The migration of household savings from physical to financial assets bodes well for the financial services sector and mutual funds will be the key beneficiaries of this trend.

However, only a few fund houses with better distribution reach and brand recall are expected to benefit from this shift. A Nirmal Bang report notes that the benefits will accrue to the top five players. This is because despite the industry having 44 players, five largest fund houses account for 58.3% of industry assets. HDFC, ICICI Prudential, SBI, Aditya Birla and Reliance collectively account for 58.3% of total market share.

The concentration is attributed to their brand reputation and distribution strength. The report states that bank/financial conglomerate-promoted asset management companies (AMCs) enjoy an inherent distribution and brand reputation advantage and their AUM market share has grown from 26.6% as of Mar 2007 to 38.7% as of March 2019.

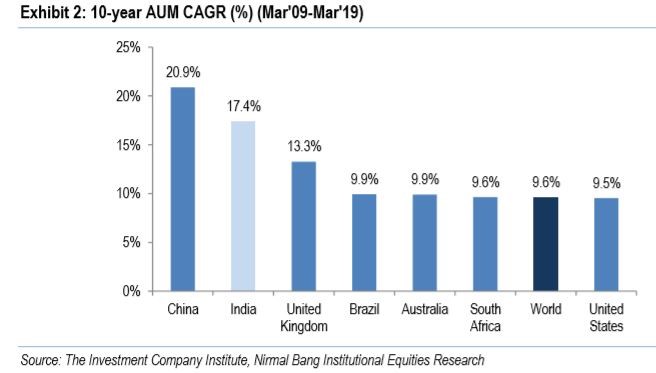

Higher growth as compared to global markets

The Indian asset management industry has grown at a CAGR of 17.4% over the last ten years which is higher than some of the major developed and developing nations, and even higher than global AUM growth of 9.6%.

Next phase of growth

The Indian asset management space is ripe for a rapid growth due to factors like low penetration, increasing financial awareness and the move to financial assets. India has the second highest gross savings rate (30%) after China (46%), yet mutual fund penetration is lower at 11% (world average: 62%).

The next leg of growth for the industry is expected from the smaller cities. AUM to-deposits ratio for B15 cities is 9% compared to 34% for T15 cities. At the total industry level, B30 AUM accounts for 15% of the overall AUM.

SBI MF has the highest market share in B30 cities followed by HDFC MF and ICICI Prudential at 18%, 12.4% and 11% respectively.

Distributors will play a key role for penetration in smaller towns since many first-time investors need handholding and advice.