Through a notice dated April 23, 2020, Franklin Templeton Mutual Fund announced its decision to wind up six of its schemes - Franklin India Low Duration Fund, Franklin India Ultra Short Bond Fund, Franklin India Short Term Income Plan, Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund and Franklin India Income Opportunities Fund.

The fund house took this extreme decision in light of the severe market dislocation and illiquidity caused by the COVID-19 pandemic. As per the found house, ‘There has been a dramatic and sustained fall in liquidity in certain segments of the corporate bonds market on account of the Covid-19 crisis and the resultant lock-down of the Indian economy which was necessary to address the same. At the same time, mutual funds, especially in the fixed income segment, are facing continuous and heightened redemptions.’

These funds have been facing significant redemption pressure, which intensified in the months of March and April. The fund house maintains that in this scenario, this is the best possible way to safeguard the interest of exiting investors and is the only viable means to secure an orderly realization of portfolio assets.

Hence from April 24, 2020, the Trustee and the AMC have:

(a) ceased to carry on any business activity in respect of the Schemes;

(b) ceased to create or cancel units in the Schemes;

(c) ceased to issue or redeem units in the Schemes.

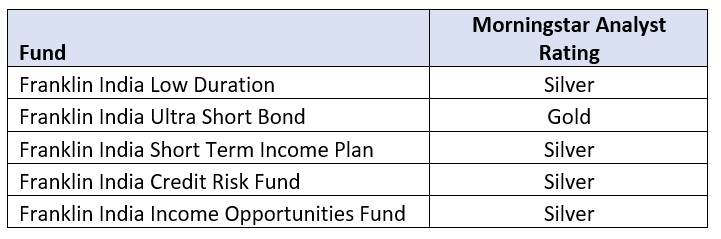

Morningstar’s Take

Out of these six funds, we have historically maintained positive Morningstar Analyst Ratings on five of them given the team’s strength in managing funds in the lower credit space. Franklin India Dynamic Accrual Fund has not been a part of our coverage. Over the years, the fixed income team at Franklin Templeton mutual fund has created a niche for itself in the low credit space and have managed the same with a good degree of success. The team has been through difficult situations in the past and has come out of it with its superior execution capabilities. Franklin Templeton is among the first few AMCs to explore opportunities in the lower credit space in the Indian fixed income markets. They have been investing in that segment for over a decade now and have performed well so far.

The Indian bond markets are fairly illiquid and even more so in the lower credit rating space. To tackle these issues the fund manager had instituted several measures to reduce the liquidity risk – namely laddering of portfolio maturities over time to create frequent liquidity, introduction of steep exit loads, bank borrowing lines and diversified investor base to reduce investor concentration. While these measures were effective in normal market conditions, what we are witnessing now is unprecedented.

