Deepak Shenoy, the CEO of Capitalmind, a SEBI registered portfolio manager, shares his perspective when stocks are on sale.

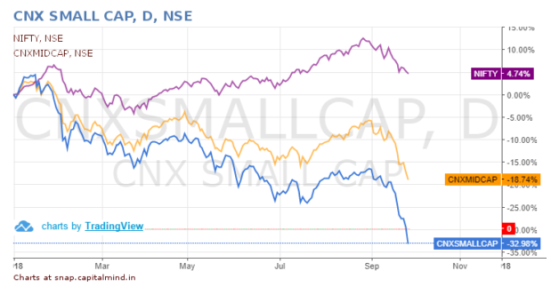

Markets have fallen. But you won’t know it looking at the Nifty.

Mid caps have fallen over 18% this year and small caps are down nearly by a third! Even the Nifty Next 50 is down 15%.

For small caps, this is a fall to levels last seen end 2016, post demonetization.

Since the Global Financial Crisis of 2008, we’ve had a few tumbles –2011, 2013, early 2016, late 2016 (due to demonetization) and the current correction. We’ve mapped out the drawdowns on the index level in each such case.

As you can see, this is roughly about the same time and intensity as the corrections in the past. Before 2007, the mid-cap index (which is currently down about 23% from the peak) took slightly larger tumbles – between 22% and 38%. There, we may still have a little more to go, looking at the past.

The Nifty is about 8% below it’s all time high. But out of the 50 constituent stocks, 35 are down over 10% from their highs in 2018, and of these are down over 25% – with Yes Bank leading the way at 53% drawdowns.

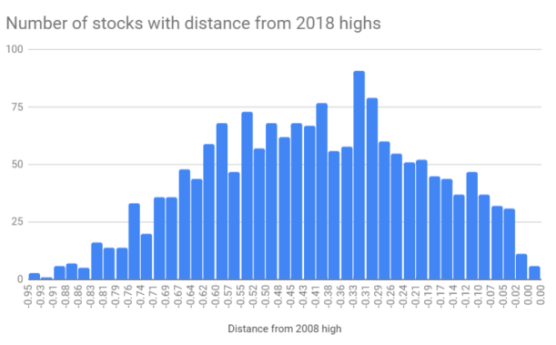

From the universe of 1,700 stocks that we have prices for, around 1,000 have fallen more than 35% from their peaks this year. In fact there are only 126 stocks where we’ve seen a less than 10% fall from the highs.

Valuations wise, things have improved.

The Nifty P/E still shows 26 or so, but we recalculated this using “consolidated” numbers, and found that the P/E is only 22.

This is still high, and in general, smaller cap indexes are at even higher P/Es, but some stocks now trade at sub-10 P/Es and grow at over 20% – and they’ve fallen 40% to 50% in the last few months. Their valuation, relative to their own growth, has moved, perhaps, from “Fair/Expensive” to “Maybe They’re Shutting Everything Down”.

In the last quarter we started to see a small recovery in earnings. If – and this is a big if – the banking sector madness is done, we should start seeing recovery in PSU bank earnings by the December quarter and they have indeed been responsible for bringing down aggregate earnings in general. A good portion of our larger stocks is exporters. They’ll do well too with a weaker rupee.

The economy itself is doing well.

Discretionary spends seem to continue as usual, and while there are some setbacks due to floods, we believe the rebuilding of the flood areas will result in an even higher interest. We hear news that petrol prices will cause inflation or hit auto sales – till now, this does not seem to have happened.

Interest rates have been high on the back of fear that global rates are rising. But we must note that Indian inflation is benign, even as the dollar has crept up to 72. Inflation could rise of course, what with India being a importing country overall, but the problem with the dollar isn’t the fact that we are net importers – we have always been that – but the fact that we aren’t getting as much in terms of inflow as we used to. Most of those inflows are equity inflows (FDI or FPI) and in effect, with lower inflation, the way to help our currency might actually be to reduce rates, not increase them.

(Countries hike rates thinking that foreigners will jump in at the prospect of getting higher returns. In reality, this is valid only where countries allow easy access to their debt markets and where currencies are easily convertible. India is neither. So foreigners can’t even jump in and buy debt like crazy – they only hold 77% of their limits in corporate and government debt, and just a little bit more and they’ll hit the limit. So no point raising debt rates to attract foreign money, really)

Debt rates have been high due to liquidity pressures as well. This has now eased up substantially, and debt markets are alive and kicking.

The Il&FS default had created an issue where people started to get scared to give money to financial companies, but even that will be sorted out soon as they transition their fund raising measures to longer term products. At yields of 10%+, some of the corporate bonds in the market are at juicy levels.

It seems like this: There’s fear and panic in the stock markets. There’s some uneasiness in debt markets. The rest of the picture doesn’t look horrible just yet. And stock valuations are far better than earlier.

Fear of default

Fear is what makes people sell in panic.

But that is also a great time to buy. Yes, DHFL has fallen 70% or so. But along with it, a bunch of reasonably strong financial companies have cracked too. Bajaj Finance might still be expensive, but it’s 30% less less expensive than it used to be. HDFC Bank is cheaper, as is HDFC, and a bunch of others. Additionally, their bonds have also become cheap (and therefore at a higher yield) because of this fear.

Take technology. Admittedly some of them have run away this year, but the sector has typically no debt and a low P/E ratio. Other than TCS, most of the large IT firms are trading at P/Es of less than 20, and in many cases, less than 15. There’s likely to be a big bump in earnings this quarter onwards, due to the dollar depreciation and the major economic boom in the U.S. Panic makes people sell everything, so they’ll also sell the no-debt names.

And in pockets, people that sell in panic – due to either fear or margin calls – sell at any cost. Means you can buy if the price is totally out of whack.

It will probably take up to 6 months for the madness to resolve. It could happen tomorrow, of course. But it could easily go on till the general elections.

The Distress-Sale Purchase

You could buy stocks or bonds when they’re trading a distress prices. But do remember that distress can easily turn into more distress. There will be unknown unknowns. You can’t predict what you don’t know or can’t imagine.

If you buy so selectively that you have got to be 100% right in order to make a good return, then you have to be super sure of the companies you buy. That’s difficult in a crisis, because there is too much fear, rumour and panic.

You don’t have to win every battle. You just need to win enough so that your losers don’t hurt you. Also, exiting a bad stock isn’t the worst thing in the world.

There’s more than enough in terms of blood on the streets. On average, most of these stocks won’t recover. Perhaps 2/3rd of them won’t. But that still leaves you with enough room to buy – and at valuations you would have loved earlier. If nothing has changed, and you spread your investments over the next few months, and the market looks so bad that it’s definitely going to get worse because everyone says so, the time may have come.

For all the bearish commentary we’ve done in years, this is one of those times that looks like the market might be ignoring some really green shoots on the ground.

The above version is edited from the original which appeared on Capitalmind.in.