Large cap fund managers are finding the going tough. Over a ten-year period as of July 1, 2022, only 26% of funds have beaten the S&P BSE 100 Total Return Index. The average alpha in comparison to the benchmark of these funds over this period is 1.15%.

While Large Cap funds are struggling, in comparison, a larger proportion of funds from Mid and Small Cap Funds have been able to outperform the benchmark over the last ten years.

10-year rolling outperformance

Large Cap

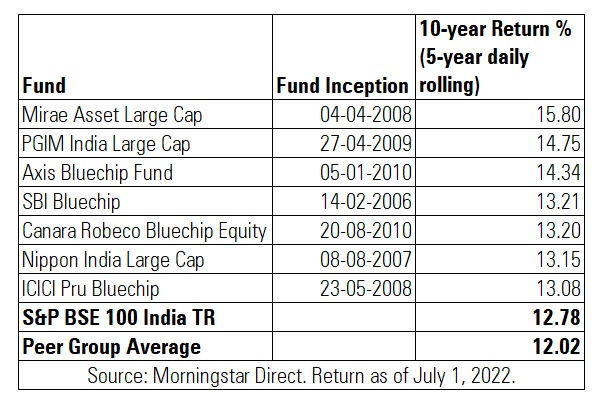

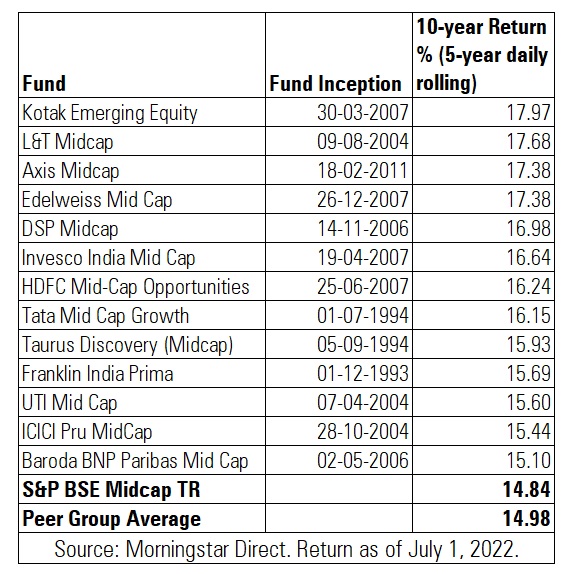

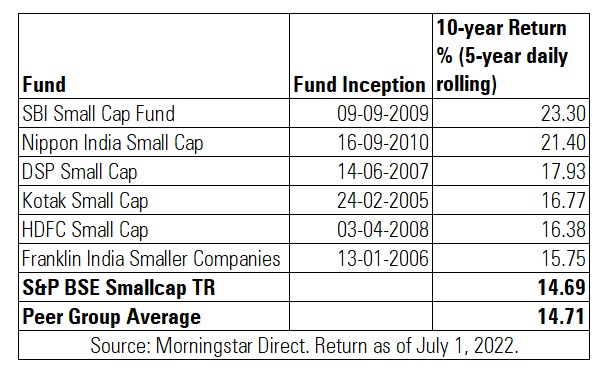

We looked at the 5-year daily rolling return data for ten years (July 2, 2012 – July 1, 2022) across three categories - Large, Mid and Small.

Of 27 funds that have completed ten years in the Large Cap category, only seven have outperformed over a ten-year period. The S&P BSE 100 India TRI delivered 12.78% during the same period while the average peer group return of Large Cap Funds stood at 12.02%.

Mirae Asset Large Cap Fund has been the top performer over a ten-year period. The fund generated 15.80% CAGR over this period, beating its peers and benchmark.

Mid Cap

Mid Cap funds fared better as compared to Large Caps. Of 18 funds that have completed ten years as of July 1, 2022, 72% or 13 funds have outperformed the S&P BSE Mid Cap TRI. Kotak Emerging Equity has been the top performer in this category, beating the index and peer group. The fund delivered 17.97% CAGR versus 14.84% by the index and 14.98% by the peer group average.

The average alpha in comparison to the benchmark of these 13 funds over this period is 1.64%.

Small Cap

Of 11 funds that have completed ten years as of July 1, 2022, 55% or 6 funds have beaten the S&P BSE Small Cap TRI. SBI Small Cap Fund has been the top performer. It delivered 23.30% CAGR over a ten-year period while the BSE Small Cap delivered 14.69%.

The average outperformance of these six funds over the index over this ten-year period is 3.90%. SBI Small Cap and Nippon India Small Cap have been able to outperform S&P BSE Small Cap TRI by a wide margin of 8.62% and 6.71%, respectively.

Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Adviser India, notes that the level of alpha has been shrinking and the number of funds that beat their benchmarks has also been falling.

“Investors need to be very selective in choosing their fund managers. If they can’t do so themselves, they should take an advisor’s help. Whatever style the fund manager follows, the investor must not deviate from it. Use the style box to judge consistency. All fund management styles will underperform during certain periods. Investors should stay invested during such periods as hopping from one fund to another would hurt portfolio return.”

ALSO READ:

How to build a diversified mutual fund portfolio