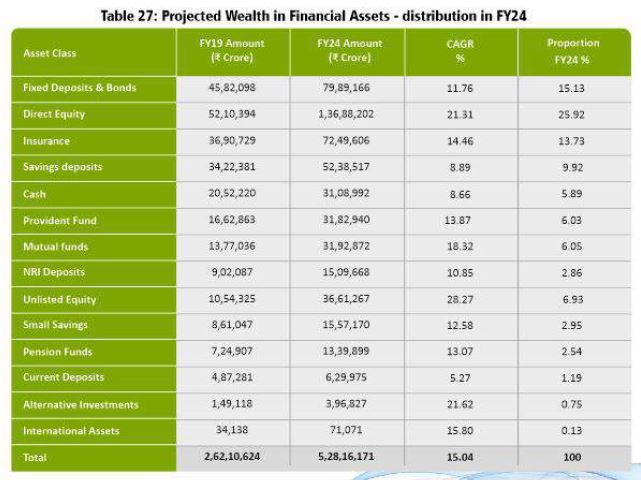

Indian households’ appetite for equities is set to increase manifold in the next five years. According to Karvy Wealth Report 2019, individual wealth in financial assets is projected to more than double to reach Rs 528 trillion in FY 24 from the current Rs 262 trillion. Of this, direct equity will constitute the highest share at 26%.

Currently, individuals hold Rs 52 trillion in direct equity, which is expected to reach Rs 136 trillion in FY24. India has 5,000 listed companies, second only to US, in terms of investment universe, which could provide immense opportunity for investors to participate in the wealth creation story.

After direct equity, fixed deposits and bonds will occupy the second position at 15% share or Rs 79 trillion of the total individual wealth pie (Rs 528 trillion) in FY24. Insurance assets will constitute the third largest slice of the pie at Rs 72.49 trillion.

Currently, individuals hold Rs 13.77 trillion in mutual funds, which is expected to increase at a CAGR of 18% to reach Rs 31.92 crore in FY24. Less than 2% of 1.3 billion Indians currently invest in mutual funds, providing a huge opportunity for advisers.

Financial assets now constitute 61% of total individual wealth in India. By FY24, the report estimates that the share of financial assets in total individual wealth will increase to 66.11% while that of physical assets will be at 33.89%.

Total individual wealth (financial and physical) is expected to increase from the current Rs 430 trillion to 798 trillion in FY24.