Financial advisers have come a long way from the era of selling assured return products to transitioning into fee-only financial planners. Amid fast-paced regulatory reforms, changing investor expectations, emergence of complex products, disruptive technologies and shrinking margins, the wealth management space continues to evolve.

Entry Loads

In 2009, the clampdown on entry loads was a significant move. Despite doomsday predictions, the wealth management space continued to evolve and thrive.

As demand and awareness of mutual funds increased, the distribution force expanded. Robo advisers and payment apps made an entry. Professionals from private banks/wealth management firms/AMCs, and stock brokers ventured into fund advisory. The total number of ARNs (Individual, Senior Citizen, New Cadre and Corporate) has gone up by 17% from 82,881 (December 2016) to 97,184 (December 2018).

Though the active distribution force is estimated to be around 40,000 (taking into account sub-brokers of national distributors), the space is expanding. During the same period, employees engaged in advising mutual funds holding with corporates and IFAs holding EUINs increased from 90,229 to 1.03 lakh.

Shrinking Margins

The year 2018 was full of surprises from a regulatory point of view. The reduction in expense charged in lieu of exit load by 15bps, transition to a full-trail model, ban of upfront commissions, and extension of extra incentive of 30bps to beyond 30 cities has translated into reduced earnings for distributors. The all-trail is not a new model and many distributors who have achieved a certain size have already transitioned to this regime.

Those who just started their practice will find the going tough as the sudden change from upfront to trail will impact their cash flows. Industry watchers are of the view that the removal of upfront commission coupled with the reduction in trail due to TER rationalization will create roadblocks for attracting new distributors in the industry, thereby slowing down the growth momentum. Even larger distribution outfits could go slow in adding feet-on-street distributors in the absence of any upfront incentive.

While the changes could have a short-term impact, financial advisers will continue to play an important role in a market like India where the penetration of financial products is abysmal. Financial advisers should anticipate change and adapt their business models keeping with evolving trends. They would do well to increase volume, diversify product offerings and adopt technology to reduce costs to build strong practices. Those wanting to enter mutual fund distribution should treat it just like any other business which requires capital and time to break even.

Growth in Number of Top Distributors

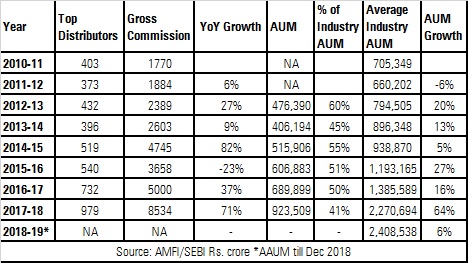

From FY10-11, SEBI mandated fund companies to disclose the gross commissions paid to select mutual fund distributors on their websites.

These distributors should satisfy one or more of the following conditions with respect to non-institutional (retail and HNIs) investors:

- Multiple point of presence (More than 20 locations)

- AUM raised over Rs 100 crore across industry in the non-institutional category but including HNIs

- Commission received of over Rs 1 crore per annum across industry

- Commission received of over Rs 50 lakh from a single fund house

From the below table, we see that 403 distributors qualified for these criteria in FY2010-11. They collectively earned Rs 1,770 in gross commissions (net earnings of these distributors are less since they incur expenses on running their businesses). With the growth in industry assets, particularly equity assets, distributors earnings also went up. There were 979 top distributors during FY17-18, collectively managing Rs 9.23 lakh crore assets under advisory, earning gross commissions of Rs 8,534 crore. Also, distributors qualifying in this top league went up from 403 in FY2010-11 to 979 in FY2017-18. Distributors earn higher commissions on equity funds as compared to debt funds. The equity (pure equity + ELSS) assets grew at a CAGR of 18% from Rs 1.95 lakh crore to Rs 7.49 lakh crore during the same period.

Source: AMFI, SEBI. Figures in Rs/crore. AAUM till Dec 2018

Enter the RIA

In a bid to segregate advice and distribution, SEBI introduced the concept of Registered Investment Advisers (RIAs) in 2013. The growth of RIAs has been slow, just 1,097 RIAs registered with SEBI. Now robo-advisory firms, wealth outfits and family offices are taking up RIA licenses.

