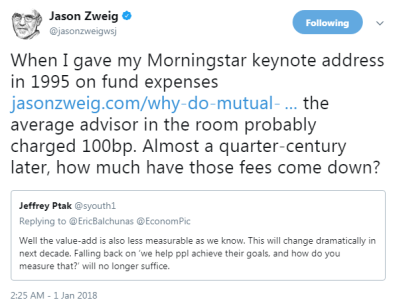

At the Morningstar Mutual Funds Conference in Chicago on June 1, 1995, Jason Zweig delivered the keynote address titled Why do mutual funds cost so much? At that time, he was the senior editor of Forbes.

While you can read the entire transcript here, below are specific extracts pertaining to fund fees.

Industry‑wide, mutual fund expenses are running at just under $30 billion a year. That’s $80 million a day, folks. If expenses are just one‑third too high‑‑and trust me, they are‑‑the fund industry is overcharging the public by $27 million a day. Management fees alone are running at $14 billion a year. 12b‑1 fees chew up another $6 billion.

Am I being too hard on the fund companies? Doesn’t it cost money to hire hordes of Harvard MBAs, to put Bloomberg terminals on every desk, to answer all those phones? Of course it does. But I urge you, before you buy a fund, to see if the parent company of the fund’s adviser is publicly traded. What you’ll see will astound you.

At the low end, Pimco Advisers earned an 11% net profit margin in 1994. Eaton Vance earned 14% net. T. Rowe Price Associates earned 16% net; Alliance Capital Management, 22%; John Nuveen, 26%; Franklin Resources, 30%. The median net margin on Forbes’ annual list of the 500 U.S. companies with the biggest profits was 8% for 1994. Think about it: Fund managers are making up to four times as much money as the most profitable companies in the rest of the American economy.

Just where do you think that money comes from? It comes out of your clients’ pockets.

In 1956, when Forbes published our first annual mutual funds survey, the average expense ratio on stock funds was 80 basis points. Today, by our count, it’s 120. That’s a 50% increase in less than 40 years. (And I’ve excluded 12b‑1s to make the calculation comparable.)

Even fund companies that treat their investors well don’t go all the way. Look at Fidelity, which has generally done an outstanding job of reducing expenses as its funds have blossomed. Last year alone, Fidelity reduced management fees on dozens of its funds. The expense ratio at Fidelity Growth & Income, with $11.2 billion in assets, is 82 basis points. And at Fidelity Puritan, with $13.5 billion in assets, it’s 79 basis points. So why at Magellan, with $44 billion in assets, is it 99 basis points?

As you can see, at a certain point the economies of scale just stop. Even the most conscientious fund companies appear to believe that, so long as performance is outstanding, no one really expects them to keep cutting expenses indefinitely.

In the long run it’s only by cutting their fees that fund companies can assure steady unit sales growth. Ultimately, what’s good for their customers is good for them too.

In the short run, they don’t like my message one bit.

In a Twitter interaction with Morningstar’s Jeffrey Ptak yesterday, he referred to it.

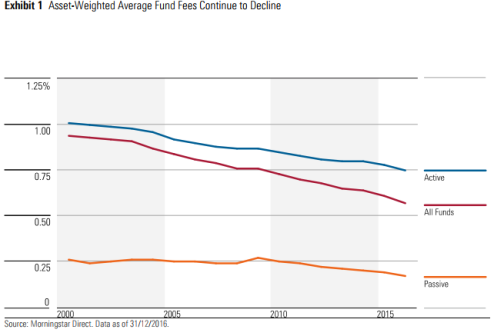

The 2016 U.S. fund fee study and 2015 fund fee study revealed that investors are paying lesser for fund management.

Market rallies cause the total assets under management of the fund industry to grow tremendously and that in turn triggers breakpoints in mutual fund management fees. Having said that, a contributing factor to the decline in average mutual fund fees paid by investors stems from their migration to lower-costs funds.

The asset-weighted expense ratio across all funds has been:

- 0.57% in 2016

- 0.61% in 2015

- 0.64% in 2014

- 0.65% in 2013