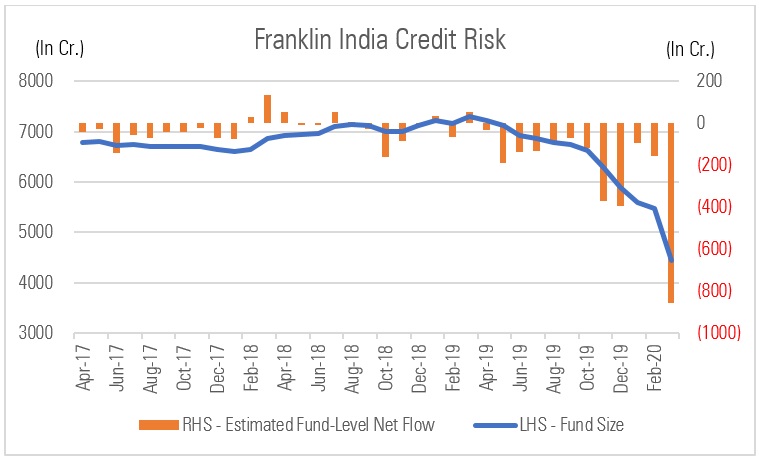

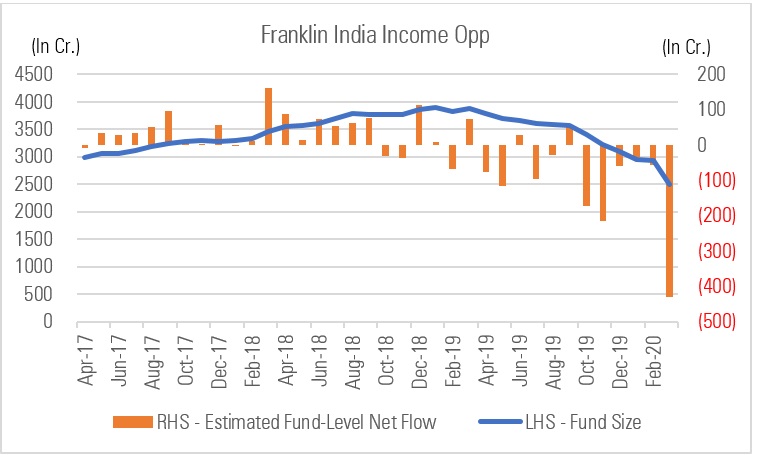

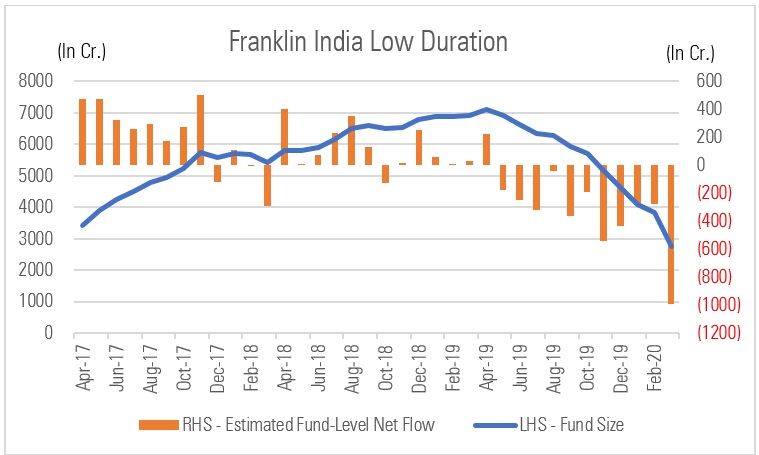

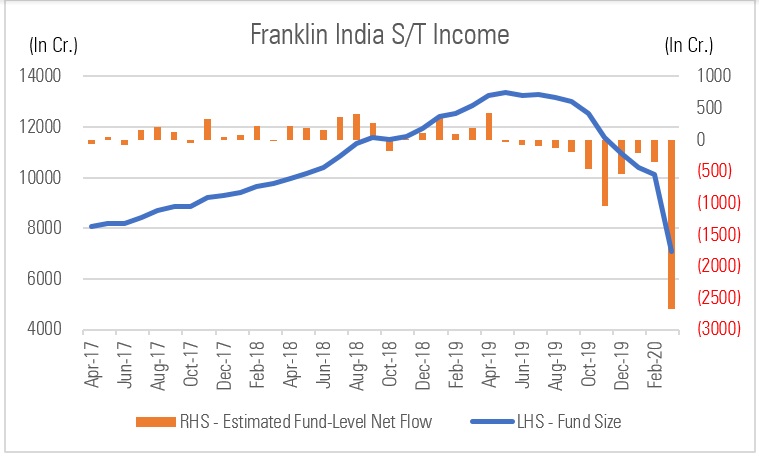

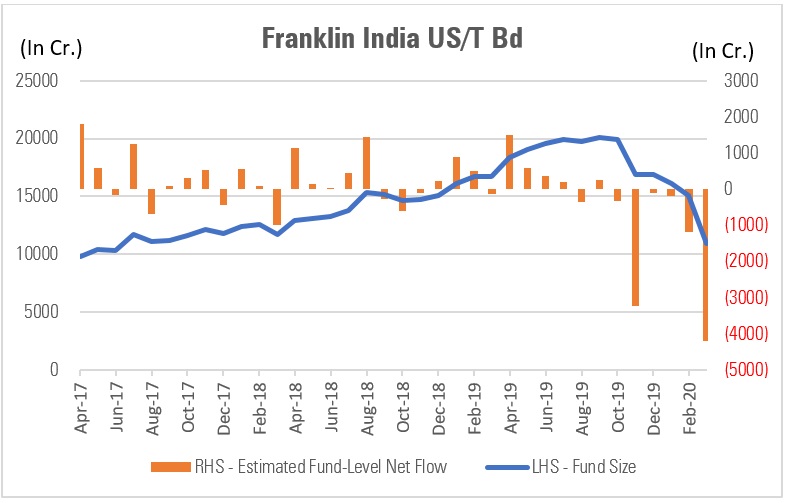

Due to the corona virus pandemic, the country has been under a lockdown with business activity coming to a standstill. Despite measures taken by RBI, the liquidity in the Indian bond markets, especially in the lower credit space, has squeezed substantially. The fund house did take measures to meet redemption pressure by way of getting borrowers to pre-pay debt, selling bonds to banks and using the credit line provided by banks. However, with unprecedented high redemptions from these funds, it came to a situation where these were not viable options anymore. Basically, it reached a stage where the manager started finding it difficult to meet the redemption demand without impacting the returns. For instance, in the month of March alone, cumulatively, these funds witnessed an estimated net outflow of Rs 9,148 crore.

