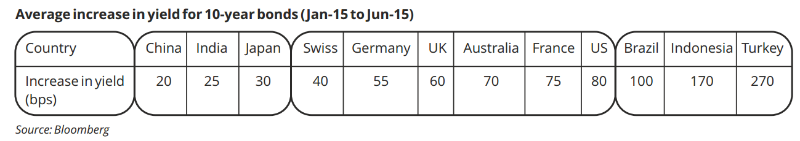

The uncertainty on the Federal Reserve rates lift-off, rising crude prices early this year, deteriorating Greece position and active (asynchronous) global central banks' policies led to huge volatility in global bond markets and resulted in the "global deflation trade" going wrong. End result was sharp spike in bond yields across markets.

The Indian debt market has also been impacted by this global volatility though the impact has not been as severe.

(See table below: Average increase in yield for 10-year bonds).

The is partly owing to the improvement of domestic economic factors and partial credit goes to the Reserve Bank of India, or RBI, for placing curbs on foreign institutional investment in the Indian debt market.

The Indian debt market has seen the influence of limited fresh buying more than from global bond rout. Foreign banks have been largely sellers since February 2015 and this was further accentuated by selling from Foreign Institutional Investors, or FIIs, in addition to exhaustion in limits with a very low probability of an increase. The low deposit growth has sapped liquidity wherein participation from public sector banks has whittled down in the fiscal while mutual funds have been consistent sellers.

One interesting observation over the last year has been the decoupling of policy and market rates. The answer lies in deposit growth slack.

Contrary to market perception, I believe that rates are less driven by RBI action today than in the past. How else do we explain the decoupling of rates seen in the recent past when yields spiked despite RBI cutting rates twice?

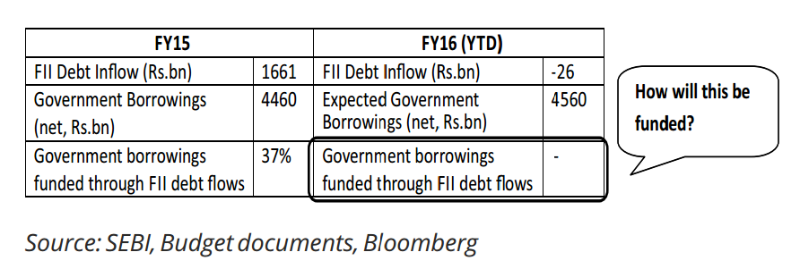

The bond rally seen last year was driven by FII buying and bank deposit growth, an important driver of liquidity. This year, we have seen a weakness in fund flows and deposit growth slack while government borrowing remains high. So where do you get liquidity from? The other options are deep cuts or monetization and the RBI, unfortunately, doesn't have either of these luxuries with one eye on inflation.

I believe that the 10-year bond is a great asset but the rally will come when deposit growth rates climb back to 12-14% levels.

Households have invested in physical assets in the past to retain the value of currency and this is expected to reverse with the strict curbs on black money funded transactions. My advice is to stay put and buy on dips for a medium to long term investment horizon.

The government's borrowing plan has not changed. In the absence of capital inflows and deposit growth, how will this be funded?

You can see the answer below.