An investor’s world is often influenced by sentiment and an information overload, leading to performance-chasing behaviour.

While evaluating past performance can throw a lot of insight into the character of a fund, it is not the sole parameter to assess a fund from a forward looking perspective.

Investors switch between funds in search of superior returns, only to find that they’ve lost the additional returns that they could have gained from simply staying ‘invested’.

It’s important to remember that returns that look attractive in the short term often go through a mean reversion over the long term. As Paul Samuelson said: “Investing should be more like watching paint dry or grass grow. If you want excitement, take $800 and go to Las Vegas.”

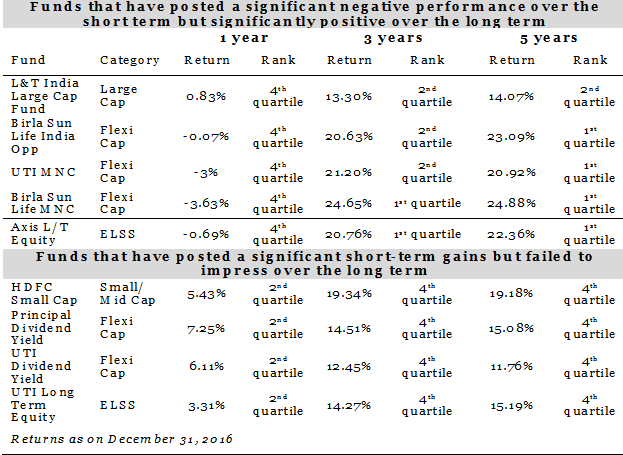

The data (see table) is proof fact that returns are an ever-changing number and not the best indicator of how the fund will perform going forward. Investors wanting to maximize their wealth often invest in ‘chart toppers’ only to realize that they’ve missed the rally and bought/sold at the wrong time.

We strongly believe in looking at past performance as one of the factors in evaluating a fund, but it’s even more crucial to look at the underlying reasons that lead to the returns - positive or negative. We are wary of funds where all the performance stems from a single sector bet or a small set of stocks.

A fund that adheres to its mandate, internal construct and processes tends to perform with a greater consistency. However, most funds reflect the fund manager’s individual style of investing and his/her conviction levels across sectors and stocks. The discipline with which the investment strategy is followed and the manager’s individual style also leads to an outcome in the form of the fund’s returns.

Performance, therefore, is the outcome of multiple factors that tie in together and is in no way a means to an end. These factors make it important to choose a fund based on its fundamentals rather than its past performance.

Past performance does give an ‘insight’ into how the fund delivered during down markets and how it tends to hold up across different market cycles. It also gives us a fair idea of the fund’s potential to consistently outperform during a positive market cycle. Put succinctly, past performance helps set a broad level of expectation and helps evaluate the ‘gap’ between expected and actual returns that the fund delivered across market cycles both on an absolute as well as relative basis.

Let’s look at how to evaluate a fund’s performance when looking at the returns.

Risk

The risk-adjusted returns give a fair idea of the returns that an investment will provide, given the underlying levels of risk associated with it. Most investors use Standard Deviation in this regard. However, it assumes a normal or a lognormal distribution of a fund’s excess returns over the risk-free rate.

The Morningstar Risk Adjusted Returns (MRAR) gives more weight to the downside variation when calculating the Morningstar Risk-Adjusted Return and does not make any assumptions about the distribution of excess returns. This is keeping in line with the assumption that investors are generally risk-averse and dislike downside variation. They are therefore willing to part with a small portion of an investment's expected return in exchange for greater certainty.

Returns

Cumulative numbers aggregate returns for a specific time period (e.g. 3 years, 5 years) and can give investors an idea of the cumulative gain or loss on their investment over that time frame. It is important to remember that a couple of years of significant underperformance can skew cumulative returns, thus dragging it down significantly and vice versa.

Yearly returns break down a fund’s returns over shorter time periods and helps evaluate where it went wrong. An excessively volatile short-term return could impact long-term performance and it’s important to understand the qualitative reasons behind this volatility. For example, HDFC Top 200 outperformed significantly during 2 out of 3 years, which pushed the 3-year cumulative return of the fund upwards. However, the fund underperformed significantly in 2015 due to the manager’s exposure to public sector banks. While the impact of the underperformance in 2015 was cushioned by the significant outperformance in 2014 and 2016, the positive cumulative return on the fund did not bring out this difference.

Predictability

A consistent performer is better than a fund that has performed in spurts. It is also vital to account for how well the fund has performed in down markets.

Past performance can be used as a starting point to understand what went wrong with a fund, and the probability that it will be different this time (without being overconfident that it will be different!). Evaluating past performance also gives investors the opportunity to evaluate how the fund manager course corrected his portfolio in case of an underperformance. Some pertinent questions to look into include factors like how often a manager’s portfolio is churned with a view to generate additional returns, how detailed the fundamental stock based research is and if the manager looks at investing as ‘owning’ a part of the company rather than simply trading in a ‘stock’.

While using a momentum based strategy could tend to generate high returns during market cycles that favour the strategy, it could also entail a higher risk factor that is punctuated by periods of strong reversal. The returns generated by such strategies are often skewed and looking at the return cycle as a stand-alone could spell trouble. It’s important to understand the investment strategy, look at the market cycles during which the strategy will typically outperform/underperform and base your investment decision based on facts rather than historical data alone.

Funds mentioned in this post do not construe a buy or sell recommendation. All data is sourced from Morningstar Direct.

This post initially appeared in the India Markets Observer 2017 where you can read the perspectives and views of other experts too. It is available to all for FREE. All you need is a minute to register.

Download your copy Now!