Market participants attribute challenges in collecting fees from investors, onerous compliance, high costs and regulatory uncertainty as the primary causes for muted acceptance of this model. That said, the trend of charging an advisory fee has already started. Not all investors are averse to paying for advice if they see value in it. This is evident by a small group of RIAs who are now actively migrating client assets from regular to direct plans. Of Rs 5,268 crore gross direct sales in equity funds (including ELSS, balanced, ETF, arbitrage and index funds) as on December 2018, Rs 681 crore (13%) was contributed by RIAs, according to a report by CAMS. Of this amount that came through RIAs, lumpsum sales were Rs 568 crore and the remaining assets came through SIPs. This data represents only CAMS-serviced mutual funds, which is 67% of industry data.

Mumbai-based adviser Melvin Joseph has been one of the earliest adopters of the RIA model. He shifted all his clients to direct plans and has around 400 paying him an annual fee. According to him: “If you are investing Rs 10,000 per month in a regular plan which gives a return of 12% p.a., the accumulation will be around Rs 1 crore in 20 years. If you invest in the same fund under the direct plan, you will get around Rs 1.15 crore. You gain Rs 15 lakhs on a monthly investment of 10,000. My fees for the next 20 years will be 1.58 lakhs, which is just 10% of the above gain. See the gain when investing in the range of Rs 50,000 – 80,000 per month”.

Kavitha Menon took the plunge as a fee-based advisor when the RIA regulations were not in existence. According to her, “The RIA field is not a place to make quick big bucks. It’s a profession that takes years to build. I think RIAs will be regarded with the same respect and trust that one regards other professionals like doctors and lawyers. Likewise, RIAs will also command bargaining power and will be able to charge fees as per their expertise and experience.”

In a consultation paper released in January 2018, SEBI proposed that individuals registering as RIAs shall not provide any distribution services in financial products, either directly or through any of their immediate relatives. Similarly, it was proposed that individuals providing distribution services shall not provide advice for investing in financial products either directly or through their immediate relatives. The same rule was proposed for Banks, NBFCs, Body Corporates, LLPs and firms. These entities willing to get registered as investment advisers shall not provide any distribution services in financial products, either directly or through their holding company or associate company or subsidiary company. The regulator proposed that existing distributors and RIAs could opt for either of one.

While this is to eliminate conflict of interest, players cite the difficulty in migrating to a completely fee-only model in a developing market like India where penetration of financial products is abysmal and the unwillingness

of clients to pay for advice. A huge section of RIAs continue to operate distribution outfits through subsidiaries as commissions provide a recurring source of revenue. Due to the complexity of the issue, there has been no update from SEBI on this concept paper yet.

The financial advisory profession is still in its infancy in India with nomenclatures like adviser, distributor, agent and financial adviser used interchangeably. Investors are unable to distinguish the specific role of each participant. At this juncture, it is understood that the advisory model will find acceptance as markets mature. To promote a fee-paying culture, the regulator, asset managers and AMFI should sensitize investors on the value offered by RIAs. Given the developing nature of India’s capital markets and lower penetration of financial products, it is prudent to allow both advisory as well as distribution models to co-exist. We believe RIAs should only be allowed to provide execution services in direct plans.

Global Advisory Reforms

Post the global financial crisis in 2008, regulators across the globe began to tighten regulations to curb conflict-free advice, establish fiduciary obligation for intermediaries and increase transparency through higher disclosures.

Globally, regulatory reforms are revolving around three areas:

1) Focus on improving professional education skills of advisers

2) Move towards fee-only advisory

3) Holding advisers to fiduciary standards.

Australia

The Australia Treasury implemented Future of Financial Advice (FOFA) reforms from July 1, 2013. The objectives were to improve the trust and confidence of Australian retail investors in the financial services sector and ensure the availability, accessibility and affordability of high-quality financial advice. The new rules required advisers to act in the best interest of clients, as fiduciaries and have improved the quality of advice in Australia.

- The use of contests to motivate sales of funds and to compensate advisers (either monetarily or through awards) for selling particular funds was outlawed under FOFA.

- Advice fees could only be charged to customers who had chosen to "opt-in" to the charge from 2013.

- Except insurance products, commissions are banned on new investments and superannuation products from July 2013. However, financial products bought before that date can still pay ongoing commissions to the adviser. The commissions will continue to be deducted from investments until investors leave that product or end their relationship with that adviser.

