Timing is the bane of investors everywhere.

We fear buying or selling at the wrong time. Given the volatility in markets, bad timing can cost you dearly.

Those are the words of Russel Kinnel, director of manager research for Morningstar. He wrote about the Mind The Gap 2019 study where we calculate Morningstar Investor Returns to understand how investors actually fared in a fund when you take cash flows into account.

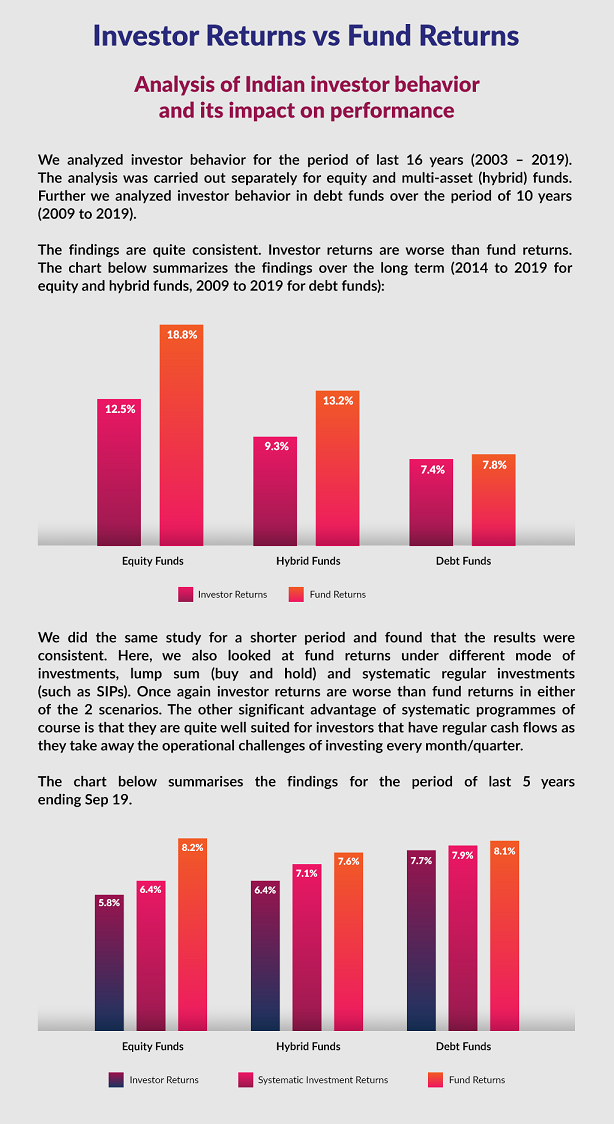

Axis Mutual Fund did a similar study for Indian investors.

As investor returns tend to be lower than fund returns as a result of the frequent churn, they conducted a study to measure the effect of buy-sell decisions on long-term performance.

They looked at performance across different category of funds and concluded that investor flows are not stable but tend to follow market performance. Consequently, their realized returns are much worse than what they would have achieved by using either simple buy-and-hold or systematic investment strategies. This effect is persistent across different time periods and shows that there has been little change in investor behaviour over the last 15 years.

Here's some advice from Russ Kinnel.

To make the most of your mutual funds, you need a good plan and the willingness to stick with it amid all the drama in the markets.

In addition, it helps to know if volatility in individual funds is the sort of thing that will cause you to sell to just stop the pain. If so, seek out less risky funds.

Your plan should include shifts to less-risky assets over time so that you don’t wake up to a bear market and realize you are at 85% equities when you should be at 60% equities.

An automatic investing plan, like an SIP, works well as a saving discipline and as a way to keep emotions out of the process.

A second piece of investor success is knowing your investments. The more you know about your funds, the less likely you are to be disappointed. Remember that no active manager will sail through every storm with flying colors.

Even reviewing calendar-year returns as far back as you can will help you have a tangible idea of the risks. Virtually every index lost more than 30% in 2008 and more than 50% from peak to trough. Those who held their ground were richly rewarded, but it’s not easy to do that.

A good plan and patience will serve you well.