Fund Size and Estimated Net Flows in the Funds

Data Source – Morningstar Direct

These funds were run with a clear focus towards a credit (or accrual) strategy, with significantly higher exposure to AA and A rated instruments than their peers. In such a strategy, the idea is to invest in high yielding bonds and stay invested till they mature. This is an apt approach to be plied in such funds or strategies as the underlying securities tend to be less liquid in nature making it difficult to liquidate them in the interim. It is this nature of these funds that the team has been finding it difficult to meet the redemption pressure in the recent times.

Our conviction in these funds has stemmed from the experience of Santosh Kamath in the lower credit space, capability of the team in managing credit funds, and robust research infrastructure which has enabled them to shortlist investment worthy companies in the lower credit space for over a decade.

Having said that, the last one and a half years have been tough for investments in the lower credit space. Many fund houses have had to face credit related events in the recent past, driven by the negative sentiment in the markets post the IL&FS crises. Franklin Templeton too faced some credit events as some of its holdings fell below the investment grade last year, for which it had to absorb a haircut. These investments were primarily in group companies of Anil Ambani-led Reliance Group (or ADAG) and ESSEL group. More recently, on January 16, 2020, the fund house proactively marked down its investments in Vodafone Idea Limited (VIL) held in its fixed income schemes to zero. Consequently, the fixed income funds, having exposure to these securities, witnessed a sharp fall, which dented their returns. Such instances of downgrade or default tag along with credit strategy. While this could be limited by following research-oriented investment approach, they cannot be eradicated.

The negative sentiment around these episodes, coupled with the pessimism emanating from the Covid-19 pandemic, created a situation where a large number of investors started redeeming from Fixed Income funds, of which Franklin Templeton saw amongst the highest outflows.

However, it is worth noting that what we are witnessing now is an unforeseen scenario, and the decision to wind up the fund has been taken by the fund house due to the extreme liquidity issues/redemption pressure, rather than any credit event necessarily, which, from the current context of the significant redemptions, was a prudent measure to safeguard the value for investors

As for investors, the funds are closed for investments or redemptions. Given the scenario we are in, it would take some time for the fund house to liquidate investments and pass on the proceeds to investors. It would be rather difficult for the fund house to liquidate assets in the current market environment and at such compressed valuations. As per our interaction with the fund house, they will be trying to make the payments in a staggered manner through portfolio maturities, coupon and pre-payments, once the borrowings in the funds have been paid back. Given the laddered maturity approach of the portfolio, there will be repayments happening through the course, rather than bullet repayments. Additionally, they may also explore the possibility of liquidating the securities in the secondary market when the situation in the bond market stabilizes. That said, the process will be a slightly long drawn one.

We understand that in the light of these developments, these funds cannot justify continuation of Morningstar Analyst Ratings. Hence, we are putting the Morningstar Analyst Ratings on the affected funds Under Review/suspended with immediate effect.

Please watch this space for more updates.

Disclaimers:

@2020. All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. This Report is issued by Morningstar Investment Adviser India Private Limited (“Morningstar”), which is registered with SEBI as an investment adviser (Registration number INA000001357), providing investment advice and research, and as a portfolio manager (Registration number INP000006156). Morningstar has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. Morningstar is a wholly owned subsidiary of Morningstar Investment Management LLC. In India, Morningstar has one associate, Morningstar India Private Limited, which provides data related services, financial data analysis and software development. The terms and conditions on which Morningstar offers investment research to clients varies from client to client and are detailed in the respective client agreement. • The information, data, analyses and opinions presented herein are provided solely for informational purposes, and are not warranted to be correct, complete or accurate. • Redistribution is prohibited without prior written permission of Morningstar. • Except as otherwise required by law, Morningstar and its officers, directors, employees and associates shall not be responsible or liable for any trading decisions, damages or other losses resulting from the use of this Report. • The author/creator of this Report (“Manager Research Analyst”) or his/her associates or relatives may have (i) a financial interest, including a long or short position, in the mutual fund schemes that are the subject of the Report (“Subject Mutual Fund Schemes”), or (ii) an actual/beneficial ownership of one per cent or more of the Subject Mutual Fund Schemes, at the end of the month immediately preceding the date of publication of this Report. • The Manager Research Analyst, his/her associates and relatives do not have any other material conflict of interest at the time of publication of this Report. • The Manager Research Analyst has received no compensation or material benefits from the issuer of the Subject Mutual Fund Schemes or from any third party in connection with this Report in the past twelve months. • The Manager Research Analyst has not engaged in market making activities in the Subject Mutual Fund Schemes. • The Manager Research Analyst has not served as an officer, director or employee of the fund company of the Subject Mutual Fund Schemes in the past twelve months. • Morningstar and the portfolios that are managed under Morningstar’s Portfolio Management Services licence have no financial interest or actual or beneficial ownership or investment in the Subject Mutual Fund Schemes.