United Kingdom

All financial advisers in UK are regulated by the Financial Conduct Authority (FCA). The U.K has implemented the Retail Distribution Review (RDR) to improve the investor experience in three areas:

- Improve the clarity with which firms describe their services to consumers.

- Address the potential for adviser remuneration to distort consumer outcomes.

- Increase the professional standards of advisers.

The rules associated with RDR are explicitly designed to eliminate any linkage between fund selection by advisers and the payment of commissions by fund houses. As on January 1, 2013, advisers, unless they elect only to offer "basic advice," are banned from receiving commission payments from fund houses. Independent advisers may not elect this option, which is only available to "restricted" advisers. Restricted advisers can only recommend certain types of investment products or products from a limited number of providers. Restricted advisers might either be restricted in the type of products they offer, or the number of providers they choose from. Those who provide "basic advice" can be compensated via commission, fee, or other benefit but must clearly disclose these arrangements to the client prior to providing services. The practice of using sales contests to motivate general sales of funds is prohibited.

IFAs are those who offer a broad range of retail investment products and give consumers unbiased and unrestricted advice based on a comprehensive and fair analysis of the market. The main effects are that funds now offer a class free of all commissions and that most investors are expected to pay advisers directly for their services. In addition to ensuring that investor outcomes are not skewed by incentives provided by funds, the proposals have increased transparency in fees such that investors are more aware of what they pay for investment advice versus fund management.

Under the rules generated by the RDR, most new investments will flow into classes that are free of sales charges and ongoing trail commissions. The implementation of the RDR has resulted in the mass creation of share classes that investors are able to purchase without paying a load or retrocessions, as advice is now largely required to be paid for directly by fund investors to their advisers. Thus, the percentage of share classes that report charging a front load is expected to decrease in the future.

Since January 2013, advisers who deal with investments; pensions (including pension transfers); retirement income products and general financial planning must carry higher levels of qualifications. Since 2013 advisers cannot be paid a commission if they give you advice about: a) Pensions, b) Investments, or c) Retirement income products such as annuities.

However, advisers offering products like mortgages, equity release, general insurance (like travel or home insurance) or protection insurance, such as term life insurance, advisers can still be paid commission.

United States

Under the Investment Advisers Act of 1940, RIA firms have a fiduciary duty to all their investment clients, which means they have a legal responsibility for managing someone else's money.

The Department of Labor (DOL) Rule, which required all financial advisers to act in their clients' best interests regarding retirement accounts was vacated by the U.S Fifth Circuit Court of Appeals. Critics of DOL Rule claimed that it would be costly for the industry to implement these rules.

Further, critics observed that the rules could introduce liability that would make it costly for small retirement savers to access financial advice.

In April 2018, the SEC which regulates the fund industry, has proposed its own rules called ‘Regulation Best Interest’ that would raise standards of conduct for broker-dealers. Currently, broker-dealers are held to suitability standard. The proposed regulations require broker-dealers to act in the best interest of retail investors while recommending products, without placing the financial or other interest of the broker-dealer. Effectively, SEC has proposed to bring broker-dealers under fiduciary standard.

While advisers get commissions (upfront and trailing) for selling products in U.S this is a small share of assets. The U.S market is predominantly unbundled. In particular, flows into mutual funds paying unusually high excess loads declined after the DOL proposed its Fiduciary Rule in 2015, and this shift was statistically significant.

Morningstar’s econometric analysis reveals that harms from a key financial conflict of interest — load-sharing between mutual funds and intermediaries—appear to have declined since 2010. This benefit for investors could be due to regulatory pressure, pre-existing trends away from load-sharing, or a mix of the two.

This reduction in the distortionary effect of conflicted payments suggests that firms put in place effective policies and procedures to mitigate conflicts of interest in response to the DOL rule and, further, that the SEC’s proposal could maintain this important momentum.

Conclusion

The advisory landscape across the world has a few common threads – increased disclosures, upgradation of education and skills for advisers, clampdown on conflicted advice and move to a fiduciary standard. These changes are aimed at increasing investor protection and restoring trust in financial markets. All stakeholders need to embrace the changes in the spirit of law.

You can access more such insights in the India Markets Observer 2019. All you have to do is register and gain free access to the entire online publication.