We recently assigned a Silver rating to the Kotak Standard Multicap fund despite its large fund size. The fund’s asset allocation, its investments in highly liquid companies and an experienced manager at the helm lead to this rating.

The Standard Multicap fund was previously categorized as a large cap fund and typically holds exposures of around 20% in mid cap stocks. The large cap exposure on this fund is higher as compared to the average for the multi cap category of around 66%. While fund manager Harsha Upadhyaya has been buying into mid-cap stocks on this fund whenever opportunities become available, he will continue to run the fund with a large cap bias. In our opinion, large cap stocks tend to remain more liquid as compared to their small and mid-cap counterparts. This is especially relevant now, considering that SEBI has a clear definition for large-cap stocks.

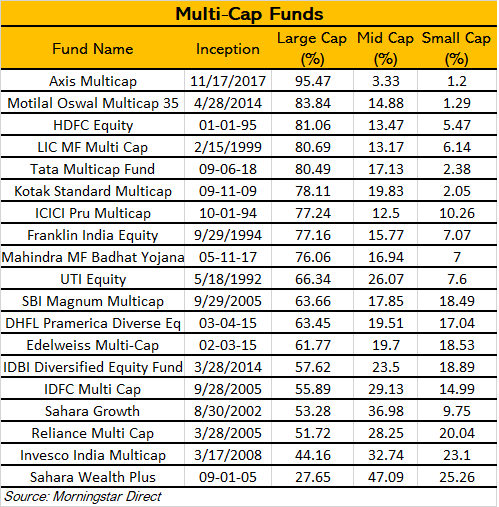

It is important to make note that the multi-cap category consists of quite a few funds that have never (and in all probability will not in the future) go below 75-80% allocation towards large caps. On the other hand, it also includes funds that have a 50% allocation towards large caps and the rest in Mid and small caps. As a result, it becomes important to use some discretion while comparing funds within this category.

The table below outlines the market cap breakdowns of the funds in the multi cap category as of June 2019. (We’ve only included 10 funds with the maximum exposure to large cap stocks and the 10 with the least exposure to this segment).

A few other factors to consider here are that the manager will only invest in Mid-Caps that meet his quality and growth criterion. The mandate of this fund focuses on large cap stocks and the manger has remained true to this since the time that he has been at the helm. Owing to this, we think that he will continue to remain selective about the mid and small cap stocks that he buys into. Upadhyaya also places a lot of focus on the liquidity of his portfolio reflects this style of investing.

Another point to note here is that, even a 2-3% exposure to a small/mid cap stocks can turn into a sizeable number, given the fund’s size. In line with this thought process, Upadhyaya typically caps exposure to this segment at 2-3%. We think that having this discipline is extremely important for a fund of this size. We draw conviction from the manner in which the fund has been managed so far and expect the process to hold the fund in good stead going forward too.

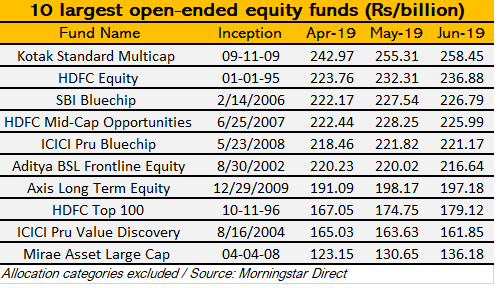

This fund is currently the largest fund across categories but not by a huge margin. The table below lists the out the 10 largest open-ended equity funds (excluding allocation categories) in the Indian market just to give you a perspective.

The Indian markets continue to grow, especially given the economic growth trajectory that it’s witnessing.

Despite the large size we think that the large cap focus helps from a liquidity standpoint. Moreover, the fund size does not seem to be a constraining factor from a capacity point of view. In fact, a lot of funds in the allocation category are much larger in terms of their asset size – The HDFC Balanced Advantage for example, is currently at around Rs 441.68 bn and the SBI Equity Hybrid fund is at around Rs 298.32 Bn.

In conclusion, we think that it’s important to look at the underlying strategy of a large sized fund. Factors to consider include liquidity, market capitalization of underlying stocks and the fund’s mandate to name a few.