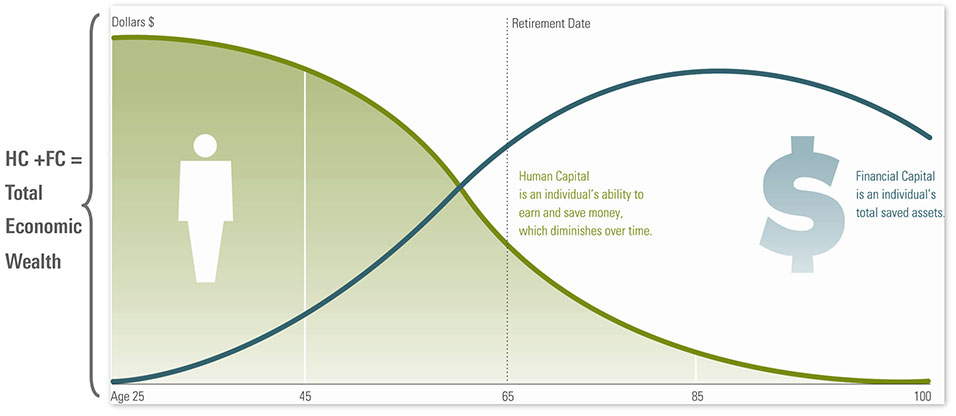

"Human capital is an individual's ability to earn and save. Human capital is measured by the present value of all your expected future wages, including pension and social securities." Therefore, when it comes to looking at wealth creation, people must look at financial capital as well as human capital. "The most important of all the factors dependent on financial security is how long you work," he said.

In the graph below, Galloway illustrated how the two concepts work together and what people must consider when moving towards retirement.

The key risks when a person is accumulating their wealth are: expense risk, mortality risk, savings risk and market risk.

Once a person moves into retirement they confront other risks including: expense risk, longevity risk, bequest risk and market risk.

It's obvious that younger people have a higher future earning potential relative to savings. As people get older, the savings pool increases but at the same time their earnings potential is lower.

Galloway highlighted an interesting example of how asset allocation can be determined by a person's career.

"Careers obviously affect your human capital. A university professor has a stable income. The chance of him or her losing their job is remote, therefore they have the ability to have a more aggressive investment portfolio," he said. On the other hand, a professional rugby player does not have the same secure income that lasts his entire working life. Hence, investments need to be more stable and defensive.

Bankruptcy or death?

Quoting industry research, Galloway noted that retirees fear outliving their retirement (61%) more than death (31%).

When it comes to retirement, life becomes a race between death and bankruptcy, Galloway said.

Having the ability to work longer is one obvious way of not outliving your savings and is a reason why governments are looking to extend the official retirement age.

Galloway also highlighted two other key risks to a comfortable retirement: sequencing risk and valuations.

Sequencing risk happens when retirees confront a significant market fall nearing or upon retirement. Think about the global financial crisis of 2007. A market fall has more of an impact on retirees than someone just starting a career, given they have an almost 40-year horizon to make up the fall.

Galloway said an annuity can help minimise this risk but acknowledges that people are generally not favourable towards annuities. "People should be aware that in falling markets an annuity can help protect retirees from portfolio losses. It can guarantee a form of income. I am not encouraging you to buy an annuity but it is an avenue you can consider," he said.

The other big risk is valuations, that is, the old chestnut of buying at the top of the market. In fact, Galloway said this is the biggest risk facing both retirees and investors. "When thinking about investing there are times to be aggressive, but importantly, there are times to be patient when valuations are higher," he said.